Balance Your Mutual Fund Investment to Minimize Downside Risk

Posted On Tuesday, Apr 27, 2021

Balance Your Mutual Fund Investment to Minimize Downside Risk

Rising budget deficits, inflationary pressures, Covid-19 resurgence are current macro trends that contribute to market uncertainty. So if you cannot escape market correction, what option do you have to minimize downside risk?

Assets grow and contract in cycles. When your equity investments are not doing well, the debt funds may be doing well. When both equity and debt are not doing well, probably that’s when gold may do well. This is where an effective asset allocation strategy becomes important.

Asset allocation refers to how you divide your investments across different asset classes (equity, debt, cash/fixed deposits, gold) based on your individual goals and risk appetite.

Asset Class Performance FY 2021

| Index | YTD FY 2021 (Mar 31, 2020 – Mar 21, 2021) |

| S&P BSE Sensex TRI | 69.82% |

| S&P BSE 200 TRI | 76.26% |

| NIFTY100 ESG TRI | 77.23% |

| CRISIL Composite Bond Fund Index | 7.69% |

| CRISIL 10 year Gilt Index | 3.60% |

| CRISIL 1yr T-bill Index | 4.66% |

| CRISIL Liquid Fund Index | 4.07% |

| Domestic Price of Gold | 0.36% |

Past performance may or may not be sustained in future.

Source: BSE Sensex, CRISIL & World Gold Council

While DIY Asset Allocation is one way to diversify your portfolio, there are several readymade asset allocation solutions.

Readymade Asset Allocation Solutions

| Equity | Debt | Gold | |

| Conservative Hybrid Fund | 10-25% | 75-90% | NA |

| Balanced Hybrid Fund | 40-60% | 40-60% | |

| Aggressive Hybrid Fund | 65-80% | 20-35% | |

| Balanced advantage Fund | 0-100% | 0-100% | |

| Equity Savings Fund | Min 65% | Min 10% | |

| Arbitrage Fund | Min 65% | ||

| Multi-Asset Allocation Fund | Min 10% | Min 10% | Min 10% |

| Quantum Multi Asset Fund of Funds | 25-65% | 25-65% | 10-20% |

Another solution that may be easier is choosing to invest in a single fund called a Fund of Funds.

Simplify asset allocation by investing in just one mutual fund

This is a more comprehensive approach to diversification. Quantum Multi-Asset Fund of Funds (QMAFOF) is a Fund of Funds with characteristics of a hybrid fund invests in schemes of Quantum Mutual Fund having units of at least three asset classes of Equity, Debt and Gold. QMAFoF is an ideal fund to balance your portfolio within the three asset classes depending on market conditions while aiming to generate long-term risk-adjusted returns.

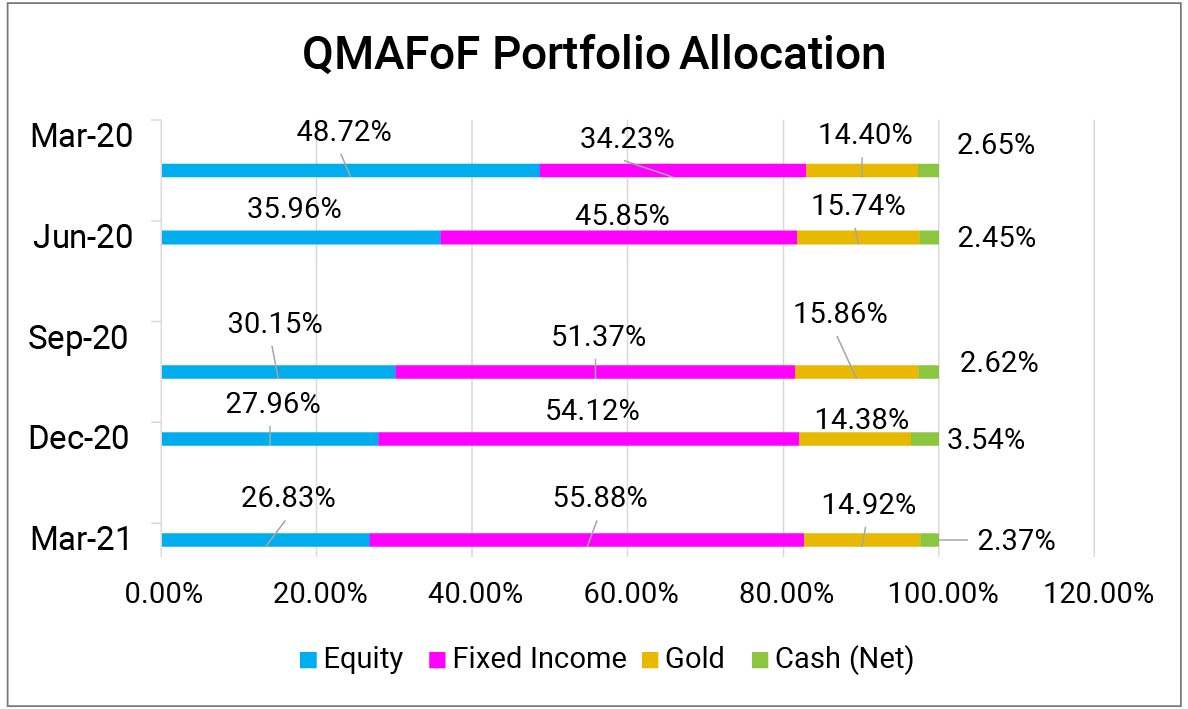

This fund invests in 4 Quantum Mutual Fund Schemes and 2 Quantum ETFs. The fund managers of QMAFOF strategically position the portfolio depending on the prevailing market conditions, thus allowing you to ignore the need to time the market. The fund has a broad and flexible mandate where the fund manager can dynamically allocate between 25%-65% of the portfolio to equity or debt and 10% - 20% to Gold.

To make things simpler, please have a look at the asset allocation strategy the fund follows:

| Asset Class | Range of Exposure | Fund |

Equity Engine for your wealth creation Better performer than other investment option in the long term | 25-65% | Quantum Long Term Equity Value Fund, Quantum India ESG Equity Fund, Quantum Nifty ETF |

Debt Offers liquidity & stability | 25-65% | Quantum Liquid Fund, Quantum Dynamic Bond Fund |

Gold Efficient portfolio diversifier & a store of value | 10-20% | Quantum Gold Fund |

This diversification strategy across asset classes reduces the portfolio risk and optimizes gains.

What are the advantages of Quantum Multi Asset Fund of Funds?

If you are a medium risk investor looking for the ideal way to get a flavor of equity investing with limited risk, a Multi-Asset fund could be the way to go.

1. Allocation to equity, debt and gold based on research-backed investment process:

We determine the relative valuations through evaluation of various influencing factors:

• Price/Earnings Ratio relative to historical averages;

• The relationship between Earnings Yield to Bond Yield relative to historical averages;

• Macroeconomic factors prevailing globally and within India

2. Constant monitoring of assets according to the changing market conditions:

Constant monitoring of your mutual fund portfolio is necessary to evaluate its asset class’s relative performance vis-à-vis other asset classes. Thus, you can worry less about adding to or redeeming from Equity or Debt Funds if the Markets are touching new highs or if interest rates have moved dramatically. Quantum Multi Asset Fund of Funds takes care of all such situations on its own.

The fund follows a regular rebalancing approach within each asset class, allowing investors to “buy-low sell-high,” thereby eliminating the need to predict the near-term future direction of the financial markets.

Data for the period between Mar 31, 2020 to Mar 31, 2021.

Past performance may or may not be sustained in future.

3. Risk-adjusted returns:

The agility in positioning the portfolio correctly as per market correction ensures that allocations are not biased to any particular asset class. The equity allocation went up when markets came down due to Covid-19. As markets ran up again, we actively reduced allocation to equities, reallocating to other asset classes such as Debt or Gold. The presence of Gold in the portfolio has delivered returns and mitigated risks, thereby offering better risk-adjusted returns.

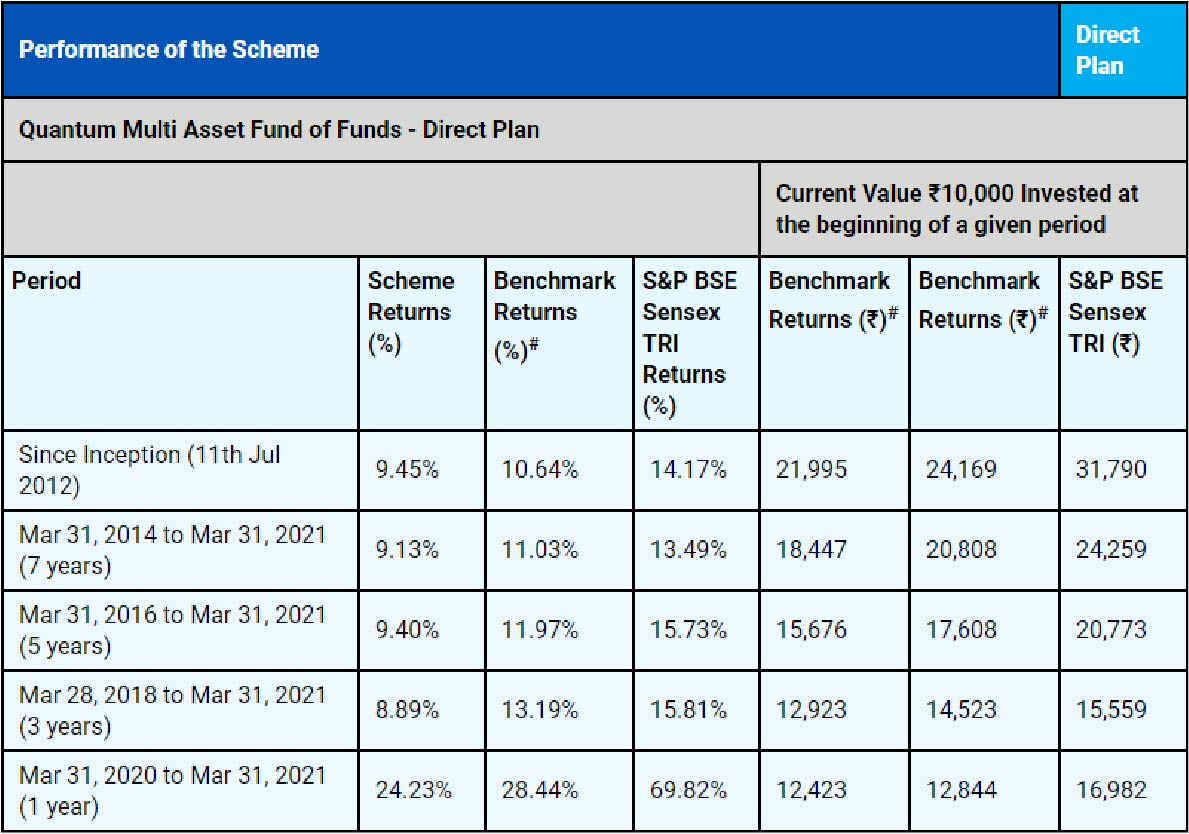

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Data as of Mar 31, 2021

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#Indicates CRISIL Composite Bond Fund Index (40%) + S&P BSE SENSEX Total Return Index (40%) + Domestic price of Gold (20%). The benchmark of the scheme has been changed to CRISIL Composite Bond Fund Index (20%) + CRISIL Liquid Fund Index (25%) + S&P BSE SENSEX TRI (40%) + Domestic price of Gold (15%) w.e.f. April 01, 2021. It is a customized index and it is rebalanced daily. The fund is managed by Mr. Chirag Mehta and Mr. Nilesh Shetty. For performance of other Schemes managed by them please click here.

4. Fund of Fund Taxation:

Quantum Multi Asset Fund of Funds is a better tax-efficient option for investors who park their money in long-term FDs* (3 years and above). That’s because, unlike fixed deposit returns taxation as per the income tax slab of the investor, Quantum Multi Asset Fund of Fund’s long term capital gains tax is 20% with the benefits of indexation. If you redeem investment within 3 years, short term capital gains tax is as per the investors income tax slab.

5. Potential to Stay ahead of inflation:

The Equity component in QMAFOF can generate risk adjusted long-term market-linked returns.

Thus, the key takeaways from QMAFoF are:

|

|

|

|---|

Invest your money for the long-term that rightfully balance safety and returns in your mutual fund investment portfolio with Quantum Multi Asset Fund of Fund.

*Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor

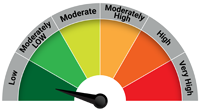

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Nifty ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More