A New Year Checklist to a Healthier, Stronger Portfolio in 2022

Posted On Wednesday, Jan 12, 2022

New year is a time to make resolutions such as working towards better fitness or diet plan and work towards achieving it through the year. Against the backdrop of rising Omnicron cases, while you should undoubtedly prioritize your physical health, this new year, also use the opportunity to review and reinstate the financial health of your investment portfolio. Here’s a handy checklist to evaluate which areas of your portfolio need to be tweaked to make it fitter and stronger to weather any market uncertainty.

Resolution 1: Be ready for any emergency with a backup financial plan

The future is unpredictable. But how you respond to uncertainty can be planned well in advance. Keep a financial backup ready to see through 12 months of expenses. Ideally, park this money in a safe place that is a bank account or a Liquid Fund scheme. This acts as a safety or the foundation block of your portfolio.

Quantum Liquid Fund can be considered as a source to park your emergency fund due to its key advantages as below:

1. Minimal credit risk and no private credit

2. Portfolio of AAA/A1+ rated PSU bonds, high-quality government securities, T-bills with a duration not exceeding 91 days

3. Option for insta-redemption that allows you to redeem money upto Rs.50,000 instantly

Resolution 2: Buy Gold without ever worrying about its purity, price, or storage hassles

Gold acts as a portfolio diversifying building block in your portfolio. It generally performs better when equities are under stress as it is generally inversely proportional to the performance of other assets such as equities. You can now invest in pure, price-efficient forms such as Gold ETF. Invest in a small denomination as low as 1/100th of a gram which is easy and accessible for any wallet size.

Investing in Quantum Gold Fund ETF offers the following advantages:

1. Market Linked Prices

2. Pure Gold of 99.5% finesse

3. Regular independent purity tests of all gold bars

4. Stored in accredited professional vaults

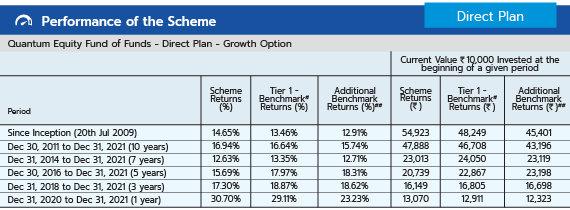

Resolution 3: Not waste time chasing after the top-performing mutual funds or sectors

Mutual Fund rankings are only transitory. While rankings and returns could be one aspect of assessing mutual funds, there’s more to the story behind a mutual fund on what is the fund philosophy, the quality of the fund management team, etc. Investing in Quantum Equity Fund of Funds simplifies your equity mutual fund selection needs by investing in well-researched diversified funds of third-party equity mutual funds chosen after careful quantitative and qualitative research.

Advantages of investing in Quantum Equity Fund of Funds

• Diversified basket of well-researched 5 – 10 equity funds

• Portfolio shortlisted based on in-depth quantitative and qualitative aspects

• Ease of tracking just one folio and one NAV

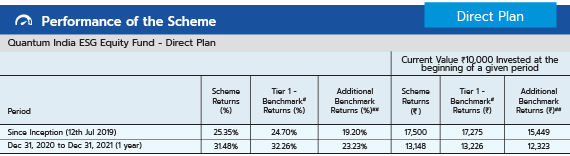

Resolution 4: Look beyond bottom-lines and look for sustainable growth

Several investors are beginning to recognize the importance of weighing financial and non-financial metrics while making investment decisions. Moreover, they understand that a lack of foresight on risk and responsibility management eventually translates into lower profitability and valuation. With that effect, consider ESG investing that incorporates the three non-financial parameters of the environment, social and governance that have a material impact on the future of earnings potential and valuation, making them important considerations for you, our thoughtful investors.

Advantages of investing in Quantum India ESG Equity Fund

• A resilient portfolio that lowers downside risks

• The portfolio incorporates the triple bottom line of 3 Ps - people, planet and profits.

• In-house proprietary research and scoring model

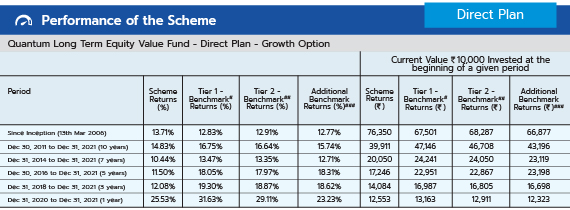

Resolution 5: Believe in the long-term India growth story and not let near-term volatility affect me

When valuations appear elevated and there is uncertainty in the market, you can reduce downside risk with a portfolio that is at a discount to its intrinsic value based on the historical average. Such a fund is a value fund and at Quantum, we have been following the tenets of value investing since 2006 with our flagship fund Quantum Long Term Equity Value Fund.

Advantages of Investing in Quantum Long Term Equity Value Fund

• Incorporates a reasonable margin of safety.

• Portfolio Stress tested for balance sheet strength

• Minimizing downturns during periods of uncertainty

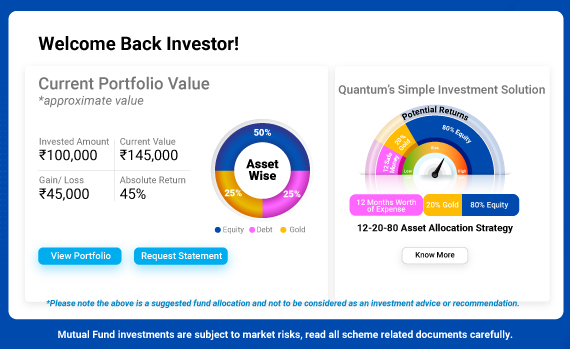

Resolution 6: Diversify my portfolio with a prudent asset allocation strategy

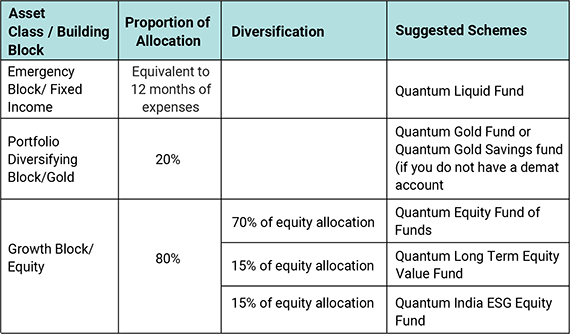

We have time and again stressed how a 12-20-80 asset allocation strategy can be the answer to strengthen your portfolio to fulfill long-term goals and minimize the impact of short-term market uncertainty. Bring all the individual products /building blocks underlying your financial resolutions to build a diversified portfolio that limits the downside and helps you build wealth.

Our proprietary 12 – 20 – 80 strategy calls for investing in equity funds of different market cap segments, investment styles and strategies to build a truly diversified portfolio.

Investment portfolio with 12–20–80 strategy

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

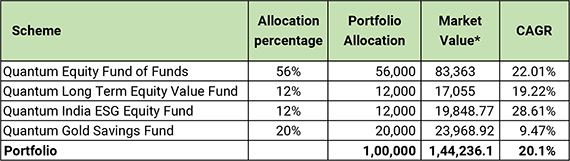

To see how this asset allocation strategy works. Consider an investor with a wealth creation goal who has invested using the 12-20-80 asset allocation strategy. The table below shows the growth in value of Rs 1 lakh investment using equity-gold portion of portfolio from Dec 31, 2019 to December 31, 2021.

Let’s see key highlights of the performance during this period:

• This period saw rising, falling and volatile markets.

• The annualized return (CAGR) of the Equity-Gold portion of the portfolio over the last 2 years (ending 31st December 2021) was 20.01%.

• Over the same period, S&P BSE 200 TRI gave a 23.29% CAGR return.

• Though portfolio return was slightly lower than a pure equity fund, such an allocation would have provided a more stable investment experience, as we will see in the next section.

The following example illustrates the performance of this portfolio (only the equity and gold portion) from Dec 31, 2019 to Dec 31, 2021.

Disclaimer: Past performance may or may not be sustained in the future. The market value of the portfolio as on 31st December 2021. The performance of the fund to be read in conjunction with the complete performance of the funds as given below.

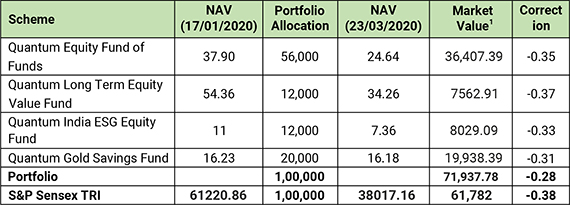

Limited downside risk

Evaluating drawdown of Rs 1 lakh investment in the equity-gold portion of the portfolio compared to S & P BSE Sensex TRI from the pre-COVID peak (17th January 2020) to the COVID market crash bottom (23rd March 2020).

• During this period, S & P BSE Sensex TRI fell by 38%, while the model portfolio fell by 28% (see the table below).

• You can see that the asset allocation strategy limited the downside risk and provided stability in highly volatile market.

Notes: 1. Market value of the portfolio as on 30th December 2021. Past performance may or may not be sustained in the future.

Thus, by using the building blocks with underlying assets in Equity, Debt and Gold, you can be on your way to negate any worry concerning market uncertainty and achieve your long term financial goals.

Create your account today and use our easy Asset Allocation tool to balance your portfolio in just a few clicks. It’s that simple!

So what are you waiting for? Make your New Year checklist to build and strengthen the financial health of your portfolio.

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of Dec 31, 2021

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from February 01, 2020 benchmark has been changed from S&P Sensex TRI to S&P BSE 200 TRI.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. Nilesh Shetty. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. Nilesh Shetty has been managing the fund since Mar 28, 2011.

Click here to view other funds managed by them.

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as on December 31, 2021.

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Mr. Chirag Mehta manages 5 Schemes and Ms. Ghazal Jain manages 2 Schemes of the Quantum Mutual Fund. For other schemes managed by them, please Click here.

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as on December 31, 2021.

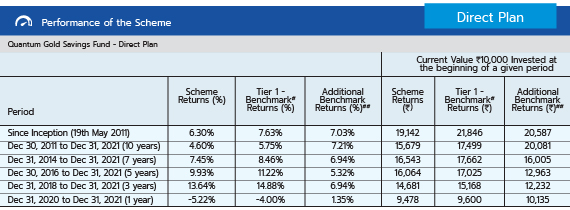

#Domestic Price of Gold, ##CRISIL 10 Year Gilt Index.

Data as on December 31, 2021.

Past performance may or may not be sustained in the future. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Different Plans shall have different expense structure. Mr. Chirag Mehta manages 5 Schemes and Ms. Ghazal Jain manages 2 Schemes of the Quantum Mutual Fund. For other schemes managed by them, please Click here.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on December 31, 2021.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on December 31, 2021.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

| Quantum Equity Fund of Funds An Open-ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Primary Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |  Investors understand that their principal will be at Very High Risk |  |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Primary Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Primary Benchmark: Domestic Price of Gold | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |  |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold Primary Benchmark: Domestic Price of Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |  |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) Primary Benchmark: Crisil Liquid Fund Index | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on December 31, 2021.

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on December 31, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More