Index Inclusion: How will it Unfold

Posted On Monday, May 27, 2024

India is all geared up to enter the JP Morgan’s Emerging Market Government Bond Index starting June 2024. Over the course of the next 10 months, Indian Government Bonds (IGB) will eventually gain the maximum allowed weight of 10% in the JP Morgan GBI EM Index, following 1% additions to its weightage each month.

Given foreigners’ under-allocation to the Indian bonds, index inclusion is expected to attract a large pool of foreign capital into the Indian bond market over the next few months. As per market estimates, combined inflows from passive and active investors could be in the range of USD 20-40 billion.

Chart – I: Indian Bonds are under-owned by foreign investors

Source: Asian Bonds Online, Quantum Research Graphics. Data till December 2023

Can India absorb the extent of such inflows?

India’s bond market is worth more than USD 2 trillion. With index inclusion, we believe the additional USD 0.02 trillion inflows can be easily absorbed by the markets.

However, with foreign investors buying Indian bonds, the exchange of foreign currency, such as dollars, for rupees shall also pick up pace. The increased demand for the rupee is then likely to increase its value, making it stronger against other currencies. Thus, increased foreign flows is likely to bring some volatility in the currency markets causing the RBI to intervene more actively to avoid excessive appreciation in INR.

Given the RBI’s operational track record, we expect them to absorb most of the dollar inflows and minimize the impact on Indian currency.

What does it mean for the domestic bond markets?

The RBI buying dollars also has a second leg impact on liquidity. Easy liquidity in the system is likely to fuel demand for short term bonds.

Assuming RBI doesn’t withdraw much of the additional system liquidity and with index inclusion, the foreigners continue to stay bullish on long bonds – we shall see a downward shift in the yield curve, thus relaxing the bond yields across the curve.

On the flip side, if the RBI actively absorbs the liquidity created due to its forex interventions, short-term yields will have little to no impact. Buoyant demand at the longer end of the yield curve shall thus lead to a flatter yield curve.

Will index inclusion bring more bond tourists or bond investors?

Many investors may foresee such index inclusion as a tactical opportunity to benefit from surge in foreign flows. We argue that foreigners should look at the Indian bond markets with a strategic lens much more than a tactical one.

The impact of index inclusion is largely positive for the Indian bond markets (refer Why Soaring Oil Prices Couldn't Dampen Market Mood) as it is likely to bring down the cost of borrowing for the government, support the Indian currency & the bond markets. Corporate borrowers shall also benefit since their borrowing costs too are largely benchmarked to government bond yields.

Chart – II: Foreign buying in Indian bonds picked up significantly post the announcement of index inclusion

Source: CCIL, Quantum Research Graphics. Data complied till April 2024

However, there is always a risk of large foreign money overwhelming the domestic financial system particularly when it moves in or out in a short span of time. India witnessed one such event during the ‘taper tantrum’ episode in 2013 when large outflows from Indian bonds led to around 20% crash in the value of Indian Rupee and sharp jump in domestic interest rates.

Chart – III: Debt inflows in 2012 almost entirely wiped out in 2013 Taper Tantrum

Source: RBI, Quantum Research. Historical data from FY10 till FY14

However, with India undergoing structural reforms over the years and its inclusion in the global emerging market indices, we believe bond inflows now are likely to be stickier in nature.

We base our view on the back of a series of improvements in the overall economic environment in India, some of which we would like to highlight as under:

1. India’s strengthening External Position:

Over the last 10 years, India has made significant progress in manging its current account balances. Growing services surplus and rising remittance are keeping CAD under check despite crude oil prices remaining elevated.

Chart – IV: Growing Services Surplus and Rising Remittances keeping CAD low despite elevated crude oil prices

Source: CMIE, Quantum Research. Data complied till December 2023 for CAD and March 2024 for others

India has also reduced its reliance on foreign debt significantly over the last 10 years and has worked on building its foreign exchange reserves. Anyways, India’s public debt is almost entirely domestic funded. The external debt is mostly from corporates sector, long-term real estate, and infrastructure investors and NRI deposits which are more sticky.

Chart – V: Foreign Assets nearing external debt

Source: CMIE, Quantum Research

2. India’s Inflation – much lower and less volatile

India officially adopted the inflation targeting framework in 2016. But it has been in operation since 2014, completing 10 years now. The inflation targeting framework in India is now mature enough and has achieved the desired goal of keeping inflation within a tight range.

In April 2024, the headline CPI inflation remained steady at 4.83%. At the same time, the CPI ex-vegetable which captures around 94% of the total CPI basket, fell to 3.52% (vs 3.55% in March 2024) and the core CPI (ex-Food and Fuel) also remained stable at 3.19% (vs 3.27% in March 2024). The underlying inflation in India has been on a downward trend, much below the RBI’s 4% target (refer The last Mile).

Chart – VI: Underlying inflation trending below 4%, headline inflation inching lower too

Source: MOSPI Press Release, Quantum Research. Data complied till April 2024

3. Fiscal tightening and shrinking bond supply

Over the past 10 years, the government has demonstrated disciplined fiscal management by keeping overall fiscal deficit under check. The fiscal deficit widened, understandably, during covid-19 pandemic. But coming out of pandemic the government started its fiscal consolidation bringing down the fiscal deficit from peak of 9.2% of GDP in FY21 to estimated 5.1% in FY25. We expect the fiscal consolidation trend to continue over coming years.

With government continuing with the fiscal consolidation, supply of government bonds is expected to decline over coming years (refer Time to bond). The Government’s gross market borrowing in FY25 is estimated to be Rs. 14.1 trillion. This will be Rs. 1.3 trillion or 8.4% lower than the market borrowing in FY24. If government continues with the fiscal consolidation, which seems highly likely, government bond issuances will decline further in FY26.

Chart – VII: Fiscal consolidation to reduce bond supply

Source: Union Budget, Quantum Research.

Falling bond supply and strong demand for bonds should bode well for the fixed income market. Longer maturity bonds will likely benefit most from the favourable demand supply mix. So far, banks, insurance companies and mutual funds have been the largest buyers of government debt. An additional source of funds shall help cap bond yields and aid in lowering the government's borrowing costs, especially for bonds with longer maturities.

4. Backdrop set to make a case for a rating upgrade

India currently has a rating of BBB- by S&P and Baa3 by Moody’s. In order to upgrade the credit rating India needs improvements in Economic growth, stability, and debt levels.

While international organisations and rating agencies have predicted slow-down in global growth this year, India’s growth prospects look a lot more optimistic. IMF has raised India’s growth forecast for FY 2024-25 to 6.8%, much closer to RBI’s growth projection of 7% for 2024-2025.

India’s financial systems too have improved significantly over the last few years. Banks’ capitalization ratios have been way above the minimum required levels as per RBI.

Chart – VIII (a): Bank balance sheets stronger than ever

Source: RBI, Quantum Research, Data collated till September 2023.

Net Non-Performing Assets (NNPA) too have shown significant decline over the few years on the back of lower incremental slippages, reduction in special mention accounts, restructuring of portfolios, and healthy growth in advances, thereby adding strength to the banking system.

Chart – VIII (b): Bank balance sheets stronger than ever

Source: RBI, Quantum Research, Data collated till September 2023.

We believe India is well positioned to remain a faster-growing major economy, demonstrating resilience amid geopolitical challenges and supply chain pressures. Corporate balance sheets too continue its upward trend, thus adding additional support. With this backdrop we believe India has the merits for a potential rating upgrade

5. High Yield Opportunity

India offers relatively high yield on its local currency bonds compared to most of the emerging economies.

Chart – IX: Relative higher yields in the Indian Bond Market

Source: Refinitiv, Quantum Research, Data collated till April 2024.

Given the relatively high yield and lower volatility of Indian government bonds, and low correlation with other assets and bond markets (Read Pull Back or Reversal), investors may be attracted to running overweight position in Indian bonds.

Market Outlook:

Bull case for India Bonds Intact

We continue to hold our positive outlook on Indian bonds (refer The Bull Case) supported by a structural shift in demand supply balance, and a cyclical turn in inflation and monetary policy.

India’s inclusion in the global bond indices and rapidly growing domestic financial savings will continue to boost demand in the bond market. At the same time, government’s fiscal consolidation is reducing supply of bonds making demand supply balance in favour of long-term duration bonds.

What should Investors do?

Considering a strong case for long term yields to decline over the next 1-2 years backed by the reasons described above, we believe long term government bonds offer a rewarding opportunity.

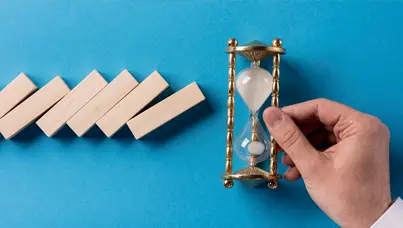

Dynamic Bond Funds are probably well placed to capture this opportunity with a flexibility to change if things don’t pan out as expected. However, investors need to have a longer holding period of at-least 2-3 years to ride through the intermittent volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of portfolio invested in above 10 year maturity segment. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More