Equity monthly view for April 2022

Posted On Monday, May 09, 2022

S&P BSE SENSEX declined by -2.5% on a total return basis in the month of April 2022. It has outperformed developed market indices like S&P 500 (-8.71%) and Dow Jones Industrial Average Index (-4.82%). S&P BSE SENSEX has also outperformed MSCI Emerging Market Index (-5.55%). The broader market was much more resilient, S&P BSE Midcap Index has increased by 1.33% for the month & S&P BSE Smallcap Index gave a monthly return of 1.43%.Power sector was the biggest outperformer sector. IT & Telecom were the laggards

Quantum Long Term Equity Value Fund (QLTEVF) saw a decline of - 0.6% in its NAV in April 2022. This compares to a -0.56% decline in its Tier I benchmark S&P BSE 500 & -0.68% decline in its Tier II Benchmark S&P BSE 200. Cash in the scheme stood at approximately 6.3% at the end of the month. The portfolio is attractively valued at 14.1x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 18.7x FY24E consensus earnings.

FPI outflow intensity has increased due to geopolitical risks

March-22 has seen FPI outflows of US$ -2.2 bn. With this month’s outflows, FIIs have sold close to US$ 16.8 bn till date in CY22. DIIs have been net buyers for March 2022 to the tune of US$2.9 bn and have absorbed a lot of selling pressure from the FIIs

Power supply is falling short of demand

Power demand is up by 7.9% y-o-y in FY22. The peak power demand reached 201GW in March 2022, growing 7.7% y-o-y due to the early onset of summer. In the first 27 days of April, electricity supplies fell short of demand by 1.88 bn units or 1.67% (worst since FY16).

India’s current power shortage can be attributable to coal production not keeping pace with the growing demand over the last few years – FY21 production levels were similar to those in FY17. Power demand had been weak in the past 2 years due to reduced economic activity (Covid-19 lockdown impact). However, with the economy reopening completely & heatwaves hitting across the country early this year supply is falling short of demand. Spot prices of power have soared amidst the current shortage (the government has intervened & capped prices at Rs 12/unit). This deficit is expected to continue till June when the monsoon begins, and hydro capacities enter the mix.

From a manufacturing sector perspective, it will not impact production significantly as India has a history of erratic power supply so Indian manufacturing facilities are designed with backup power generation capabilities, further 94% of India’s thermal power generation is based on local sourcing of coal with fixed pricing, therefore, power prices are not expected to shoot up for long term power agreements.

A sudden Rate hike by RBI

RBI monetary policy committee meets six times a year. The last MPC meeting was on 6-8 April and the next one was scheduled on June 6-8 despite such frequent meetings the committee decided to raise repo rates by 40bp to 4.4% and CRR by 50bp to 4.5% in an unscheduled meeting. Therefore, the timing of the rate hike came as a big surprise for markets. The only reason one could fathom for this unscheduled policy action is RBI’s inclination to raise rates before the US Federal Reserve raised rates (Fed eventually raised rates by 50 bps).

Q4FY22 & Full Year FY22 results have been a mixed bag till now

The Q4FY22 results have started to trickle in & broadly can be considered a mixed bag. The overall demand scenario looks upbeat for most sectors despite inflationary pressure but maintaining the operating margins has been a key challenge due rise in input costs. The companies are taking multiple steps like increasing product prices, cost control & mix changes to fend off margin pressures, & it should stabilise in the next few quarters.

RBI’s surprise move on increasing the repo rates is an acknowledgment of inflation becoming a more important variable in policy decisions than growth. It will not have an immediate bearing on growth or inflation, but it is an indication of things to come. These types of events will come & go multiple times in an investor’s journey to achieving financial goals & one should not be swayed too much. An equity portfolio stress-tested for balance sheet strength (lower leverage) & attractive valuations of investee companies is well suited for this environment. Investors should stick to their asset allocation plans & use a staggered approach to increase allocation to equities.

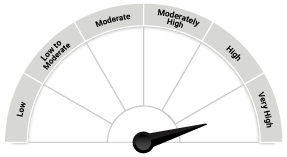

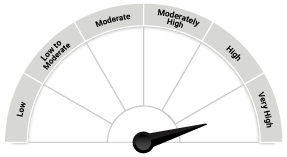

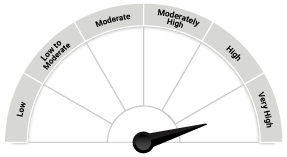

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) Tier I Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on April 30, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on April 30, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More