Here’s a New way to Personalize Your Investments – With a Few Clicks

Posted On Friday, Jul 01, 2022

In the interest of continuing our investor-first approach, we have made the Asset Allocation Approach easy and simple for you to adopt, either using an active or a passive approach.

With the launch of our new fund offer, personalize your investments based on your financial goals and choose how you want to ride your investment journey – building your asset allocation using active or passive investments.

We bring you a new opportunity to simplify your investments in a few clicks. Simply build your allocation using the Asset Allocator calculator to allocate your investments across equity, debt and gold. This tool helps you meet your wealth creation goals – without having to stress about timing markets and unforeseen circumstances.

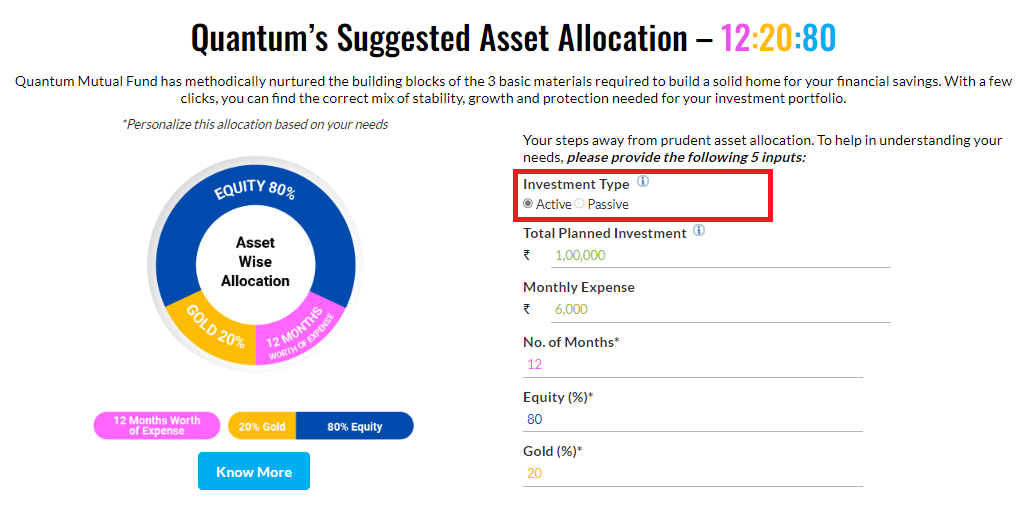

Fig 1: Asset Allocation Calculator: Choose the Style of Investment

How Does the Asset Allocator Tool Help Simplify Your Investments?

Quantum’s tried and tested 12-20-80 Asset Allocation Strategy has worked across market cycles and helped safeguard your investments and offer you the potential for risk-adjusted returns over the long term. Quantum has meticulously added each of the funds across the asset classes of Equity, Debt and Gold to create a one-stop shop to simplify your need for diversification and achieving your objectives. Along with a bouquet of diversified investments in the active space, you also get the flexibility to build your allocation in the passive space.

Here’s how you can use our simple tool available on the website or on your online dashboard:

• Build or rebalance your portfolio

• Personalize your allocation based on your financial goals

• Choose to invest actively or passively

• Add or Switch to any of Quantum’s Diversified bouquet Funds in just a few clicks.

• View your optimised portfolio

Step 1: Choose the investing style you want to adopt

If you are someone who wants the potential to beat the market, greater diversification or fund manager involvement, active investing might be better suited to you. On the other hand, if you prefer to keep things simple and clock returns in tandem with the benchmark index, a passive approach might suit you. You get the flexibility to choose how you want to ride your investment journey.

Step 2: Enter the total amount you intend to invest

Next, enter the total investible corpus that you intend to invest. As a general rule, your investment should not be what is left over after your monthly expenses but should be a fixed sum set aside with a specific financial goal in mind.

Step 3: Build the portfolio diversifying block with Gold

After deducting the Emergency Corpus from your indicated investible corpus, the tool will allocate the balance into Gold and Equity in the ratio of 20-80.

The 20% portion allocation gold in Quantum Gold Savings Fund or Quantum Gold Fund in your portfolio helps offset risks better during periods of macroeconomic uncertainty due to the inverse relationship with equities. At any point, you can change the percentage to gold if required to suit your existing portfolio or goals better.

Step 4: Build the portfolio diversifying block with Gold

The balance of your investible corpus i.e 80% gets diversified into long-term opportunities using a diversified equity bucket. The funds get allocated across three different equity funds - Quantum Equity Fund of Funds, (70%) Quantum India ESG Equity Fund (15%) and the Quantum Long Term Equity Value Fund (15%) with varying investing styles.

If you choose a passive allocation, the entire growth block of your portfolio gets allocated to Quantum Nifty ETF Fund of Fund or the Quantum Nifty 50 ETF.

Step 5: Get an overview of existing allocation and suggested allocation

You receive an overview of your existing allocation and suggested allocation giving you the flexibility to add, switch and personalize as per your requirements.

So, check out the asset allocation tool today and build your portfolio in just a few clicks. Personalize your investments the way you want and just focus on strengthening your investment journey to build long term goals.

|

|

| Related Articles | ||

| Active or Passive Investing: Which Style is Right for You? | ||

| Is Your Portfolio in a Free fall? Or Are You on Your Dream Vacation | ||

| Why Market Crashes Don't Rattle Thoughtful Investors |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund scheme investing in Quantum Nifty ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Low Risk |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on May 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on May 31, 2022

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Quantum ELSS Tax Saver Fund: Solid, Stable and works 30 hours a week for you

Posted On Friday, Jan 31, 2025

Investors seek stability, consistency, and reliability in their financial journey.

Read More -

Choosing the Right Mutual Fund for your Client?

Posted On Thursday, Jan 30, 2025

Choosing the right mutual fund can be a pivotal step towards building a secure financial future for your clients.

Read More -

The Importance of Regular Portfolio Reviews

Posted On Thursday, Jan 30, 2025

While managing a portfolio involves what one thinks will be suitable investments...

Read More