Low Bank FD Rates & Market Uncertainty

Posted On Friday, Jan 22, 2021

With low bank deposit interest rates and expensive equities; you may be confused about choosing the next best fit for your investment portfolio, especially in an uncertain market. Are you in search of an investment avenue that has the potential to give good risk adjusted long-term returns while also mitigating risk?

What is a multi-asset fund and why do you need one?

The way to balance risk and reward in your investment portfolio is to diversify your assets. Investing in just one asset class could hamper your financial goals. Hence, it becomes important to have an asset allocation strategy by diversifying across asset classes such as equities, debt and gold to generate long term risk adjusted returns. You can perform the asset allocation yourselves or invest in a Multi-Asset Fund.

Quantum Multi Asset Fund of Funds (QMAFOF) is a Fund of Funds with characteristics of a hybrid fund that invest a minimum of 10 -25 % in schemes having units of at least three asset classes. This fund typically has a combination of equity, debt, and one more asset class such as gold. The logic behind a QMAFOF is that ideal asset allocation is not static. Instead of timing the market, here the fund manager strategically positions the portfolio depending on the prevailing market conditions.

We give you four ways you can navigate the uncertainty in the market with Quantum Multi Asset Fund of Funds.

1. Risk-adjusted returns:

With QMAFOF, thanks to its dynamic allocation strategy and an allocation to the third leg of the portfolio stool - portfolio diversifier - gold, investors benefit from the low volatility and thereby better risk adjusted returns.

Subbu (Mr. I V Subramaniam - Director, Quantum AMC) has always suggested QMAFOF to all our long-term risk-averse investors. Whereas Ajit, Founder – Quantum Advisors has parked a portion of his Emergency Fund in QMAFOF.

| Performance of the Scheme | Direct Plan | |||

| Quantum Multi Asset Fund of Funds - Direct Plan | ||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||

| Period | Scheme Returns (%) | Benchmark Returns (%)# | Scheme (₹) | Benchmark Returns (₹)# |

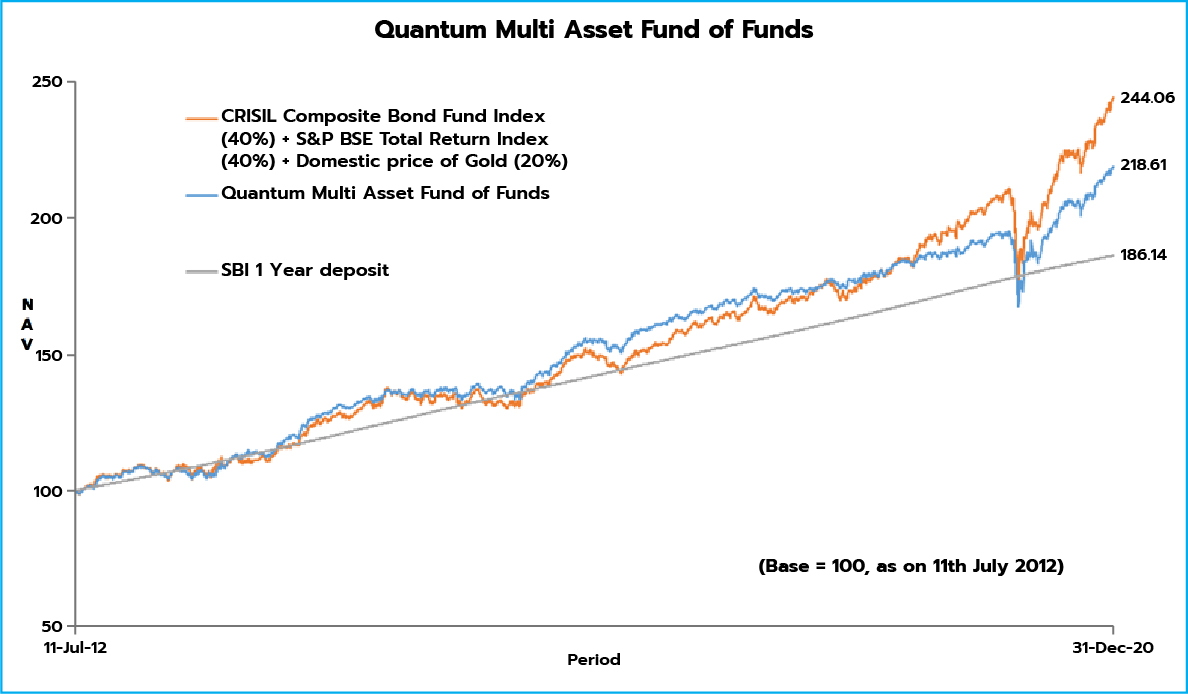

| Since Inception (11th Jul 2012) | 9.67% | 11.11% | 21,886 | 24,441 |

| Dec 31, 2013 to Dec 31, 2020 (7 years) | 9.72% | 11.88% | 19,154 | 21,961 |

| Dec 31, 2015 to Dec 31, 2020 (5 years) | 9.61% | 12.91% | 15,827 | 18,367 |

| Dec 29, 2017 to Dec 31, 2020 (3 years) | 8.59% | 13.75% | 12,814 | 14,733 |

| Dec 31, 2019 to Dec 31, 2020 (1 year) | 13.42% | 18.81% | 11,346 | 11,887 |

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Data as of Dec 31, 2020

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#Indicates CRISIL Composite Bond Fund Index (40%) + S&P BSE SENSEX Total Return Index (40%) + Domestic price of Gold (20%). It is a customized

index and it is rebalanced daily.

The fund is managed Mr. Chirag Mehta and Mr. Nilesh Shetty.

For performance of other Schemes managed by them please click here.

2. Cope better with inflation:

As per IMF, India’s inflation rate is 3.7% as on Oct 2020 and considering a return of not exceeding 5.75%1 on your fixed deposit, you end up earning net returns of just ~2% over your initial capital invested. Although returns and principal in QMAFOF are not guaranteed and insured like a fixed deposit, it has given returns at par or better than Bank Fixed Deposits over the long term.* Due to the equity component, it offers market linked returns. So over the long-term, you are better positioned to earn returns greater than the prevailing rate of inflation.

Considering the risk-reward ratio, Quantum Multi Asset Fund of Funds (QMAFOF) could be a sensible option to consider instead of investing in fixed deposits*. Given the falling FD rates, we believe it’s time for you to be an investor than a mere saver.

Past performance may or may not be sustained in the future. This Graph is to read in conjunction with the complete performance of the scheme provided above.

3. Dynamic Asset Allocation Strategy:

But since it has an equity exposure, does QMAFOF has the potential to tackle market uncertainty?

Well, our answer would be ...a Yes!

QMAFOF has the right balance of not only equity & debt but also gold, unlike most Balanced Funds. Balanced funds are generally biased towards either equity or debt. With such lopsided allocations, these funds are not “balanced” in the true sense of the word and tend to have higher volatility and risks. Plus, they don’t have exposure to gold, which is an excellent portfolio diversifier.

QMAFOF on the other hand has a broad and flexible mandate by which the fund can dynamically allocate anywhere between 25%-65% of the portfolio to equities or debt and 10% - 20% to gold. Gold has not only delivered returns but mitigated risks when it mattered the most.(Gold was one of the most attractive asset class in 2020) With QMAFOF, thanks to its dynamic allocation strategy and an allocation to gold - a portfolio diversifier - the third leg of the portfolio stool, you have the potential to benefit from the low volatility i.e. relatively good returns, and thereby better risk-adjusted returns.

These allocations are based on asset class valuations and market dynamics. Thus, with QMAFOF, we actively reduce allocation to expensive asset classes, reallocating to other asset classes, thereby aiming to deliver risk adjusted returns and reduce risk.

4. Better tax efficiency:

Moreover, if you are an investor in a higher tax bracket with an investment horizon of 3 years QMAFOF is also more tax-efficient than Bank FDs. Interest earned on fixed deposits over any time horizon is classified as 'income from other sources' and is subject to income tax at marginal tax rates. In the QMAFOF, it is taxed like a debt fund. The short term capital gains (if the units are sold before three years) are taxed as per applicable tax rate of the investor. For an investment horizon of three years and above, effective taxation could be as or more attractive than fixed deposit taxation due to indexation benefits, which have not been provided in the latter. Long term capital gains are taxed at 20% with indexation.

So what are key factors that make QMAFOF a better option to FDs?

1. Suitable for risk-averse investors looking for a trustworthy investment option.

2. Exposure to equity gives your investments potential to stay ahead of inflation.

3. Dynamic asset allocation that not only reduces risk but has the potential to give relatively good risk adjusted long term returns.

4. Also more tax-efficient than bank FDs if investment period is more than 3 years due to indexation benefit.

Forget the responsibility of asset allocation and start investing in Quantum Multi Asset Fund of Funds.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on December 31, 2020.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More