Is Your Portfolio in a Free fall? Or Are You on Your Dream Vacation

Posted On Tuesday, May 31, 2022

Stock markets are down – are you one of those investors who is up at night worrying about what will happen to your portfolio? Or are you one who has adequately planned for your future?

Good things happen when you plan for them. Not when you make emotional or rash decisions or blindly follow trends.

For instance, when you plan for that much awaited dream vacation, you perhaps go through a checklist of what to carry, you research to find the best hotel that will suit your needs, you use simple tools and calculators to compare prices for airlines etc.

But to make that dream vacation or any other financial goal happen, how much time have you spent in planning your portfolio?

Chances are that, if you are a thoughtful investor, you would have kept aside your investments in various buckets - in various asset classes - and still be smiling today as you enjoy realizing your much awaited vacation.

If you haven’t, don’t worry, it’s never too late , we have a simple solution that can help – our 12:20:80 Asset Allocation Approach. You can also use the calculator available once you login to your Invest Online account to allocate across the three asset classes in just a few clicks.

Fig 1: Quantum’s Proprietary 12:20:80 Asset Allocation

**Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

A Step Further

For those thoughtful investors that have diversified across the three asset classes of Equity, Debt and Gold, it may be a good time to review your Equity portfolio by asking the following questions:

• Are your investments skewed to a sector, market cap, or theme?

• Is your portfolio chasing momentum and ignoring value?

• Are you getting swept by emotions and taking decisions that may disrupt your long term financial journey?

Just as diversification across the three asset classes is important – a diversified equity basket help in achieving your overall wealth creatin goals. Under 12:20:80 we suggest the following allocation.

Fig 2: Diversify your Equity Portfolio

| Fund | Allocation | Benefit |

| Quantum Equity Fund of Funds | 70% | 1 Fund = 5-10 well researched diversified Equity schemes |

| Quantum India ESG Equity Fund | 15% | Shortlists companies based on environmental, social and governance parameters |

| Quantum Tax Saving Fund or Quantum Long Term Equity Value Fund | 15% | Follows value style lowering downside risks and helps achieve long term goals |

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Value is Making a Come Back!

For those thoughtful investors that already have Value in your portfolio, we believe that it is a good time to hold on to it – even though you may be tempted to sell based on past performance and higher declines.

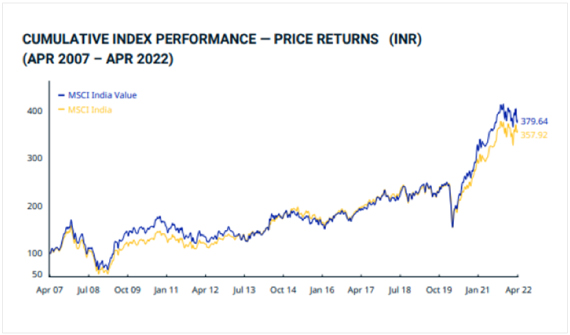

As you see in the graph below, value investing has slowly turned back in favour.

Fig 3: Value Investing is Making a Comeback

Source: MSCI Value Index India. YTD Data as of April 30, 2022. Past performance may or may not be sustained tomorrow.

In a rising interest rate environment, a value fund with a portfolio comprising of businesses with reasonable valuations and less leverage would have fallen lesser during market downturns. Quantum Long Term Equity Value Fund, a true-to-label fund since 2006, is positioned for broad based economic revival.

Fig 4: 6 Reasons to invest in Quantum Long Term Equity Value Fund

| Follows the tenets of Value Investing | Over 16 years track record | Aims to deliver long-term risk adjusted returns | Minimizes downside during periods of uncertainty | Bottom-up portfolio construction | Well-researched and diversified portfolio |

However, you must remember that “Value” like “Growth” is a style. Every style goes through its cycle.

The table below indicates how the equity-gold portion of the 12:20:80 Portfolio would have performed during different periods of macroeconomic uncertainty with and without a value fund:

Fig 5: How a Value Fund complements Your Equity Portfolio

| Fund | 12-20-80 Allocation | S&P Sensex TRI |

| Investment Value | 100,000 | 100,000 |

| Quantum Equity Fund of Funds | 56,000 | 64000 |

| Quantum Long Term Equity Value Fund | 12,000 | - |

| Quantum India ESG Equity Fund | 12,000 | 16000 |

| Quantum Gold Savings Fund | 20,000 | 20000 |

| Market Value | 98,827.06 | 96,318.13 |

| Correction | -9.5% | -11.04% |

YTD as of April 30, 2022. The above table to be read in conjunction with the complete fund performance below. Past performance may or may not be sustained in the future.

While undoubtedly holding on to a value fund helps lower the impact of market downturns, choose a diversified equity portfolio to capture the opportunities across market cycles. Use this correction as a good opportunity to add/rebalance your equity basket and hold on for the long term.

So, whether stock markets are down or not, adopt 12:20:80 so that you can sleep at night and take your family on that long-awaited vacation.

It’s your ticket to take off, even when markets are down!

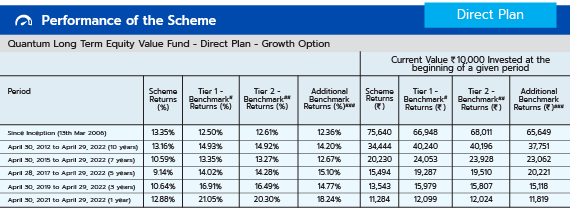

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of April 30, 2022.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. George Thomas. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. George Thomas has been managing the fund since April 01, 2022 Click here to view other funds managed by Mr. Sorbh Gupta and Mr. George Thomas.

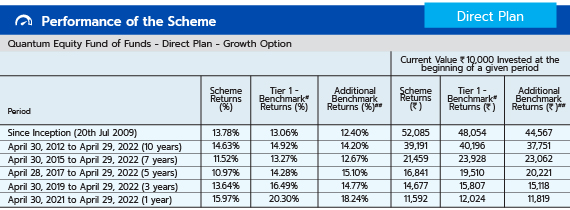

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of April 30, 2022.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by Mr. Chirag Mehta since Nov 1, 2013. Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by him, please Click here.

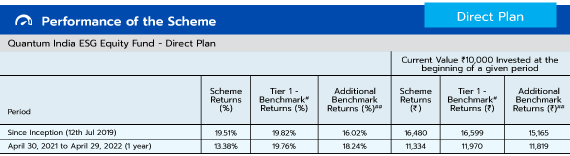

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as of April 30, 2022.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta and Ms. Sneha Joshi manage the fund since Jul 12, 2019. Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by them, please Click here.

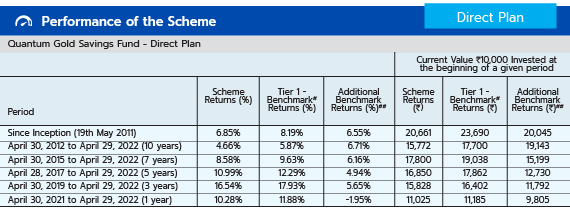

#Domestic Price of Physical Gold, ##CRISIL 10 Year Gilt Index.

Data as of April 30, 2022.

Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. The fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is handing the fund since May 19, 2011. For other funds managed by Mr. Chirag Mehta, please Click here.

| Related Articles | ||

| Add Value to your Equity Portfolio with Value Investing | ||

| Is Value Investing Here To Stay? | ||

| Stay Ahead of Inflation During These Uncertain Times |

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Tier I Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier 1 Benchmark: Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Very High Risk |  |

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier I Benchmark | Tier II Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark: S&P BSE 500 TRI | •Long term capital appreciation

|  Investors understand that their principal will be at Very High Risk |  |  |

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on April 30, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on April 30, 2022

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More