Understand why add ESG investments to your equity portfolio

Posted On Tuesday, Dec 15, 2020

Sustainable Investing, Responsible Investing, Impact Investing, Clean Investing or more popularly known as ESG Investing has been the trending investment theme that has gained momentum for over a decade and especially this year during the global pandemic. But are these mere buzz words or is there any meaning to ESG investing?

As a responsible citizen, our target investments should not only be on the basis of financial parameters but also on certain values or ethics that you identify with. A good starting point can be ESG (Environmental, Social and Governance) factors when evaluating equity investment decisions. ESG aims to achieve the triple bottom line that is good for the people, planet and profits.

ESG is a structured approach of measuring the sustainability of companies by identifying potential risks hidden beneath a company's business and the long-term impact on society, the environment, and the mission of the business itself.

We give you five reasons to add ESG Investment to your equity portfolio and how Quantum India ESG Equity Fund delivers on these parameters.

Comprehensive research: It is difficult and time consuming for you as an individual investor to invest based on ESG criteria in the absence of any readily available data. The best approach is to look for mutual fund schemes that follow ESG as a mandate. A number of mutual fund houses have launched ESG funds in India. The concept of ESG is still emerging and in its nascent stages in India and so it may be difficult to choose which is the right option for you.

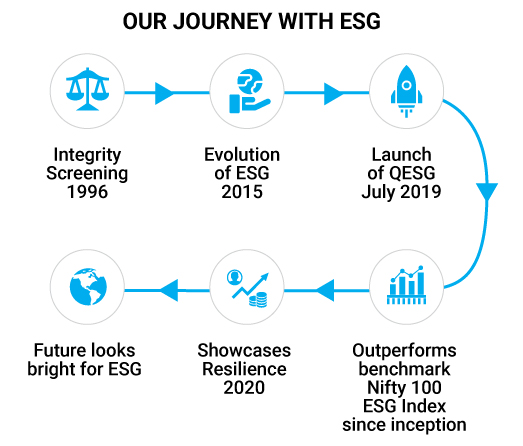

Quantum is one of the first AMCs to introduce ESG as a fund in India. What's unique about Quantum is that it banks on its own proprietary research which has evolved over the last 5 years going through our own learning curve in the ESG space. Our investing journey has emphasized Governance and social factors over last two decades.

Quantum adopted what we called an "Integrity Screen" in 1996. If a company/Board does not meet our integrity checks, it will not be included in the portfolio, irrespective of how large the company's weight is in the benchmark. While we always had some of the 'Social' aspects in-built in our research process (we avoided companies with questionable business practices), we started adopting a formal approach to ESG from 2015, in terms of an actual score.

This means you can benefit from our years of experience and research behind the process of selecting stocks based on ESG principles.

Sound ESG Metrics:

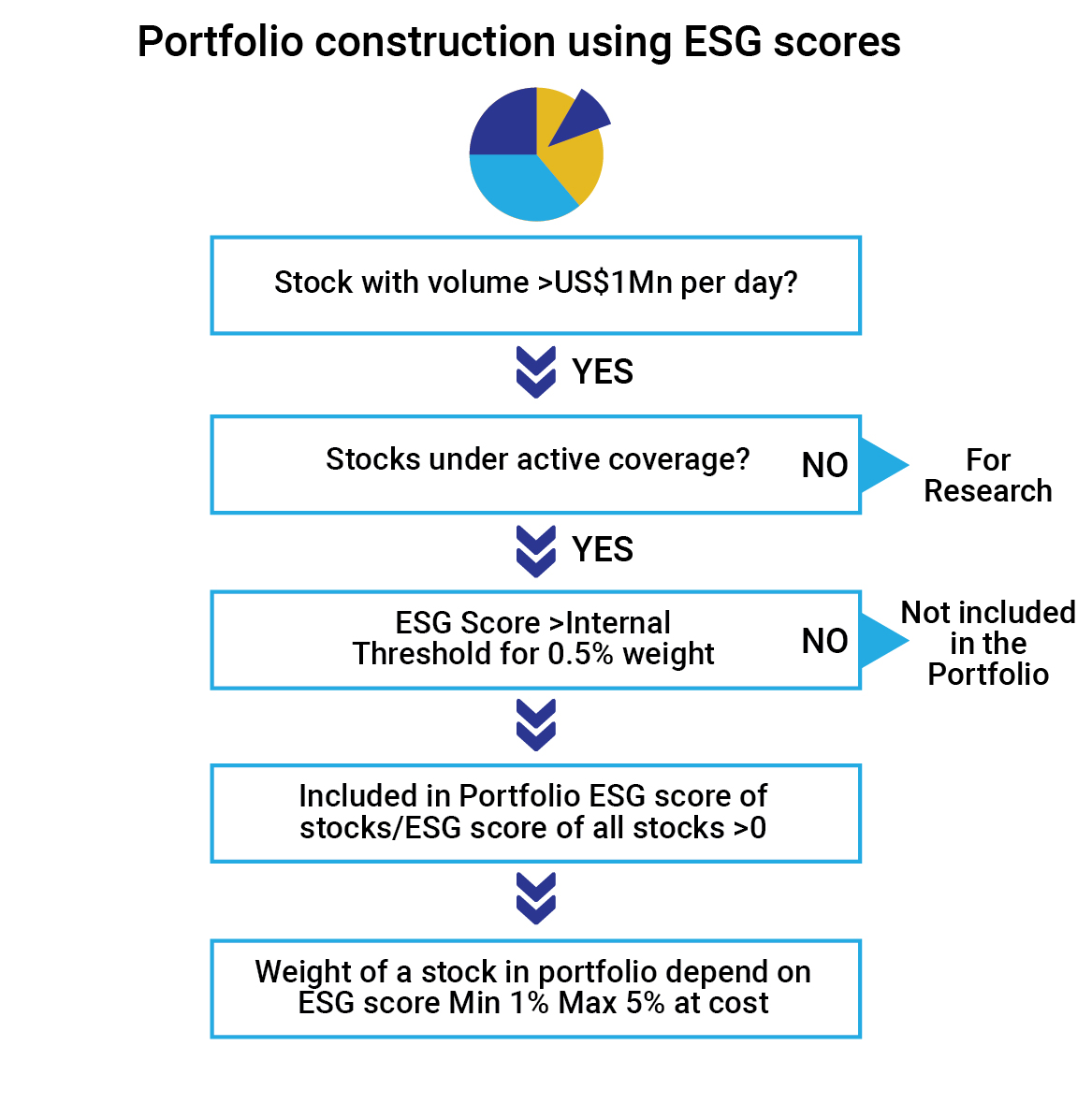

As per SEBI mandate, companies are required to prepare a business responsibility report (BRR) every year. Based on these reports, AMCs draw their selection based on the top listed 1000 companies and then use their internal criteria and systems to assign weights to companies based on multiple criteria.

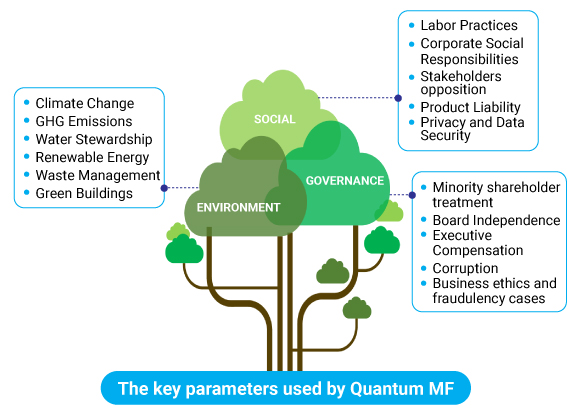

Our focus has been on better disclosures, better performance with respect to gender inclusion as well as reducing carbon footprint. Here's some of the important parameters we use to select companies that make the ESG equity portfolio.

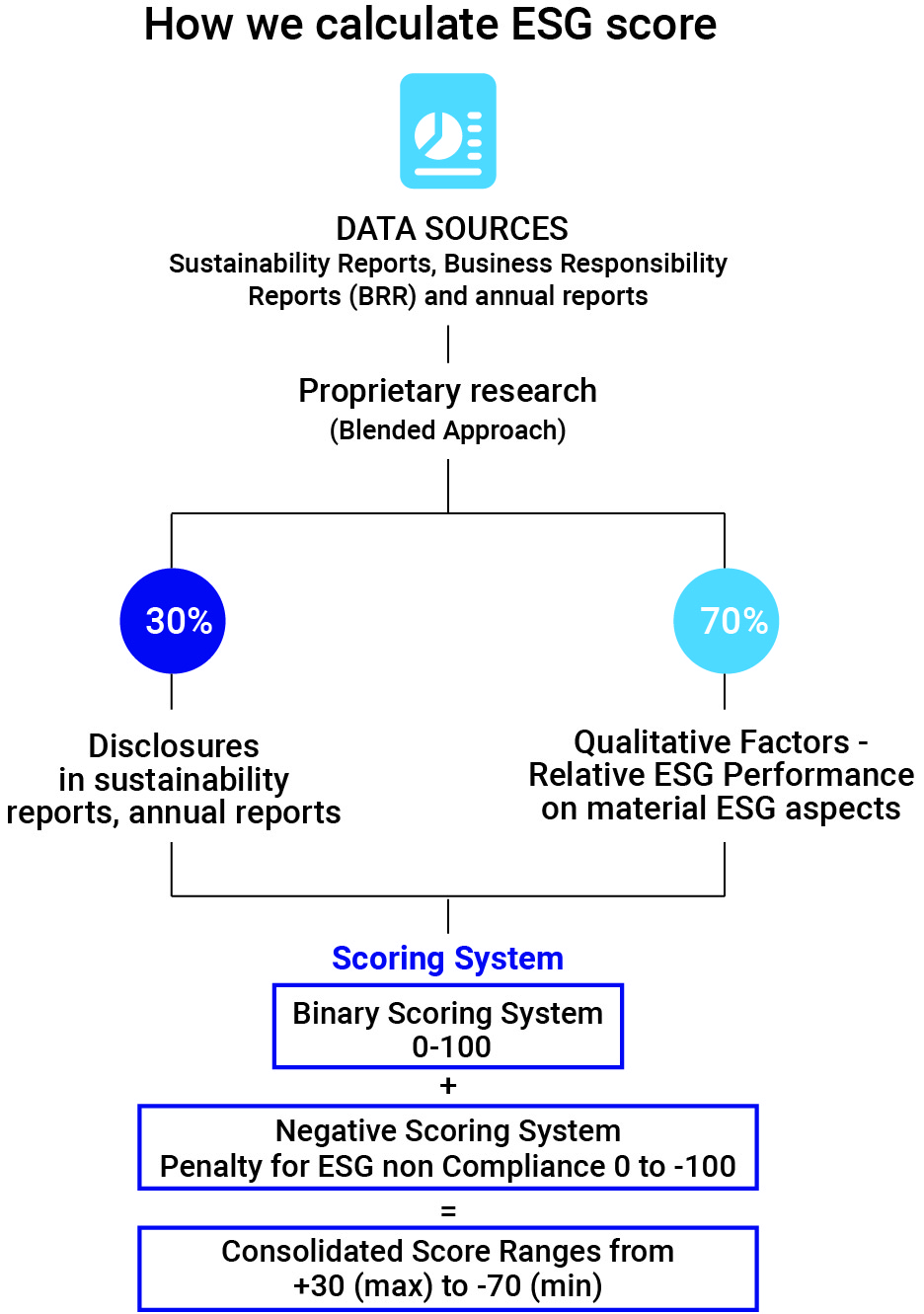

How we calculate ESG Score:

While screening companies, we subjectively evaluate more than 200 parameters across the Environment, Social and Governance domains.

• 70% weight is given to companies on their ESG performance relative to their peers and national / global regulations on material ESG aspects.

• 30% weight is given to companies on their levels of disclosures provided in their sustainability reports / business responsibility reports / annual reports.

• Governance sits at the heart of our analysis because we believe governance shortcomings usually go hand in hand with poor performance on the social and environmental fronts

• While computing the ESG score, 50% weightage is given to the Governance aspect, and the remaining 50% to the Environmental and Social aspects.

Watch Ajit Dayal explaining how Quantum works on ESG principle.

Risk adjusted returns:

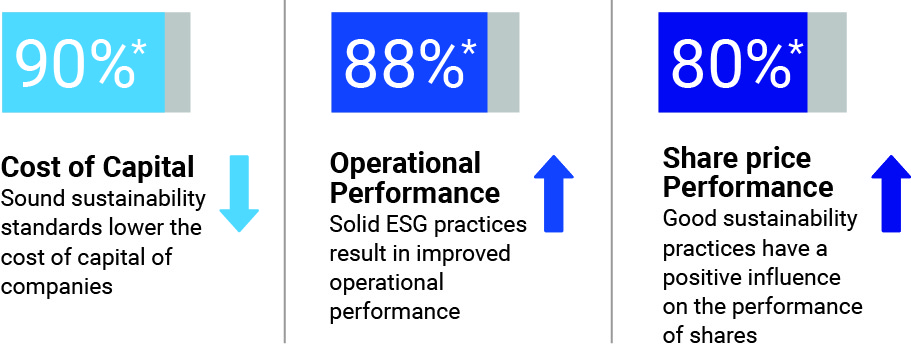

Historical trends show that a business which has good ESG practices has potential to deliver good risk adjusted returns in line with lower cost of capital and improved operational performance.

*Percentage of studies showing

Data Source: Oxford report 'From stockholder to stakeholder' based on more than 200 academic studies (March 2015)

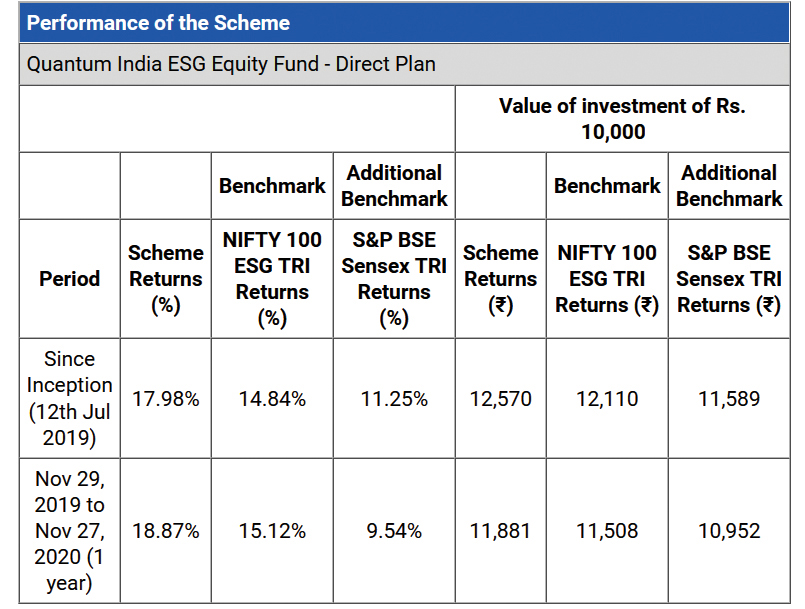

Quantum India ESG Equity Fund has outperformed the index in the first year of its inception. The fund can help you deliver risk adjusted returns over the long term. It helps you achieve long-term capital appreciation by investing in shares of companies that meet Quantum's Environment, Social and Governance (ESG) criteria.

Past performance may or may not be sustained in the future.

Data as of November 27, 2020.

Load is not taken into consideration in Scheme returns calculation.

Different Plans shall have different expense structure.

The Scheme has been in existence for more than 1 year but has not yet completed 3 and 5 years period.

Returns are net of total expence and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

Note: The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager effective from July 12, 2019. Ms. Sneha Joshi is the Associate Fund Manager effective from July 12, 2019. Mr. Chirag Mehta manages 5 schemes of Quantum Mutual Fund. For performance of other Schemes Managed by Mr. Chirag Mehta please click here

Limits downside risk:

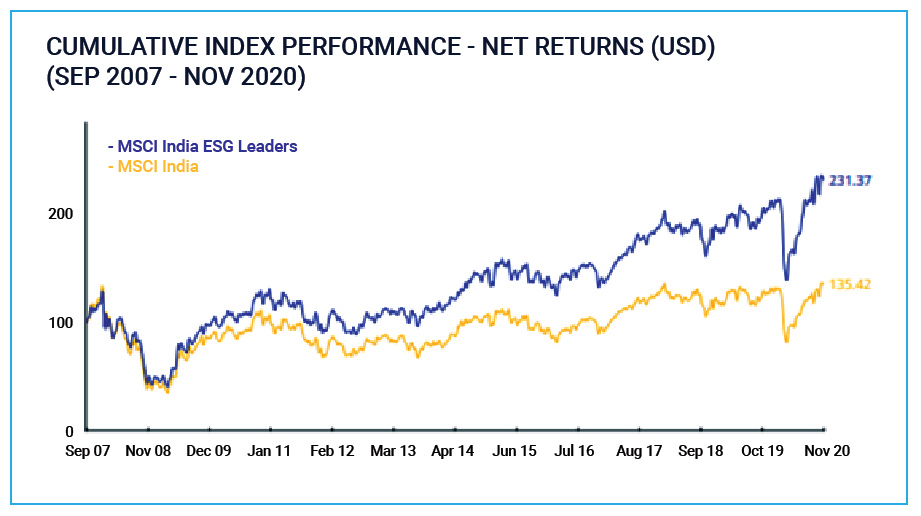

ESG investing means that you invest in sustainable companies that are likely to reduce downside risk even during market downturns. ESG investing has showcased resilience even during the pandemic.

As historical trend shows, ESG index has not only outperformed the Equity index over the period, but it has also protected downside risk better as represented in the chart as depicted below*:

Data Source:

MSCI Indexes supplied by MSCI Inc, and MSCI ESG Indexes supplied by MSCI ESG Research Inc, a subsidiary of MSCI Inc.

Diversified Investment Portfolio:

The advantage of diversifying your investments is to reduce dependency on a single basket of equities to generate risk adjusted returns. We have a well-diversified equity investment portfolio that follows a structured and disciplined investment process in portfolio selection. Companies which score positive and are above the minimum threshold ESG score are generally included in the portfolio.

Once a niche, ESG investing is fast gaining global traction. The Principles of Responsible investing (PRI) as drawn by UN has seen over 3000 signatories from institutional investors since its inception in 2006 representing over USD $110 trillion in assets under management as of 2020.**

Take advantage of the globally emerging investment opportunity to enable your portfolio to capture maximum benefits from the market cycles.

Start allocating 20% of your equity portfolio to Quantum India ESG Equity Fund.

*Past Performance may or may not be sustained in future.

Please note that the above information is for explanation purposes only. The information provided here is not meant to be considered as investment advice/ recommendation to invest. Please seek independent professional advice and arrive at an informed investment decision before making any investments.

**Data Source:

1) https://www.unpri.org/about-us/about-the-pri

2) Global Sustainable Investment Review 2016

Please note that the graph is for explanation purposes only.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More