Indian Bonds in a Volatile Global Landscape

Posted On Tuesday, Jan 21, 2025

In the last edition of the Debt Monthly Observer, titled Remain Positive, but Turning Cautious, we discussed our long-term optimism for the debt market while expressing a cautious near term outlook in light of rising global yields and depreciating INR.

The bond markets globally have been experiencing a brutal selling for the last three months. While the selloff spans multiple regions, its impact is particularly pronounced in developed markets such as the US, UK, and Japan.

Several key factors are contributing to this trend. In Japan, for instance, bond yields have spiked due to a combination of stronger-than-expected economic data and shifts in monetary policy aimed at controlling inflation.

The U.K. has been one of the hardest-hit regions, with its bond market caught in the crossfire of the global selloff. Yields on long-dated British government bonds have reached their highest levels in decades, placing additional pressure on public finances. At the same time, the British pound has struggled, and domestic equities have underperformed, reflecting broader investor unease.

In the U.S., market volatility was primarily owing to stronger than expected US job data and softer than expected decline in the US CPI numbers which led to a surge in the US bond yields. The added uncertainty surrounding future policy moves, particularly with new political leadership in the U.S., is amplifying market volatility, leaving investors navigating an increasingly uncertain landscape.

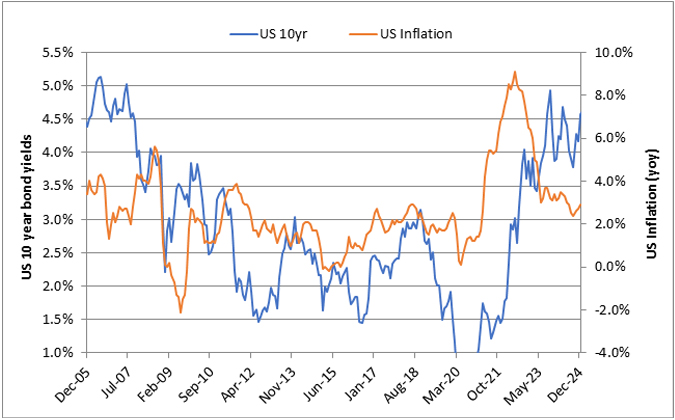

Chart – I: U.S. bond yields have become highly responsive to U.S. inflation data

Source: Bloomberg. Data on inflation for the month of December 2024. Data for US 10-year bond yields are for the period ended December 29,2024

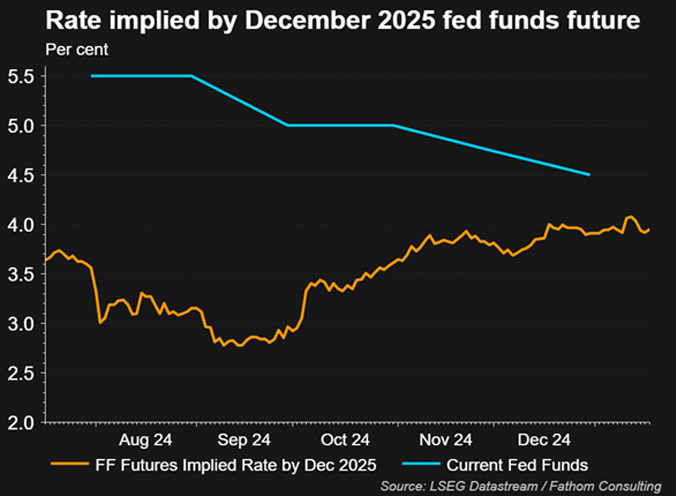

Stronger-than-expected jobs data has reinforced expectations that the Federal Reserve will keep interest rates elevated for an extended period. Markets now anticipate a single Fed rate cut, likely no sooner than June. However, US bond yields eased following a softer-than-expected increase in inflation for December 2024.

Chart – II: Fed Funds Rate Expected to Fall to 4% by Dec 2025, hinting lower rate cut expectation

Source: LSEG Datastream. Data as on January 20, 2025.

Another significant driver of global volatility has been the strengthening of the dollar, fuelled by strong U.S. economic growth data, the Fed's continued unwinding of its balance sheet (Quantitative Tightening), and Trump’s stated policies of tax cuts and trade tariffs. These factors have bolstered investor confidence in the U.S. economy, attracting more capital inflows and further strengthening the dollar.

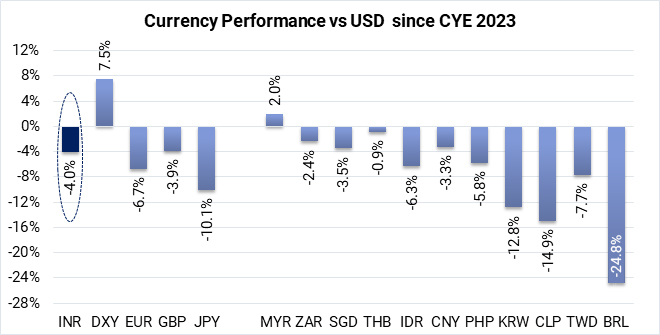

The Indian Rupee (INR) has depreciated ~4% against USD since September 2024 as against ~7.5% rise in the Dollar index. So far, the depreciation in INR looks measured when compared to most other currencies. However, much of it was contributed by an aggressive intervention by the RBI. The RBI have sold ~ USD 80 Billion of forex reserves (between September 2024 – January 10, 2025) to defend INR and have also built a cumulative short position in forwards to the tune of USD 50 billion as of November 30, 2024.

We believe, the INR will continue to face a depreciation pressure against USD. However, we believe that a gradual decline in the rupee's value will be non-disruptive for the markets and will be healthy for the economy considering that the rupee is currently about 5% overvalued against its trading peers based on the Real Effective Exchange Rate (REER).

Chart III: INR continues to exhibit a smaller decline against the dollar compared to other peer currencies

Source: Bloomberg, Quantum Research Graphics. Data since December 29, 2023 till January 16, 2025

WHERE DOES INDIA STAND AMID THIS?

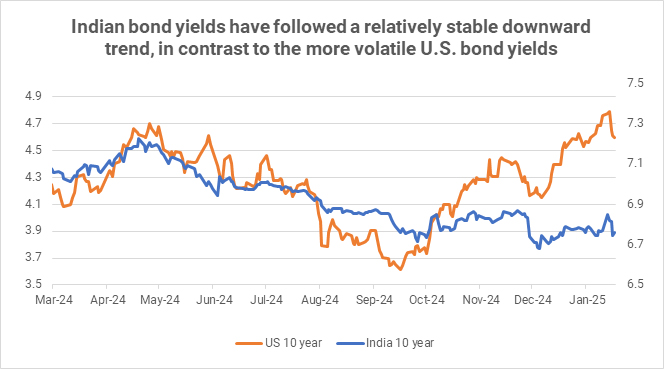

Domestically, Indian bonds initially seemed to decouple from the U.S. bond market, following a downward trajectory in yields while the 10-year U.S. Treasury yield increased. Since March 2023, U.S. 10-year bond yields have risen by 60-70 bps, while Indian 10-year bond yields have fallen by 60 bps. However, after recently absorbing the effects of the global bond sell-off, Indian bonds also responded, with yields temporarily rising alongside U.S. Treasury yields before eventually cooling off.

Chart – IV: Domestic factors remain the key drivers of Indian bond yield movements, resulting in a low correlation with U.S. Treasury yields

Source: Bloomberg, Quantum Research Graphics. Data up to January 16, 2025

India is currently navigating dual challenges of liquidity constraints and currency pressures, with the Reserve Bank of India (RBI) shouldering much of the responsibility for addressing these issues. The upcoming monetary policy meeting in February 2025 will be a critical for the Indian bond markets. A deeper analysis of these developments will be provided in the following sections.

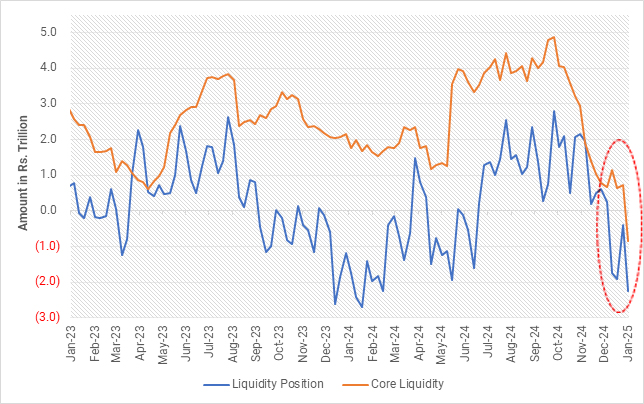

Banking system liquidity have continued to tighten in January 2025, with the system moving into a deficit exceeding Rs. 2.5 trillion and durable liquidity turning negative (deficit) for the first time since 2019, as observed in the week ended January 10, 2025.

Chart – V: Banking system liquidity continues to remain tight; Core liquidity slips into deficit

Source: RBI, Quantum Research internal Calculations. Data up to Jan 10, 2025

The primary factor behind this shift has been significant foreign exchange (FX) interventions by the Reserve Bank of India (RBI), which have drained liquidity from the system. These interventions, aimed at stabilizing the currency, have had a direct impact on the overall liquidity available in the banking system.

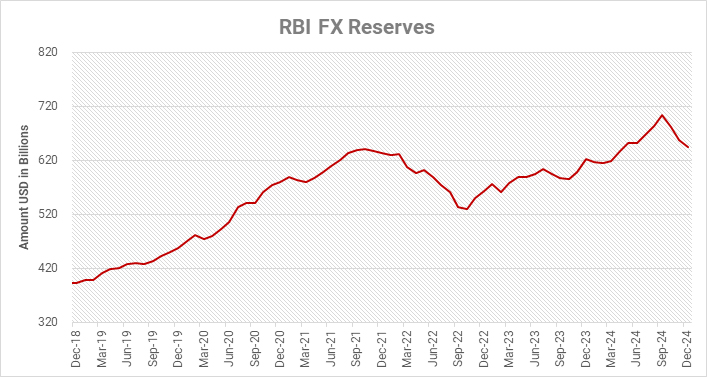

Chart – VI: RBI FX reserves data

Source: RBI, Quantum Research Graphics. Data up to December 2024

The RBI has been actively selling foreign exchange reserves since October to prevent the Indian rupee's depreciation. While this strategy aims to stabilize the rupee amid global uncertainties, it has also led to tighter liquidity in the domestic financial system, draining around Rs. 5 trillion from the banking system.

The RBI has been actively announcing variable rate repo operations to provide liquidity.

They recently introduced a daily VRR operations as well. However, VRR is a temporary liquidity measure and does not address the ongoing durable liquidity crunch. With increasing CIC (Currency in circulation) linked outflows amid wedding season and the RBI's continued interventions in the FX market, VRR alone will not suffice. In this context, we expect the RBI to provide additional support through long-term buy/sell forex swaps and open market operations (OMO) purchases, which will be vital in alleviating liquidity pressures.

CONCLUSION:

The bond sell-off has sent ripples through Indian markets, with foreign investors chasing higher yields in developed economies, driving an FPI exodus from emerging markets like India. However, India is better equipped to weather the storm this time. Unlike in previous downturns, the country boasts robust forex reserves, and its recent inclusion in JPMorgan's GBI-EM index has further enhanced market credibility.

Since the index inclusion, Indian bond markets have witnessed net inflows of Rs 1.6 trillion, a trend expected to remain strong as the rupee stabilizes, providing continued support to the domestic bond markets.

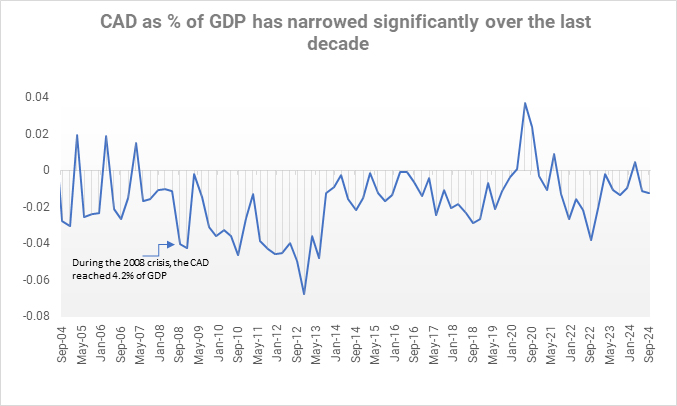

Chart – VII: India’s Current Account Deficit is much more comfortable

Source: CMIE, Quantum Research Graphics. Data up to September 2024

While global markets are in turmoil, India’s position isn’t as vulnerable as in past crises. Yes, the nation will face some challenges—pressure on the currency and higher import costs—but its strong economic fundamentals paint a more resilient picture.

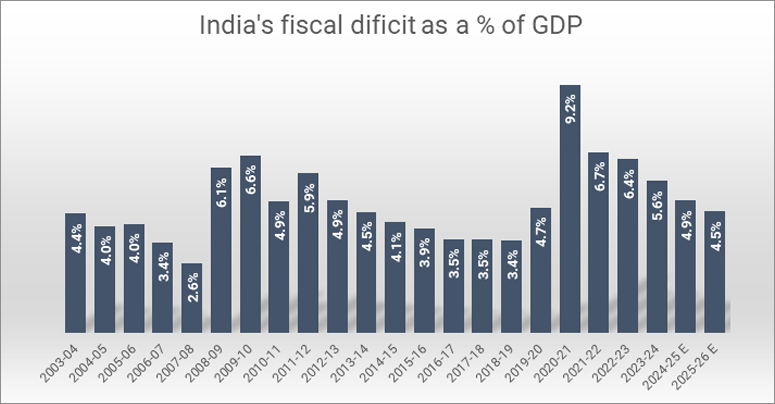

• Favourable Demand-Supply Dynamics in Government Bonds: The real demand for government bonds remains strong, driven primarily by institutional investors such as insurance companies and pension funds. On the supply side, the government’s focus on fiscal consolidation and debt reduction adds stability by limiting debt issuances. Our estimates suggest that the government is on track to comfortably meet its fiscal deficit target for FY 2024-25, with the deficit likely to be closer to 4.8% of GDP, reducing the shortfall by approximately Rs 57,000 crores from the budget estimate. Assuming fiscal deficit at 4.5% of GDP in FY 2025-26, the net issuance of government bonds might decline in FY26.

Chart – VIII: India is on track to meet its fiscal deficit target for the year

Source: India Budget, RBI, Quantum Research graphics. Data for 2024 to 2026 are budget estimates

We believe that these structural shifts in demand and supply, along with the continued internationalization of the Indian bond market, will drive growth in 2025. In fact, demand may even surpass supply, creating a favorable environment for the bond market.

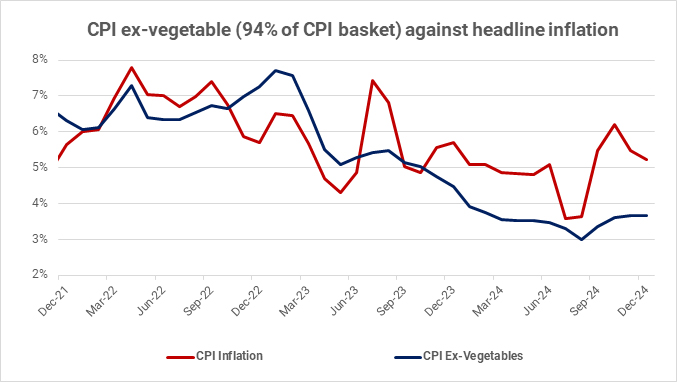

• Declining Inflation Trend: Although headline inflation remains above the Reserve Bank of India’s (RBI) target of 4%, there are clear signs of easing inflationary pressures in the economy. CPI inflation excluding vegetables which represents 94% of the CPI basket, has been below the RBI’s 4% target for last 13 months. With vegetable prices cooling off in recent months, we expect headline inflation number to fall closer to 4% in coming months.

Chart – IX: Barring food inflation, most elements of CPI basket showing a softening trend

Source: MOSPI, Quantum Research graphics. Data up to December 2024.

• Potential for a rating upgrade: India's high public debt and low per capita income may weigh on its credit profile but improving fiscal and external balance sheets and greater resilience to external shocks signal progress. With growing economic potential, stronger external balances, and improved corporate and financial sectors, there’s a strong case for an upgrade in India’s credit rating. From a market perspective, any improvement in India’s credit profile is positive, irrespective of global rating agencies' actions. Refer India Poised for a Sovereign Rating Upgrade

Thus, we maintain our positive outlook on medium to long duration bonds and expect bond yields decline further over the next 12-24 months. (refer Bull Case Revisited). However, we will remain watchful of the emerging risks and will not hesitate to change our view if conditions warrant that.

What should Investors do?

In our view, dynamic bond funds are the ideal choice for long-term investors who can tolerate occasional market volatility.

These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of the assets in 10-40-year maturity bucket. |

Source - RBI, Blomberg, Refinitiv, MOSPI, CCIL, Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Pankaj Pathak, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian - Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Remain Positive but Turning Cautious

- India Poised for a Sovereign Rating Upgrade

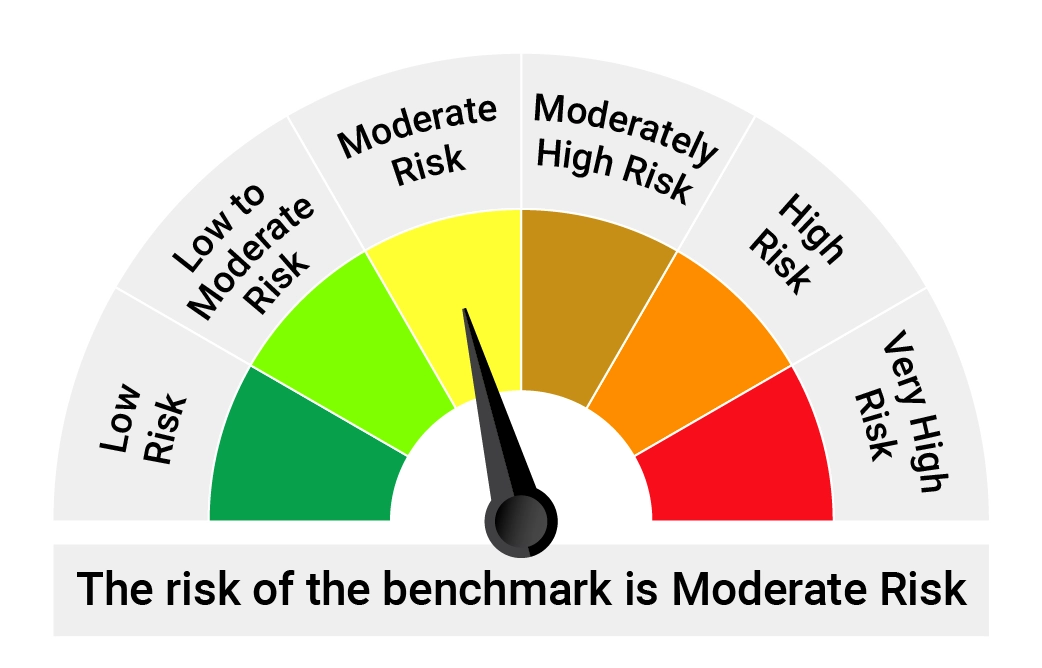

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme | Riskometer of Tier I Benchmark |

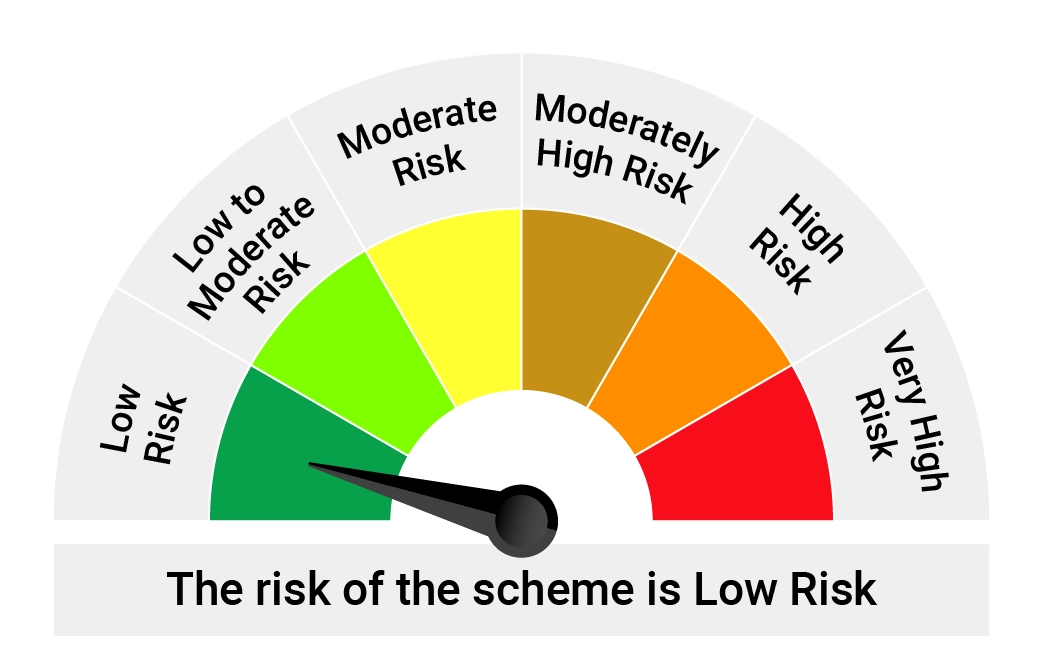

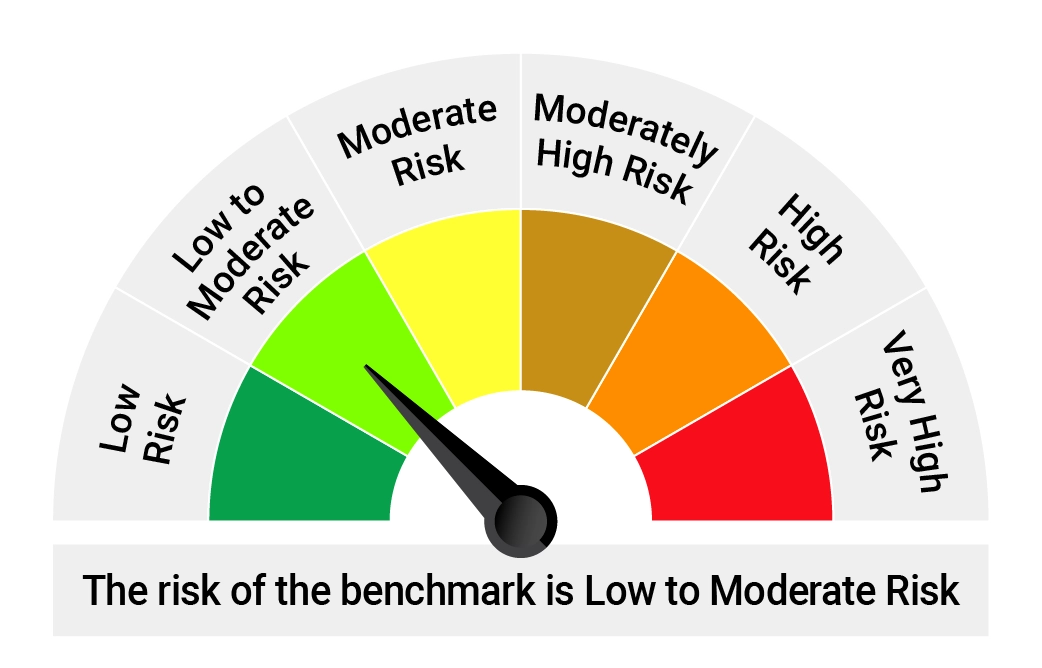

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Liquid Debt A-I Index |

|  |  |

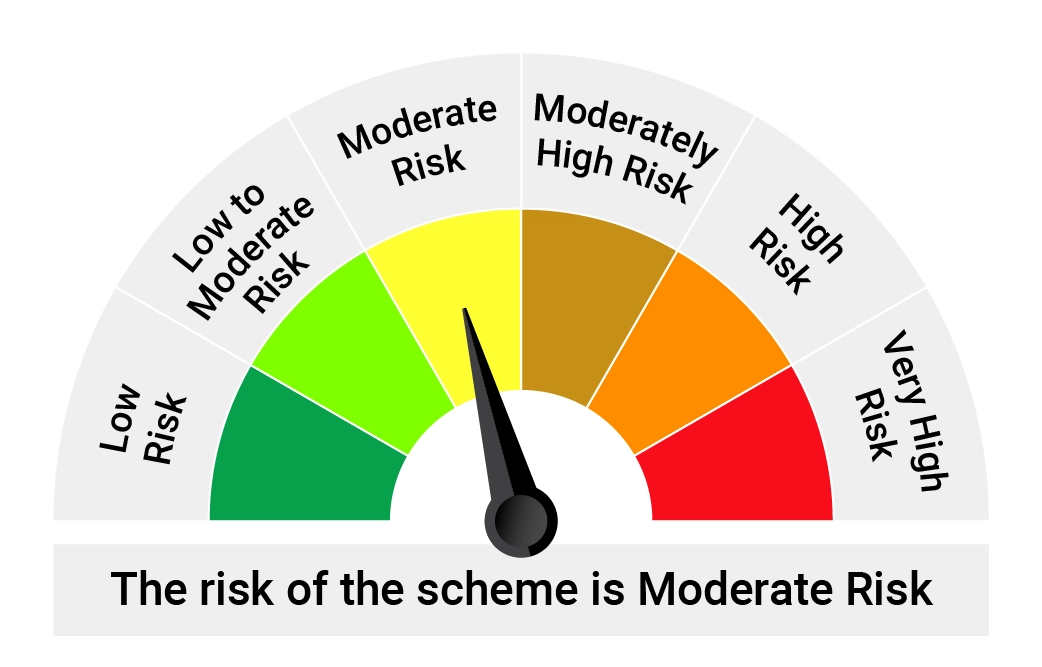

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index |

|  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More