Gold ETFs back in limelight! Should you invest?

Posted On Monday, Nov 11, 2019

As you may know, India is the second-largest consumer of gold. By tradition and culture, in India, gold has always been looked at as eternal wealth and is symbolic of Goddess Lakshmi.

Besides, in the heart of billions of Indians, gold has always carried high emotional value, as it is passed down family generations and strengthens bonds.

Gold is also considered to be a safe haven or a store of value in times of economic uncertainties.

For these reasons, most Indians have a deep affinity for gold and consciously purchase it in various forms - gold bars, coins, jewellery, etc. particularly during festive times and wedding season. But of late, some are also been investing in gold the smart way through gold ETF.

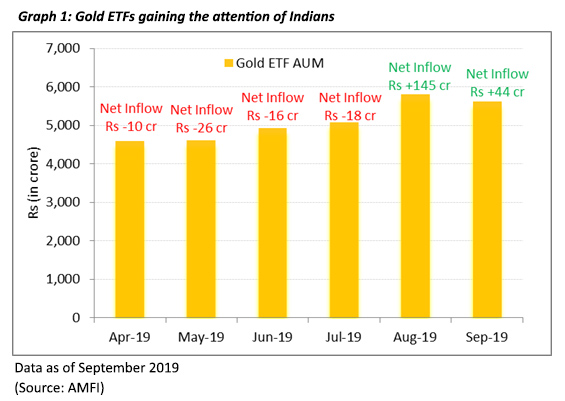

Although the net assets managed by twelve gold ETFs were lower at Rs 5,613 crore in September 2019 compared to Rs 5,799 crore in August, the net inflows remained positive to the tune of Rs 44 crore in September 2019 as per the data released by the Association of Mutual Funds in India (AMFI).

Since September 2018, the AUM of Gold ETF has reported an increase of good +26.6%. This shows that even amid elevated gold prices, some investors are parking their hard-earned money in gold, and rightly so.

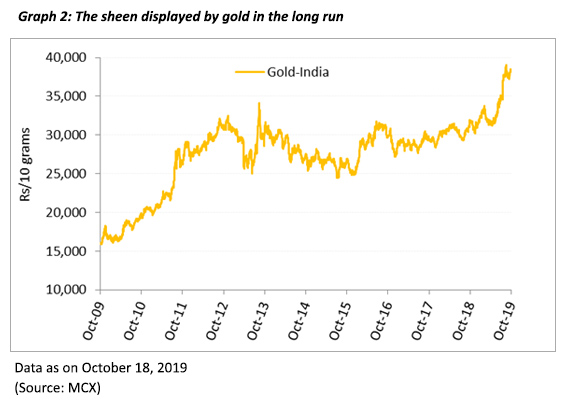

The long-term uptrend exhibited by the precious yellow, of course, has been a reason for gold ETFs to gain traction; but, with it, the underlying factors such as the following are proving supportive, such as...

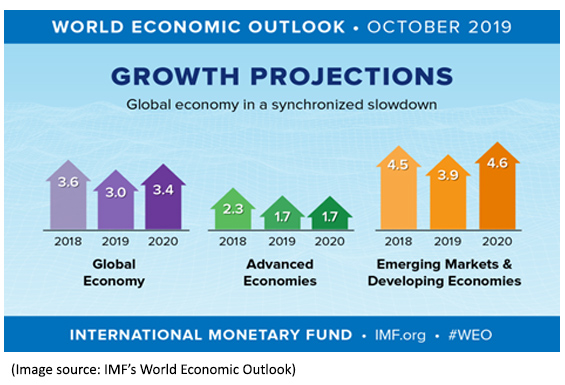

• Uncertainty looming in many parts of the world and global growth forecast is sharply lowered by the IMF (to 3.0% for 2019 ––the lowest since 2008-90). IMF’s Chief, Ms Kristalina Georgieva has warned that the global economy is in the midst of a "synchronised slowdown", and the effect will be pronounced in countries such as India.

• A slowdown in global trade growth (lowest since the last ten years), signals a possible recession.

• A Weak consumer demand along plus the cost pressures and not-so-efficient transmission of policy rates are impacting earnings of most companies, and as a result, the volatility is heightened in the equity markets.

• Investment growth is frail, particularly in developed economies.

• Trade war tensions continue between the US and the other economies.

• Delay in Brexit, has led to the drop in the value of the Pound.

• Geopolitical tensions are evident.

• There is an upside risk to inflation, emanating particularly from food and fuel prices.

• And the central banks across the world are taking accommodative and easy monetary policy stance to support growth.

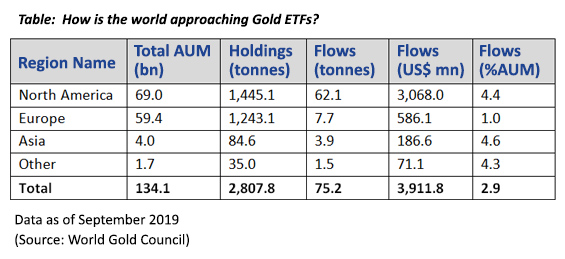

In many parts of the world as well, gold ETFs are witnessing positive participation. The World Gold Council (WGC) has observed that the holdings have surpassed late 2012 levels, at which time the gold price was near US$ 1,700 per ounce, 18% higher than current levels.

The WGC is of the view that the positive catalysts will remain going forward as well ––particularly due to the financial market uncertainty. Should investors in India continue to buy Gold ETF?

Yes, in midst of heightened global uncertainty and headwinds in play, where the Indian markets are largely expected to be coupled, it makes good sense for investors to continue to buy Gold ETF.

Here are five benefits of Gold ETF:

1. You don’t have to dole out a premium – Unlike physical gold, where an investor would pay for making charges additionally; Gold ETFs are purchased and sold at the underlying prevailing market price of gold. All the investor needs is a demat and a trading account.

2. Convenience – Since Gold ETF is traded on the stock exchange, it can be easily bought and sold at the market value. Plus, in the absence of physical delivery, they are easy to hold. The investor’s gold ETF holdings are safe in your demat account until they are sold.

3. Low cost – Gold ETFs, since they are held in demat form, have a lower relative holding cost than buying physical gold.

4. Quality – A Gold ETF is backed gold of 0.995 fineness. Further, the gold is stored in secured vaults and also insured.

5. Resale value: Since Gold ETFs are traded at their prevailing market price, as regards to the resale value, the investor doesn’t have to worry. The units can be easily sold at the prevailing market price during the trading hours of the exchange.

How much to allocate to gold?

Investors may allocate around 10-15% of their entire portfolio to gold through a Gold ETF with a long-term investment horizon.

Gold will play its role of an effective portfolio diversifier, a store of value during economic uncertainty, and a shield against inflation in the long run.

This will be a smart and sensible investment strategy in the long run.

This Article was published in Economic Times on November 05, 2019

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video. Please visit – https://www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Quantum ELSS Tax Saver Fund: Solid, Stable and works 30 hours a week for you

Posted On Friday, Jan 31, 2025

Investors seek stability, consistency, and reliability in their financial journey.

Read More -

Choosing the Right Mutual Fund for your Client?

Posted On Thursday, Jan 30, 2025

Choosing the right mutual fund can be a pivotal step towards building a secure financial future for your clients.

Read More -

The Importance of Regular Portfolio Reviews

Posted On Thursday, Jan 30, 2025

While managing a portfolio involves what one thinks will be suitable investments...

Read More