COVID Wave 2 : Buy, Sell or Hold, What should you do as an investor in mutual funds?

Posted On Tuesday, Apr 20, 2021

With the resurgence of Covid-19 cases and the subsequent lockdown-induced restrictions on economic activity, there is uncertainty yet again concerning the impact on lives and livelihoods. Brokerages have downgraded India’s GDP forecast for FY 22.

It is natural that you may be worried about the performance of your mutual fund investments or have questions about the best performing asset class to invest in. It would help if you considered that investors who remained invested during the market swings last FY 21 in equity-oriented schemes would have generated good returns on their portfolio in the past 12 months.

Let’s further understand how best to approach such uncertainties by making the right investment decisions:

1. Time in the Market vs. Timing the Market

Investing is not about beating the market or anybody else; it is about building wealth with patience and perseverance, keeping your financial goals firmly in check. The longer you stay invested, the better you can benefit from compounding your mutual fund returns. As a general guideline, it is best not to redeem from equities unless you are nearing your financial goals or have a genuine need for money.

The table below is an illustration of how starting early with a monthly SIP of Rs. 1,000 at an assumed rate of return of 8% p.a will help accumulate a larger corpus for your investment goals.

| Starting Age | Total Amount Saved Rs. | Value at the age of 60 (Rs.) |

| 25 | 4,20,000 | 23,09,175 |

| 30 | 3,60,000 | 15,00,295 |

| 35 | 3,00,000 | 9,57,367 |

| 40 | 2,40,000 | 5,92,947 |

The table above is for illustration purposes only. Investments through SIP is subject to market risk and does not assure a profit or returns or protection against a loss in downturn market.

2. Logic vs. emotion

Often, investors are compelled to make hasty redemption decisions due to passing emotions or advice from non-professionals such as friends and relatives. So, stay away from peer pressure and carefully evaluate your financial goals before coming to a decision.

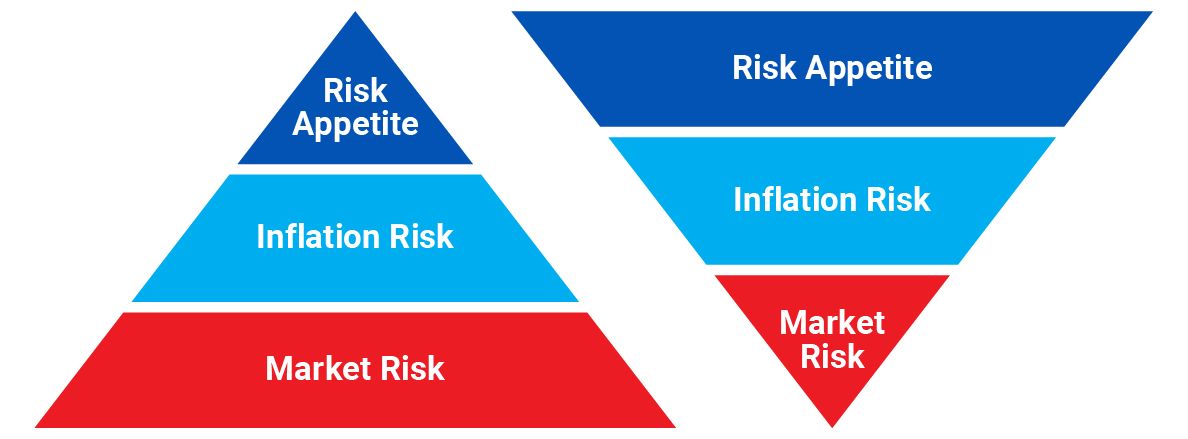

3. Inflation Risk vs. Market Risk

Instead of focusing your attention on market fluctuations that cannot be controlled and could be short-term, you need to factor in your risk appetite. This is the amount of risk you are willing to take. You may also want to consider the impact of inflation that can potentially erode the future value of your investment corpus. Investing in equity mutual funds can help you cope with the effects of inflation.

4. Diversification vs. Concentration

All asset classes do not necessarily move in the same direction; some may even move in the opposite direction, as we have seen in the recent past (in the case of equities and gold). Suppose you are overweight on equities, instead of redeeming and missing out on the long term growth potential, look at adding on to your investments. You can achieve the right balance by adding on a risk-reducing diversifier such as gold or liquid fund to diversify your risk-reward potential. Refer to the table below to understand the duration of your goals and the suggested investment options to help you achieve them.

| Short Term Needs 1-12 Months | Medium Term Needs 12-60 Months | Long Term Need More than 60 Months |

| OBJECTIVE | ||

|

|

|

| GO FOR... | ||

|

|

|

The above table is for illustrative purpose only.

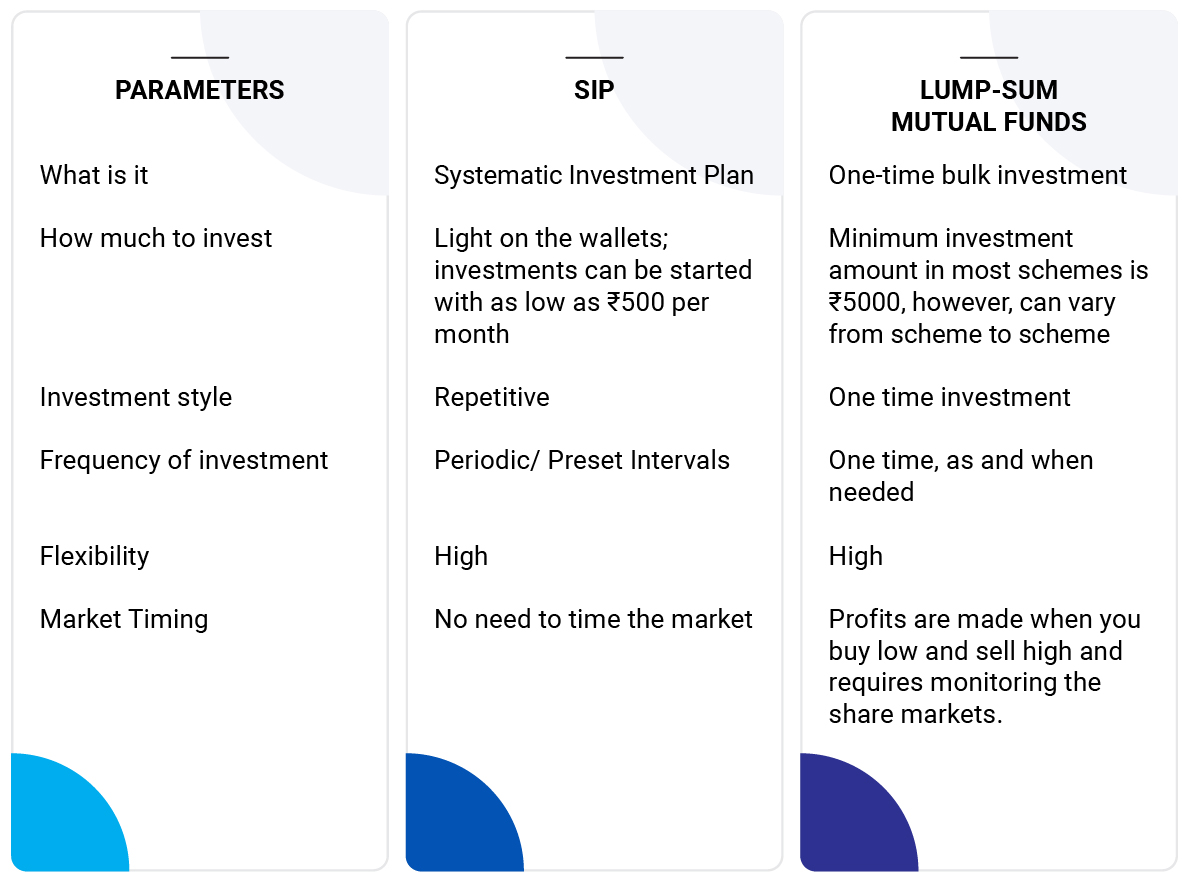

5. SIP investments vs. Lumpsum

Lumpsum is a good strategy if you are aware of the right time to enter and exit the market. On the other hand, an SIP is the suggested route to investment during market uncertainty as it averages out the cost over the long term and makes market timing irrelevant.

| Month | Investment (in INR) | Nav (in INR) | Units purchased |

| Jan 2020 | 5000 | 10 | 500 |

| Feb 2020 | 5000 | 9 | 555.56 |

| Mar 2020 | 5000 | 11 | 454.54 |

The above table is for illustrative purpose only.

Stay focused on your financial goals being cognizant of your risk profile, investment objective, and the time in hand to achieve the envisioned financial goals.

Stay on the path to achieve your goals.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More