Behind the Launch - Building Blocks for a Secure Future

Posted On Thursday, Jul 28, 2022

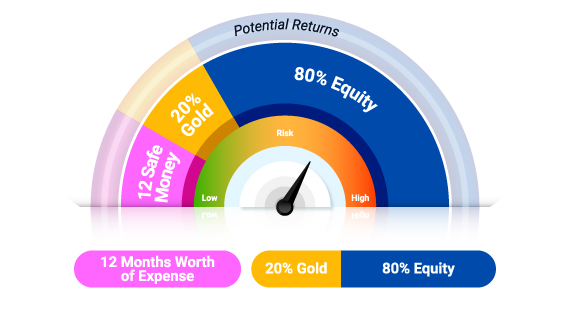

On July 18, 2022, we launched the 11th Fund in our diversified basket - the Quantum Nifty 50 ETF Fund of Fund, a critical building block for investors who need to diversify their portfolio passively according to our tried and tested 12:20:80 Asset Allocation Approach.

The Quantum Nifty 50 ETF Fund of Fund brings to you an easy way to ride India’s growth story by providing exposure to the Nifty 50 Index. It is a first of its kind wrapper fund that invests in units of the Quantum Nifty 50 ETF, offering the efficiency of an ETF with the convenience of an Index Fund. The underlying Quantum Nifty 50 ETF tracks/ replicates India’s Nifty 50 companies and has a proven track record of 14 years and counting.

Through this article, we would like to share the story behind the launch and answer some key questions that you may perhaps be thinking.

Why is Quantum MF launching a New Fund?

We continue to focus on doing what is best for you, our thoughtful investor and always will!

Ever since the launch of our flagship fund Quantum Long Term Equity Value Fund in 2006, we have been committed to our resolve to offer sensible products and simplify the investment ecosystem. What this means is that we launch a new fund only when we feel it adds value to your investment journey.

The launch of the Quantum 50 Nifty Fund of Funds completes the missing building block to help you diversify your portfolio passively according to our tried and tested 12:20:80 Asset Allocation Approach.

Fig 1: Building a Weather Proof Portfolio with 12:20:80 Asset Allocation*

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

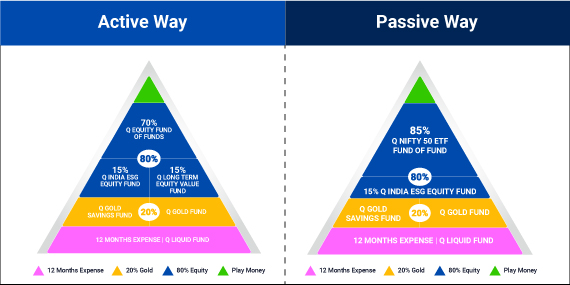

Fig 2: Building your Portfolio using the Active or Passive Approach

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Passive. Active. or Thoughtful

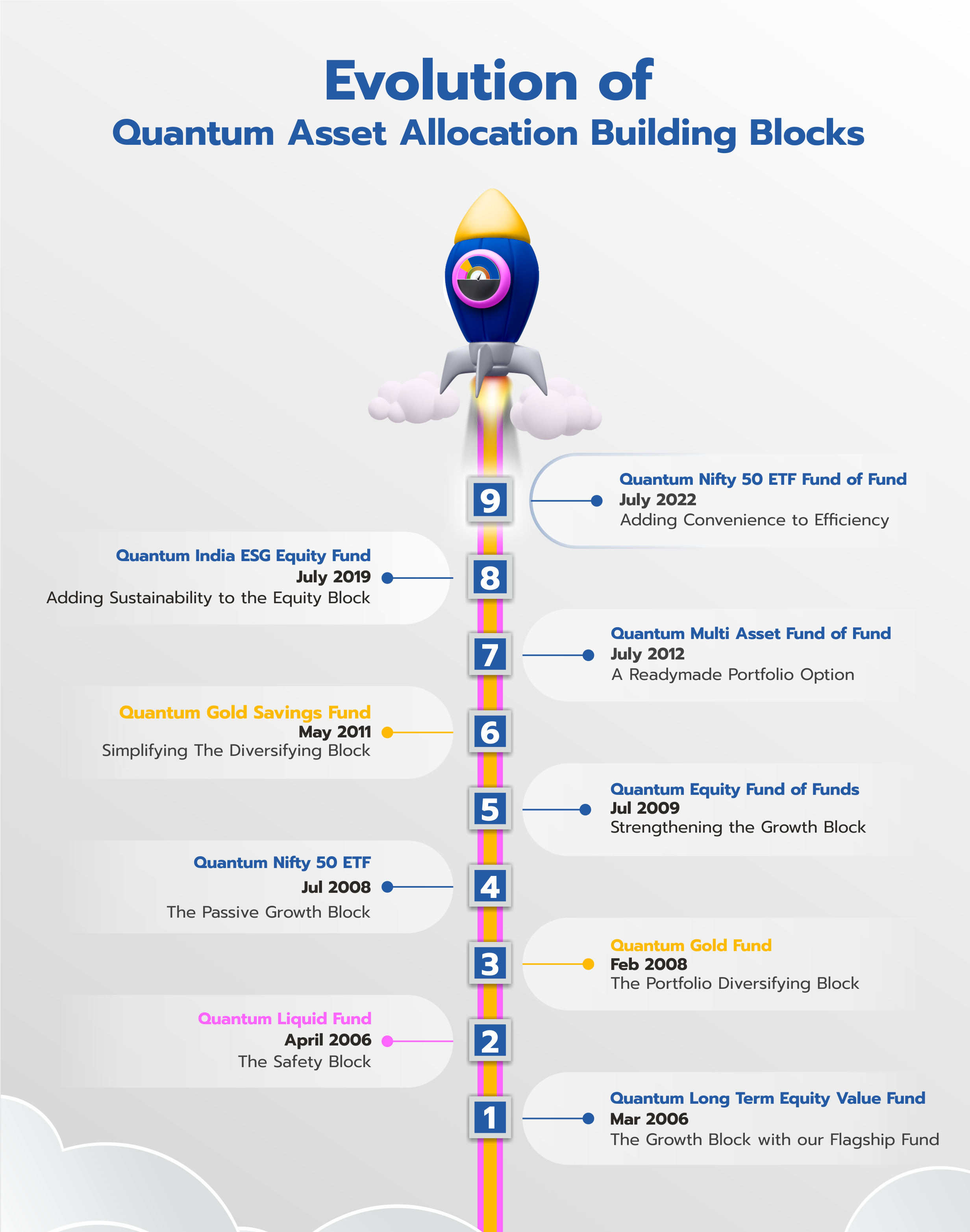

Our journey of the underlying funds has been a long and painstaking process as each fund was nurtured, tweaked, and prepared to be part of the bigger picture.

Now all the building blocks are ready on one reliable platform – by Quantum Mutual Fund.

Try our handy 12:20:80 (Baaraa, Bees aur Assi) Asset Allocator to allocate your investments Actively or Passively in just a few clicks.

Fig 3: Evolution of Quantum Building Blocks with Active and Passively Managed Funds

1) The Growth Block with our Flagship Fund

In 2006, we launched our flagship fund - the Quantum Long Term Equity Value Fund. Consider investing 15% to this fund that incorporates a margin of safety approach to portfolio building. We added a new dimension to the traditional ‘value’ investing which focused only on numbers: a dimension of avoiding managements and promoters who were not trustworthy or who adopted questionable business practices namely our integrity screen.

While the Value fund was well received, an investor who invests only in one style of equity fund is taking higher risks. We have always believed that investors must invest in a range of mutual funds following different ‘investing styles’ to attain a balance of risk, volatility, safety, and return. So, we methodically began putting together the building blocks of equity, debt and gold to provide investors solutions on the principles of diversified investment.

2) The Safety Block

While equity forms a core part of your portfolio, you should not forget the importance of a diversified portfolio to help you sail through market uncertainty. We didn’t either, which is why shortly after, in April 2006 we launched the Quantum Liquid Fund as an option to keeping your money in a Savings Bank account.

The fund prioritises safety and liquidity over returns which is why it only invests in in a Government securities or AAA rated bonds with minimal interest rate or credit risk.

This fund also offers you an insta-redemption option of up to Rs.50,000 with the flexibility to redeem anytime. Consider investing an amount equivalent to 12 months of expenses to tide you through any unforeseen or emergency events.

This Safety block has come to the aid of our investors in times of crisis, whether that be during the GFC (Global Financial Crisis), the Covid Crisis or any other black swan events.

3) The Portfolio Diversifying Block

After building the growth and foundation block, we added the third leg of the stool – the diversifying block that completed our asset mix – Gold with the Quantum Gold Fund ETF in 2008 – an innovative and efficient way to invest in Gold.

As an asset class, Gold generally has an inverse correlation to equity and tends to perform better during periods of uncertainty. Gold has and continues to serve as a long-term store of value and plays a risk-reducing, portfolio diversifying role in the long run. It has proven to give risk adjusted returns than stock markets in times of uncertainty and financial, social, or political stress.

4) The Passive Growth Block

We did not want to limit our investors to active investing. To offer you the flexibility to choose, we initiated the growth block in July 2008, 14 years ago in the passive space with Quantum Nifty 50 ETF. This now forms the underlying fund in our NFO - The Quantum Nifty 50 ETF Fund of Fund.

5) Strengthening the Growth Block

To offer you the benefit of a diversified equity portfolio, we strengthened the Growth Block – the largest block of your portfolio with an equity fund of funds in 2009. This mutual fund invests in well-researched equity mutual funds of carefully chosen third party schemes with a proven track record. Just allocate 70% of your equity portfolio to this one fund, where you get exposure to a truly diversified fund comprising of 6-10 equity mutual funds and avoid the hassle of tracking multiple funds and searching across 400 equity mutual funds that exist in the market.

6) Simplifying The Diversifying Block

We also launched the Quantum Gold Savings Fund in 2011 as a wrapper to Quantum Gold Fund to provide you with the flexibility to invest with an SIP and help build your 20% portfolio allocation to Gold.

7) A Ready Made Portfolio Option

In July 2012 we launched the Quantum Multi Asset Fund of Funds (as an option to locking up your money in a 3-year FD). This fund offers a readymade option for you if you do not have the time to track multiple funds in DIY asset allocation. Here the fund manager does the work for you – by following a regular rebalancing approach within each asset class of equity, debt and gold and has potential for better returns than conventional investments like Fixed Deposits over the long term.

8) Adding Sustainability to the Equity Block

Finally, we were one of the first funds to launch an ESG fund in India in 2019. This fund goes beyond traditional valuation metrics and looks to shortlist companies based on environmental, social and governance parameters. And hence, we suggest you allocate 15% to the Quantum India ESG Equity Fund even if you choose to invest passively. It does more than diversify your equity portfolio, it adds resilience to your portfolio during uncertain times.

9) Adding Convenience to Efficiency

In our continuous endeavour to simplify investing and provide a one stop shop for all your investment needs, this year we launched our NFO for the Quantum Nifty 50 ETF Fund of Fund to serve as a first of its kind wrapper fund that invests in units of the Quantum Nifty 50 ETF. As a passive investment, the returns of the Quantum Nifty 50 ETF will be similar to the returns of the Nifty 50 Index (subject to the tracking error), as the Quantum Nifty 50 ETF tracks / replicates the Nifty 50 Index while investing. This new fund offers the convenience of:

1) Building your 12:20:80 Asset Allocation Passively

2) No Demat Account Needed

3) Best of both worlds – Convenience of an Index Fund with Efficiency of an ETF

4) Option to Start with an SIP of Rs. 500

So, whether Active or Passive, choose to be Thoughtful by adopting prudent asset allocation to a create a weather-proof portfolio.

If you wish to strengthen your core equity portfolio using a passively managed fund, please do not miss out on investing in the NFO which Closes on - Aug 01, 2022. The Quantum Nifty 50 ETF Fund of Fund.

|

|

| Related Articles | ||

| Build a Weather-proof portfolio passively | ||

| Gear up for Growth - The Active or Passive Way | ||

| Are You Stuck in the Past or Ready for a Secure Future |

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Liquid Fund/ Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Mutual Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor. |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Nifty 50 ETF Fund of Fund** An Open-ended fund of fund scheme investing in Quantum Nifty ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on June 30, 2022.

**The product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio the same may vary post NFO when the actual investments are made. For latest riskometer, investors may have to refer to the Monthly Portfolios disclosed on the website of the fund www.QuantumAmc.com/ www.QuantumMF.comInvestors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More