Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic. But, by no means this can be characterised as a normal year. Nobody could have imagined inflation ever going up to 7%-10% in the developed world. The US Fed hiking interest rates above 3% was unimaginable until it actually happened this year.

Events, this year, exposed many fault lines in the way systems have been working for years. The war between Russia and Ukraine changed the geo-political and security strategies in many countries with an increased focus on building defence capabilities. Supply shortages in crude oil highlighted the problem of under-investments in the conventional energy sector and constraints in the pace of transition to renewables. Freezing of Russia’s foreign reserves raised alarm across many economies with large foreign exchange reserves and dollar dominance once again came into question.

These cracks will take a long time to fill and will continue to influence the investment climate over the years to come. While from a near-term perspective, inflation and monetary policy will remain the dominant forces and key drivers for the financial markets.

Higher for Longer

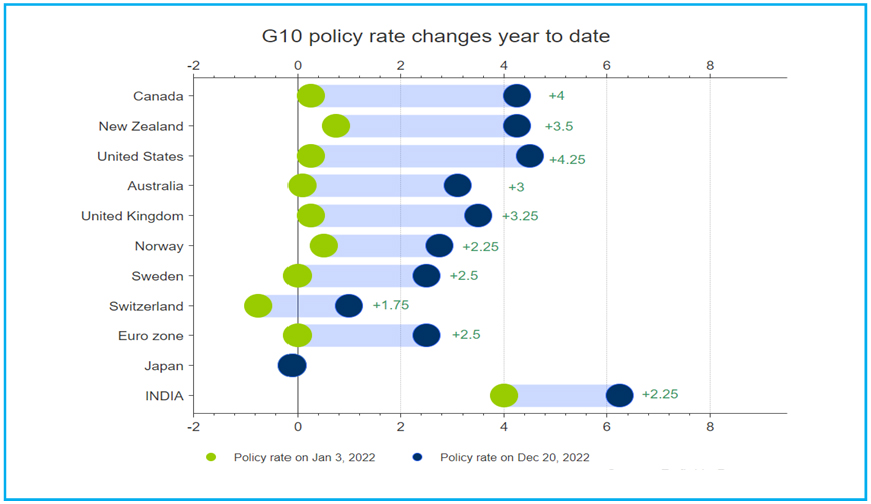

This year central banks were in hurry to tighten the monetary policy by hiking rates at the fastest pace possible. The US Fed hiked the fund's rate from 0% to 4.25% in nine months. Most of the other major central banks followed a similar path and tightened monetary policy at a rapid pace.

This seems justified as they started from very low or zero interest rates and inflation surged quickly to an intolerable level.

James Carville (Advisor to former US president Bill Clinton) must have said this as a joke. But, the movement in the bond markets over the past two months have really been intimidating for everyone from policy makers to investors. British government’s U-turn on the tax cut proposal after bond sell off is a live testimony of this.

Bond yields have been rising for the last two years. But, its sharp up move in the last two months have been particularly destabilizing for markets. Over the last two and half month (since July 31, 2022 till October 18, 2022), the 2 year US treasury yield has moved up by 154 basis points from 2.89% to 4.43%. Bond yield in other advanced and emerging economies have followed the US treasury yields.

In advance economies, these level of interest rates have not been seen for very long time. This is an unknown territory for many of the financial models built on the last 10-15 years of market data. Financial system is becoming increasing sensitive to interest rates beyond a level.

Chart – I: Globally Central banks frontloaded Rate Hikes in 2022

Source – Refinitiv Datastream

Now that interest rates have reset at much higher levels and inflation has started to moderate, central banks will slow down the pace of rate hikes. In 2023, we expect central banks to be more data-dependent and reactive rather than hiking rates too much pre-emptively.

This pivot in monetary policy was observed in the US Fed chairman Jerome Powell’s response to a question about the pace of rate hikes. He said “...the pace with which we're moving was the most important thing (this year). I think now that we're coming to the end of this year, we've raised 425 basis points this year and we're into restrictive territory, it's now not so important how fast we go. It's far more important to think about what is the ultimate level. And then it's - at a certain point, the question will become how long do we remain restrictive?

Going into 2023, the terminal level of interest rates in the US and the timeline of maintaining higher rates would be the key determinant for the fixed-income markets the world over.

Global monetary policy affects Indian markets via channels of trade, capital flows, and risk sentiment. A high-interest rate is negative for global growth which in turn reduces India’s exports and foreign earnings.

At the same time, tight monetary policy hurts capital flows into India and puts pressure on the Indian Rupee. If it comes along with a sharp increase in crude oil prices, the impact can be magnified many folds. (India is the third largest oil consumer in the world, 85% of which is imported).

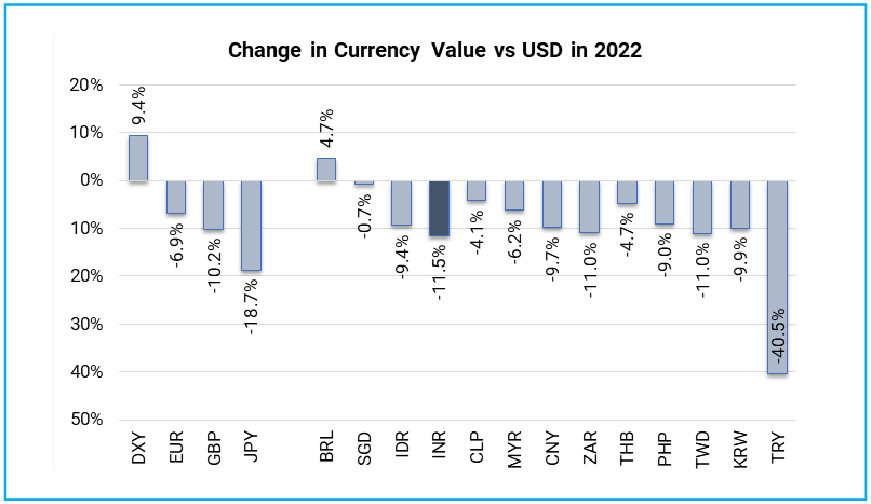

RBI’s External Concerns

In 2022 so far, the INR has fallen by 11.5% against the US Dollar. RBI’s foreign exchange reserves also depleted by USD 70 billion though more than two third of this was due to valuation changes. (RBI’s foreign reserves constitute multiple currencies and almost all major currencies lost value against the US Dollar this year – reducing the value of reserves in USD terms).

Chart – II: Hawkish US Fed and strong Dollar putting pressure on currencies globally

Source – Bloomberg, Quantum Research, Data as of December 16, 2022

The RBI still holds a sizeable foreign exchange reserve which stands at USD 564 billion USD as per the latest available data of December 9, 2022.

Nevertheless, the risk of potential external shock cannot be ignored especially at a time when India needs more foreign capital to fund its wide current account deficit of over USD 100 billion (~3.4% of GDP) this year.

This makes the domestic monetary policy increasingly sensitive to global tightening beyond a point. The RBI has been fairly hawkish with an increased discussion about the external conditions in its monetary policy statements.

Although managing external balances or INR movement is not in MPC’s (Monetary Policy Committee) mandate, we find RBI members including the governor being sensitive to these goals as well.

In this light, a downshift and an ultimate pause in rate hikes by the US Fed and other DM central banks should provide a breather to the RBI in 2023. The RBI might hike the repo rate again in the next MPC meeting in February 2023.

However, if domestic CPI inflation follows the expected glide path towards 5% by the middle of 2023, we would expect the RBI to pause the rate hiking cycle after February with a terminal repo rate at 6.5%.

Debt Outlook – Yield is Good; Yield is Real

In the October 2022 edition of the Debt Market Observer – The Fed, The RBI, and Mr. Bond, we noted that – We have already seen the worst of inflation. Much of the rate hikes have already happened. The peak of central banks’ hawkishness is now behind us.

We have been constructive on the bond market since June 2022 (Looking Beyond FED), when we called that – The inflation narrative has peaked and markets have run ahead of central banks.

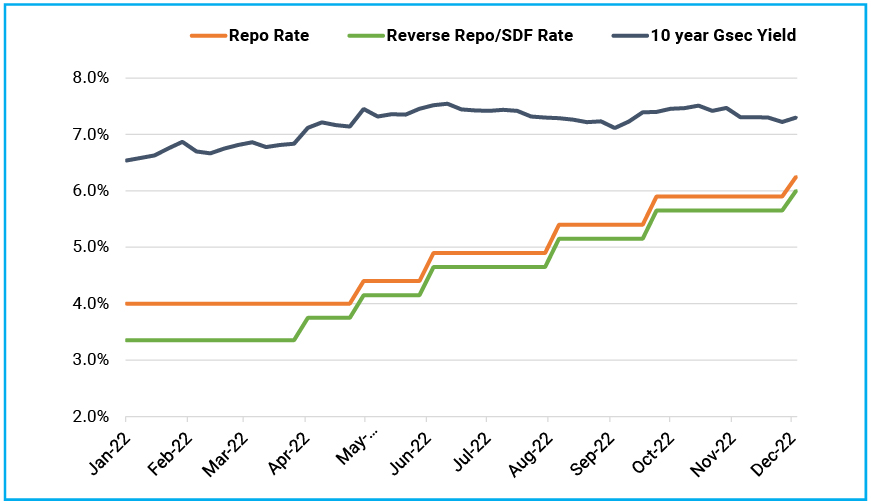

Since June 2022, the RBI has hiked the Repo rate by 185 basis points; while yields on medium to long-duration bonds have come down 10-30 basis points and remained in a tight range. The 10-year government bond yield has been in a broader range of 7.2%-7.5% since June 2022 and currently trading around 7.28%.

Source – Bloomberg, RBI, Quantum Research, Data as of December 16, 2022

Past performance may or may not sustained in future.

Can central banks ignore financial stability risk?

Going into 2023, the bond market is positioned for another rate hike of 25 basis points in February and a long pause thereafter.

With the repo rate at 6.25% and banking system liquidity near neutral levels, the monetary policy in India has been restored to normal conditions. If inflation follows the RBI’s expected glide path, we would expect the India 10-year G-sec yield to remain in the band of 7.2%-7.5% for an extended period.

At the front end (up to 2 years) G-sec yields will be more influenced by the RBI’s policy tone and liquidity conditions going forward. We expect the liquidity drain from the banking system to intensify in the first half of 2023 as cash withdrawals tend to increase during January to May period.

We expect short-term bond yields to move higher marginally, which will be good for accruals.

The yield spread on AAA corporate bonds over respective maturity government bonds should increase with the rise in credit demand and increased supply of corporate bonds. While yield spread on state development loans (SDL) might remain tight as states continue to enjoy increased tax revenues with growth recovery.

What should Investors do?

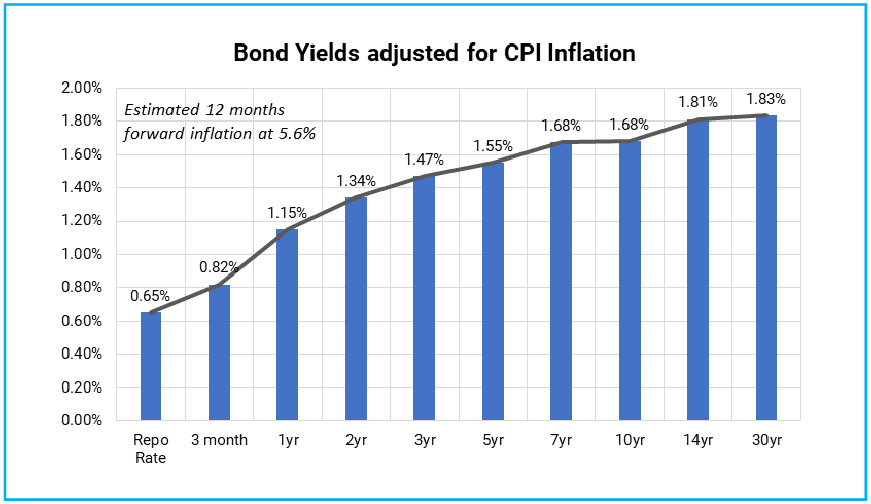

With most of the government bond yield curve above 7%, the accrual yield has improved significantly in the bond market. Currently, government bonds across all maturities are trading above the expected CPI inflation for the next year.

Higher starting yields auger well for fixed-income returns as it increases the interest accrual on fixed-income instruments. Also, with much of the rate hikes by the RBI already delivered, the probability of the market value of bonds going down has also come down meaningfully.

Source – Refinitiv, Quantum Research, Data as of December 16, 2022

Past performance may or may not sustained in future.

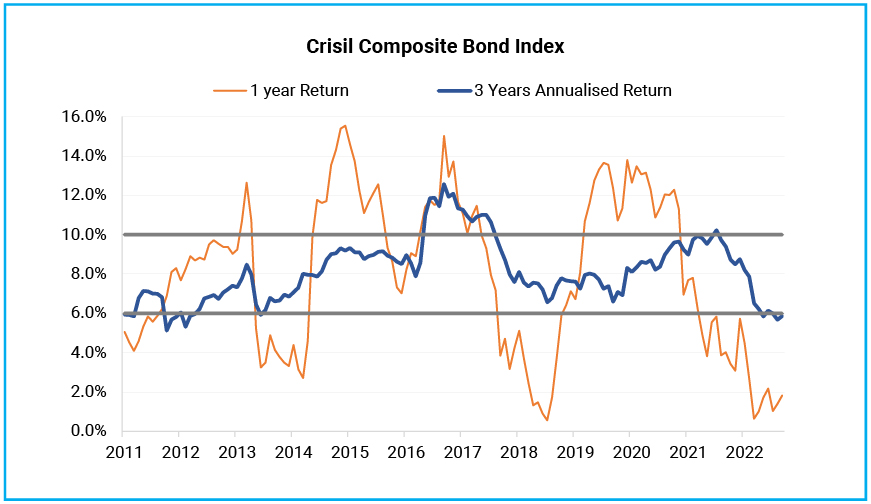

All in all, the return potential of fixed-income funds has improved and the next three years are likely to be more rewarding for fixed-income investors than what we witnessed in the last three years.

We suggest investors with 2-3 years holding period should consider adding their allocation to dynamic bond funds.

Medium to Long term interest rates in the bond markets is already at long-term averages as compared to fixed deposits which remain low. With higher accrual yield (interest income) and relatively lower price risk (compared to the last two years), dynamic bond funds are appropriately positioned to gain over the next 2-3 years.

Dynamic bond funds have the flexibility to change the portfolio positioning as per the evolving market conditions. This makes dynamic bond funds better suited for long-term investors in this volatile macro environment than other long-term bond fund categories.

A dynamic Bond fund or any other debt fund which invests in long-term debt instruments is highly sensitive to interest rate movements. Thus, in a short period of time, returns could be highly volatile and can even be negative. However, over a longer time frame of over 2-3 years period, returns tend to normalise along with the interest rate cycles.

Source – AMFI Portal, Crisil, Quantum Research; Data as of November 30, 2022

Past performance may or may not sustained in future.

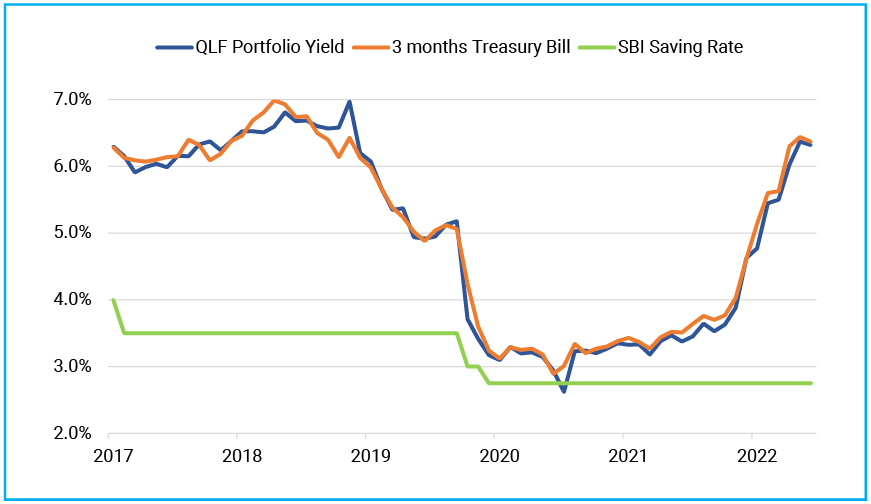

Investors with shorter investment horizons and low-risk appetite should stick with liquid funds. With the increase in short term interest rates, we should expect further improvement in potential returns from investments in liquid going forward.

Since the interest rate on bank saving accounts are not likely to increase quickly while the returns from the liquid fund are already seeing an increase, investing in liquid funds looks more attractive for your surplus funds.

Chart – VI: Liquid Fund Yields Closely Tracks 2-3 Months Treasury Bill Rate

Source – Refinitiv, Quantum Research; Data as of November 30, 2022

Past performance may or may not sustained in future.

Investors with a short-term investment horizon and with little desire to take risks should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Portfolio Positioning

| Scheme Name | Strategy |

Quantum Liquid Fund | The scheme continues to invest in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. |

Quantum Dynamic Bond Fund | The scheme continues to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the interest rate portfolio’s sensitivity to interest rates based on Interest Rate Outlook. Based on our market outlook, we continue to prefer 3-5 year government bonds as a core allocation in the scheme. However, we would take tactical positions across the yield curve depending on market opportunities. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More