Questions To Ask Before Investing In Tax Saving Schemes

Posted On Tuesday, Jan 18, 2022

The looming deadline to invest in tax saving instruments can cause several investors to make desperate last-minute tax-saving attempts. This can, unfortunately, cause poor judgement for many leading to missed appropriate investment opportunities which can help to grow their wealth along with tax savings. It can also create unnecessary strain on your wallet to gather the required funds (Rs.1.5 lakhs) at the last minute for availing of the tax benefit under section 80 C of the Income-Tax Act, 1961.

This last-minute make-shift approach may not serve the purpose of making your investments work for you.

Investing on time will give you adequate opportunity to achieve your financial goals and also cater to the tax-saving needs.

If you haven’t already invested, the apt time is – RIGHT NOW.

Questions to ask yourself before you finalize on a tax saving option:

1. What are the Different Tax Saving Avenues?

There are several instruments u/s 80C of the Income Tax Act that can help in tax-saving. From traditional fixed income instruments such as PPF, NSC, Post Office Time Deposits, NABARD Bonds to market-linked options such as ELSS or ULIP. While traditional instruments have longer lock-in periods, market-linked instruments such as ELSS has a lower lock-in and potential for market-linked returns.

| Name of Instrument | Lock-in period of Less Than 5 years | Market-Linked Returns |

| Tax Saving FD | ✖ | ✖ |

| National Savings Certificate (NSC) | ✖ | ✖ |

| Public Provident Fund (PPF) | ✖ | ✖ |

| National Pension System (NPS) | ✖ | ✔ |

| ULIP | ✖ | ✔ |

| Equity Linked Savings Scheme | ✔ | ✔ |

As you see in the table above, ELSS combines the flexibility of a lower lock-in and the potential for long term wealth creation.

2. How does an ELSS help you with your tax-saving and wealth-creation goals?

ELSS or “Equity Linked Saving Scheme” as the name suggests, are mutual funds that invest a minimum 80% of the portfolio in equity and equity-linked instruments. Like other options u/s 80C of the income tax, investments done in ELSS Mutual Funds offer tax exemption up to Rs.1,50,000 from your taxable income. Therefore, you can save up to Rs 46,800 in a year by investing in ELSS Funds provided you are in the highest tax bracket. Let’s see how you can save this money with the illustration below:

| Particulars | Amount Rs. |

| Maximum Eligible Income Tax Exemption | 1,50,000 |

| Tax rate at the highest income tax slab | 30% |

| Tax Saved | Rs. 45000 |

| Education cess @ 4% | Rs. 1800 |

| Total Tax savings | Rs. 46,800 |

Thus, with an ELSS you not only save tax but also avail potential for wealth creation in the long-term due to the equity component.

3. Who Should Invest in ELSS Funds?

Since ELSS is an Equity Investment, it is suitable for investors with a high-risk appetite.

Thus, it could be suitable if you have a long-term investment horizon. Since ELSS invests in stock markets through equities, you can navigate the near-term market ups and downs by staying invested for the long term.

4. Why the current market is a right time to invest in ELSS?

As the market levels are facing ups and downs, now is a good time to plan your long-term equity allocation with an ELSS scheme and benefit from tax savings.

5. How to Invest in an ELSS?

You can invest in an ELSS with flexible options of SIP (Systematic Investment Plan) or lumpsum investment mode. With a lump sum, you have the flexibility of withdrawing once the lock-in period of three-year ends. However, with an SIP, each SIP gets locked in for three years and you will only be able to withdraw the first SIP that will get unlocked after 3 years.

If you are not comfortable with investing entire lumpsum at one point and want to spread the risk, SIP (Systematic Investment Plan) is the way to go for you. With an SIP, you get the benefit of investing in a fund across business cycles and the benefit of Rupee cost averaging. Whichever option you choose, make sure to stay invested for the long term to get the opportunity to build wealth and achieve your financial goals.

6. Why invest using Quantum Tax Saving Plan (QTSF)?

Having decided the need to invest in an ELSS, choosing on the right fund need to be also taken into account. Launched in December 2008, Quantum Tax Saving Fund is your answer to finding the right ELSS fund for saving tax and building wealth. The fund follows the value-based strategy and hence invests in quality stocks for long term. The fund manager carefully selects quality companies with a bottom-up stock selection approach.

5 Benefits of investing with QTSF:

Investing in an ELSS using QTSF adds value to your portfolio:

Since Quantum Tax Saving Fund follows the value style of investment, any additional equity fund that you consider needs to be diversified in term of investment style or theme.

You may invest up to 15% of your equity allocation or up to Rs. 1,50,000 to a tax saving scheme (whichever is higher) to be eligible for tax savings up to Rs.46,800, provided you are under the highest tax bracket.

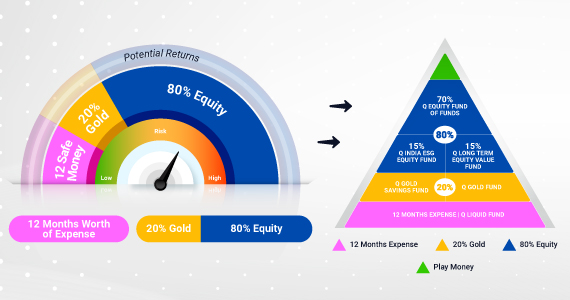

Quantum Solution for a balanced Portfolio

Use Quantum’s tried and tested 12-20-80 Asset Allocation Strategy to see how to build your portfolio with Equity, Debt and Gold.

Kindly note allocation to QTSF to be generally in a similar proportion as that of QLTEVF.

**Please note the above is a suggested fund allocation and not to be considered as an investment advice / recommendation.

1. Step 1: 12 Months in an Emergency Fund: Emergency funds should be at the foundation of your portfolio. Set aside safe money worth 12 months of expenses in a bank savings account or Liquid schemes such as Quantum Liquid Fund that helps you prepare for emergencies and offers you the insta-redemption option (up to Rs.50K) whenever you need.

2. Step 2: Risk Reducing Benefits with Gold: You can benefit from Gold’s risk-reducing characteristics and allocate 20% of your portfolio to Gold and use price-efficient (no pricing markups associated with physical gold), & liquid forms such as Quantum Gold Savings Fund and Quantum Gold Fund.

3. Step 3: Diversify the balance 80% across an equity bucket: Use the 70-15-15 model to diversify your equity portfolio with just three funds that are market cap, sector, or style agnostic.

| Sr. No | Fund | Allocation | Benefit |

| Equity Fund 1 | Quantum Equity Fund of Funds | 70% | 1 Fund = 5-10 Well Researched Equity schemes |

| Equity Fund 2 | Quantum India ESG Fund | 15% | Shortlists funds based on environmental, social and governance parameters |

| Equity Fund 3 | Quantum Tax Saving Fund or Quantum Long Term Equity Value Fund | 15% | Follows value style lowering downside risks and helps achieve long term goals |

Please note the above is a suggested fund allocation and not to be considered as an investment advice / recommendation.

So, don’t wait till 31st March, start investing in ELSS Mutual funds right away with Quantum Tax Saving Fund.

Watch this video on ELSS, where our fund manager Sorbh Gupta shares insights on how to select an ELSS mutual fund.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on December 31, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimerto read scheme specific risk factors.

Related Posts

-

Quantum ELSS Tax Saver Fund: Solid, Stable and works 30 hours a week for you

Posted On Friday, Jan 31, 2025

Investors seek stability, consistency, and reliability in their financial journey.

Read More -

Resilience in Rough Markets - Invest the Quantum Way

Posted On Friday, Jan 24, 2025

It’s been a jolly good ride for Indian equity investors since 2020 with 5-year annualized return of frontline indices Nifty 50 and Nifty 500 at 15.5% and 19% respectively as per NSE data as on December 2024.

Read More -

Equity Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

2024 was an eventful year with elections in domestic and dominant foreign countries, commencement of rate cutting cycles globally and slowdown in domestic economy.

Read More