A Systematic Approach to Your Investment in 2022 - Quantum Mutual Fund

Posted On Wednesday, Jan 05, 2022

The start of the Year may be a good time to assess your investments and rebalance your portfolio. While you may not be able to avoid the impact of risks on your investments, such as the spread of the Omicron variant, global inflationary pressures, and anticipated rate hikes, you can surely change the approach to your investments.

With a little bit of effort and education, you can lower the impact of these risks on your investments to some extent and capture the opportunity for risk-adjusted returns.

Mutual Fund Investment planning can be done systematically using three systematic facilities.

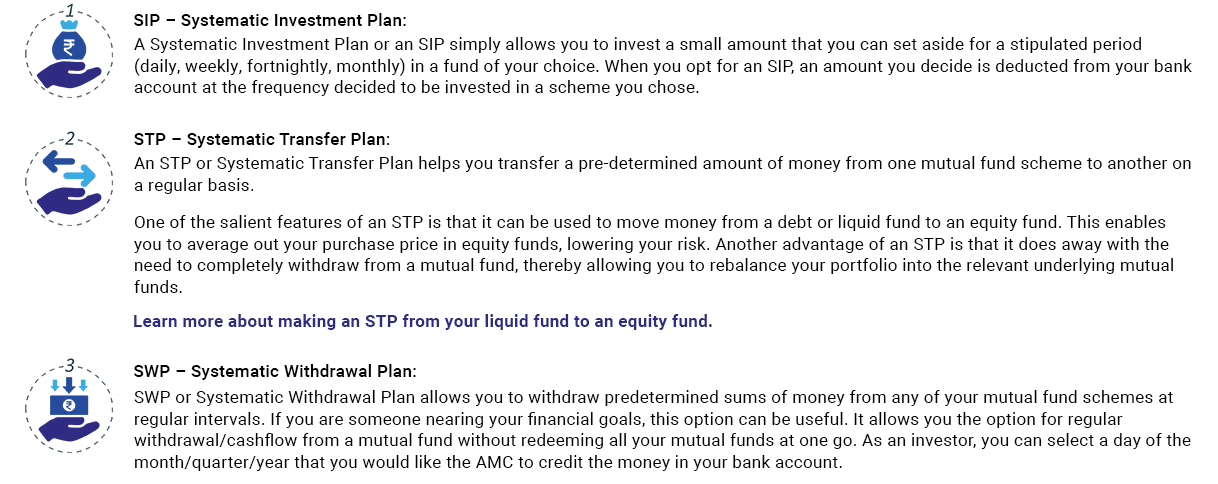

1. SIP (Systematic Investment Plan)

2. STP (Systematic Transfer Plan)

3. SWP (Systematic Withdrawal Plan)

Those of you who do not have a regular salary or have surplus money, can consider investing at any given time a lumpsum amount.

For everyone else, a systematic approach is what works best. A systematic investment approach gives you the flexibility, convenience and discipline to free you from the need to time the market. Is any of these approaches more suitable than the other? Let’s understand how they differ:

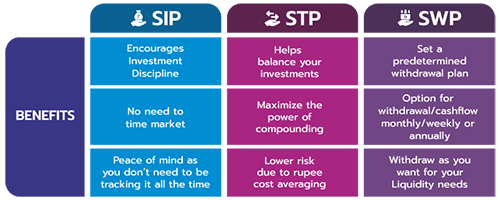

Here is a table that compares all three options:

In addition, it is also important to consider the following before making a decision:

1. How does it work?

• In an SIP, you make regular fixed investments in a Mutual Fund scheme of your choice. Generally, these investments are done in equity funds for a longer tenure.

• In an STP, generally in most of the cases, first investment is made in a Debt fund, mostly a liquid fund, and then your investment is transferred to an equity fund selected by you at regular intervals. The tenure and amount of transfer in the case of STP is fixed.

• In an SWP, you can withdraw money from Mutual Fund schemes at regular intervals. .

2. Who is it for?

• An SIP is typically suitable for investors who want to make long-term investments but cannot afford to invest a lump sum amount in Mutual Funds. Not to forget, an SIP is mostly apt for investors who wish to achieve a particular goal through Mutual Fund investment.

• An STP is suitable for investors who have some surplus money but do not want to invest the entire amount in a particular Mutual Fund scheme. So, by means of an STP, they can transfer small amounts at regular intervals in a particular mutual fund.

• An SWP, on the other hand, is suitable for investors who want a regular option for withdrawal/cashflow. They can first invest in a scheme with a low level of risk and then withdraw the amounts at regular intervals.

3. What is the Tax Impact?

• When it comes to SIPs, there is no tax applicable for purchasing subsequent investment units unless you have redeemed your investment. But when it comes to STP and SWP, there is taxation involved. Because in STP, funds are transferred from one fund to another. Each transfer is treated as a redemption and attracts a Capital gains tax. In the case of SWP, each withdrawal attracts tax. Each withdrawal is also treated as a redemption and will be subjected to Capital Gain Tax.

To summarize, all the three types – SIP, STP and SWP are systematic and disciplined modes of investment. They help investors in generating risk-adjusted returns over the long term.

So, if you have chosen which mode is best for you and decided to start, you can begin investing with Quantum Mutual Funds.

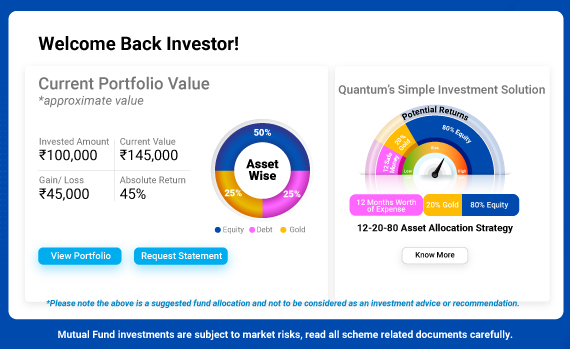

You can build your portfolio using a proven, time-tested, and diversified 12-20-80 asset allocation strategy that incorporates three simple building blocks of the three asset classes of Equity, Debt and Gold. It offers the potential to help minimize downside risks while helping to achieve long-term goals.

Build the foundation that is the emergency block by setting aside money equivalent to 12 months of monthly expenses in a bank account and a liquid fund scheme such as Quantum Liquid Fund to fulfill the urgent need for money.

Next, you can allot 20% to the portfolio diversifying block of gold that generally has a negative correlation with equities using efficient forms of gold investment such as Quantum Gold Fund ETF and Quantum Gold Savings Fund.. Finally, you can allocate 80% of the balance investment corpus to the growth block, the diversified equity bucket that is free from any style or market cap bias in the 70-15-15 ratio.

To simplify the portfolio allocation, you can now find a new solution to simplify your Asset Allocation needs.

Create your account and experience the magic and simplicity of the 12-20-80 for yourself.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More