Bull Case Revisited

Posted On Wednesday, Oct 23, 2024

In November 2023, we articulated our bullish stance on long term bonds noting - declining core inflation, improving fiscal outlook, favourable demand supply balance, turning global monetary policy, India’s inclusion in the global bond indices and India’s strong external balances. (Refer The Bull Case and Good Time to be Bond Investor)

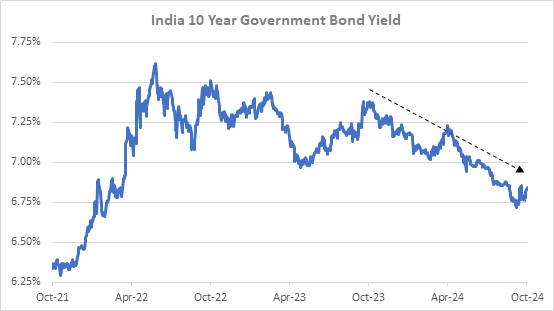

Since then, bond yields have declined substantially. The 10-year benchmark government bond (IGB) yield has come down from 7.35% on October 31, 2023, to 6.81% at the time of writing this report on October 21, 2024.

Chart I: Downward Slide of Indian 10-Year Bond Yields

Source: Bloomberg, Quantum Research, Data up to October 21, 2024

Since a substantial move in bond yields has already come, we conducted a comprehensive re-evaluation of the factors that underpinned our positive view and also looked at some of the potential new drivers for the fixed income market going forward.

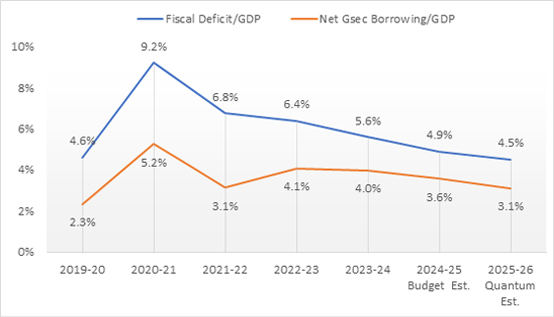

Fiscal Prudence to aid Macro stability and reduce debt supply

The government, by surpassing its target for the FY24 fiscal deficit and accelerating the pace of fiscal consolidation in FY25, has demonstrated its commitment to fiscal consolidation. Its overarching goal of bringing the fiscal deficit down to less than 4.5% of GDP by FY26, looks comfortably within reach now. We would expect further reduction in the fiscal deficit beyond FY26, as the government is aiming to bring down the public debt as percentage of GDP.

In FY25 so far, tax collections have been on track to meet (or even surpass) the budget targets, while spending is lagging due to election-related disruptions. Given the current trend, we see a possibility of another year of overachievement in deficit reduction.

Fed Chair Jerome Powell remarked, “Our economy is strong overall… and…the risks to achieving its employment and inflation goals are roughly in balance.” He also reiterated that the Fed's main focus now is to keep a lid on the unemployment rate.

In FY24, the fiscal deficit as % of GDP was reduced to 5.6% against the initial budget estimate of 5.9%. The Fiscal Deficit aim for FY25, has also been revised down from 5.1% to 4.9% of GDP. In FY25 till August, Gross Tax Collections are up 12.1% YoY. Direct Tax collections are up 18.4% YoY in FY25 till October 10, 2024. |

Lowering the budget deficit often improves macroeconomic stability. Additionally, it would reduce the amount of new debt that the government issues in the future.

Chart – II: Fiscal consolidation to lower Net Bond Issuances by the Government

Source- Indiabudget.gov.in; CMIE, Quantum Research

#Data upto FY25 is based on the Budget estimates of the Union Government

FY26 numbers are based on Quantum Research Team’s expectation.

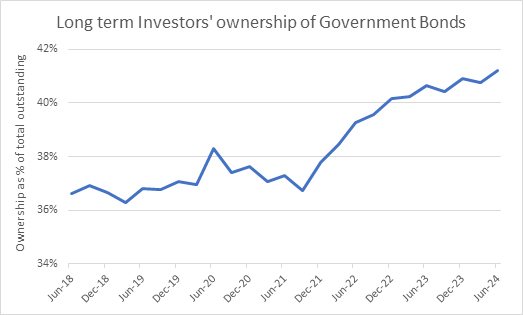

Demand Supply Balance remains favorable

While the government's emphasis on debt reduction and fiscal consolidation is limiting the availability of government bonds, demand from long-term investors like insurance, pensions and provident funds have been growing rapidly.

Given the ongoing formalization and financialization of the Indian economy, it would be reasonable to expect that demand from these investors will continue to grow, at least in line with the nominal GDP growth going forward.

Chart – III: Domestic long term investors’ appetite for bonds is growing rapidly

Source – RBI, Quantum Research, Data upto June 2024

# This includes ownership of government bonds by Insurance companies, PFs, provident Funds and others

RBI’s draft Liquidity Coverage Ratio (LCR) norms to boost bonds’ demand

With an aim to enhance the liquidity resilience of banks, the RBI has proposed changes to the liquidity coverage ratio (LCR) norms for banks which will come into effect from April 1, 2025 (RBI Draft Guidelines). Under the new guidelines, banks will have to apply higher run-off factors for deposits that are enabled with internet and mobile banking facilities.

Based on the various analysts’ reports, once the new LCR norms come into effect from April 1, 2025, the LCR position of banks are expected to decline by 10%-20%. Thus, banks will be required to buy more of high-quality liquid assets (HQLA) like government bonds and State development loans to enhance its exposure to enhance their LCR levels. Market estimates for such incremental demand are between Rs. 3 to 6 trillion. To put this in perspective, the incremental demand will be 25%-50% of the net government borrowing in FY25.

We might see some dilution in the implementation of these guidelines. However, it will surely add to the overall demand for government bonds.

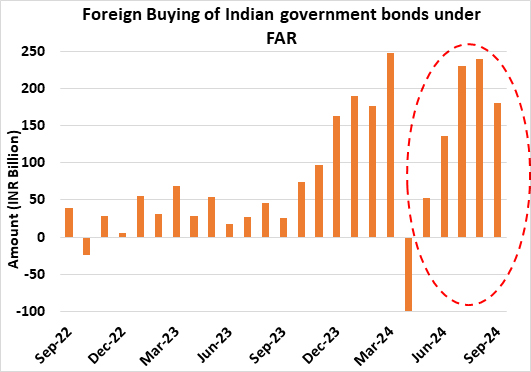

Global Index Inclusions to boost Foreign Demand

India’s inclusion in global bond indices marks a significant milestone in the nation’s financial landscape. This strategic move has already begun to attract substantial foreign investments in Indian government bonds.

India’s inclusion in the JPMorgan's Government Bond Index-Emerging Markets (GBI-EM) has already begun from June 2024. It will also become part of Bloomberg EM Local Currency Government Index and FTSE Russell's EM Government Bond index starting January 2025 and September 2025 respectively (Refer Index Inclusion: How will it Unfold).

Chart IV: Foreign Investors Ramp Up Purchases of Indian Bonds

Source: RBI, Quantum Research, Data up to September 30, 2024

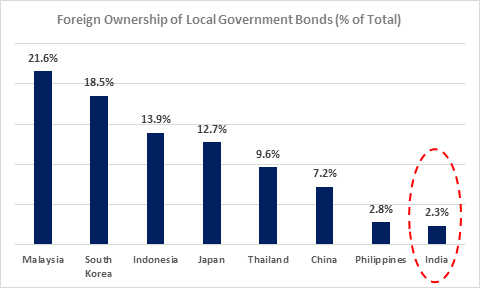

Given foreign ownership of Indian bonds is exceptionally low, we would expect demand from foreign investors to remain strong. Falling global interest rate shall further boost the foreign inflows into Indian bonds.

Participating in international benchmarks has certain long-term advantages as well. Investor confidence in Indian bonds should increase as a result of increased credibility and visibility for India in global financial markets bringing steady long-term inflows into the market.

Chart V: India's Bond Market: Ripe for More Foreign Investment

Source: Asia Bond Monitor, Quantum Research, Data as of March 30, 2024

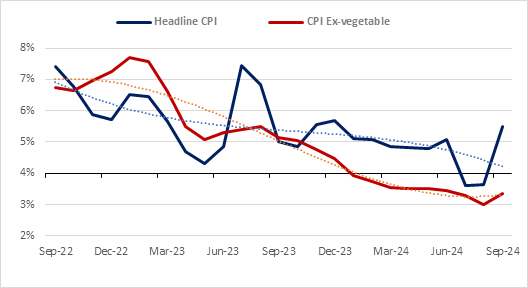

Two Part Inflation - Broad disinflation persists while vegetable prices keeping headline elevated

In February 2023, we presented a case for broad based disinflation (refer Past, Present, and Future of Inflation) in India. Later in August 2023, we highlighted the two part inflation trend pointing to volatile headline CPI due to vegetable prices and persistent disinflation in CPI-excluding vegetable prices (refer Looking Through the Noise).

Back in August 2023, we expected the disinflation in the CPI ex-vegetable (94% of the CPI index) to bring down the headline numbers in 2024. Although average inflation in 2024 has come down, the divergence between the two inflation matrices continues even now.

In September 2024, the headline CPI inflation rose to 5.49% YoY, mainly driven by a 36% YoY spike in the vegetable index. While the CPI inflation excluding vegetables, which represents 94% of the CPI basket, stood at more benign 3.36% YoY.

Vegetables are extremely susceptible to supply chain disruptions and weather shocks due to their perishable nature. Vegetables also have a short production cycle, which adds an element of cyclicity in its prices. Vegetable prices in India have historically exhibited cyclical patterns with abrupt rises and declines that contrast sharply with the actual "inflation trend."

The recent surge in vegetable inflation is mostly the result excessive rainfall in several vegetable-producing regions, which briefly caused a shortage of some important vegetables. We would anticipate vegetable inflation to decline once the new crops arrive by late December, lowering the headline CPI overall.

Chart VI: Beyond Vegetables: CPI Inflation Largely in Control

Source: MOSPI, Internal Research, Data as of September 2024

Overall, strong kharif sowing and favorable conditions for Rabi season (good soil moisture and full reservoirs) should bode well for food production and inflation next year.

Chart VII: India's Buoyant Rainfall: Supporting Crops and Reservoir Levels

| Crop sowing for FY 2025 (As on 30 Sep 2024) | |

| Crop | % departure from 2023 |

| Paddy | 2.5% |

| Pulses | 7.4% |

| Cereals | 4.0% |

| Oilseeds | 2.7% |

| Sugarcane | 1.0% |

| Jute | -13.9% |

| Cotton | -8.7% |

| Total | 1.9% |

| Reservoir Levels (Storage as on 17 Oct 2024) | |

| Region | % departure from Normal Storage |

| North | -19% |

| East | 7% |

| West | 26% |

| Central | 13% |

| South | 25% |

| COUNTRY | 15% |

Source: Department of Agriculture and Farmers welfare and Central Water Commission

The broader inflation trend remains comfortably below the RBI’s 4% threshold. Provided there is no further weather shock, we would expect the Headline CPI inflation to average below 4% mark in FY26. Any fuel price cuts by the government could further soften the headline inflation in FY26.

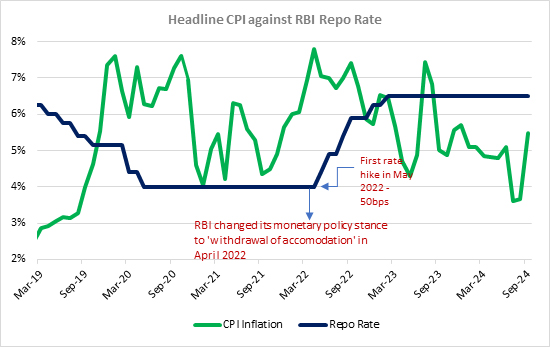

Monetary policy heading for a reversal

In the October 2024 policy meeting, the RBI decided to keep policy rates unchanged. Nonetheless, changed its policy stance from “withdrawal of accommodation” to “neutral” acknowledging the persistent decline in core inflation.

The fact that the RBI deputy governor discussed the anticipated hump in inflation, the recent spike in headline data should not cause any material change in RBI’s thinking of growth inflation balance. Furthermore, there are visible signs of economic activity slowing down.

The RBI may begin its rate-cutting cycle in December 2024 or February 2025, depending on when the inflation hump ends.

Chart VIII: CPI Nearing RBI Targets: Paving the Way for Rate Cuts

Source: MOSPI, RBI, Internal Research, Data as of September 2024

Outlook

Even though bond yields have come down significantly and term spreads have contracted, there are still good reasons to stay optimistic in the bond market. Structural shifts in the demand-supply balance as mentioned above will manifest over long period. This should continue to drive bond yields lower over the next 12-24 months.

The global monetary easing cycle is also beginning to take root, which should help the Indian bond market as well given India’s inclusion in the global bond Indices.

Based on above diagnosis, we continue to hold our medium-term positive outlook on Indian bonds. We expect a further decline in bond yields over the next 1-2 years, presenting an opportunity to capture price appreciation in long-term bonds over and above the yield accruals.

What should Investors do?

Dynamic Bond Funds are probably best placed to capture this opportunity with a flexibility to change if things don’t pan out as expected. However, investors need to have a longer holding period of at-least 2-3 years to ride through the intermittent volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of the assets in 10-30 year maturity bucket. |

Source – RBI, Blomberg, Refinitiv, MOSPI, IndianBudget.gov.in, CCIL, Asia Bond Monitor, Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- US Rate Cut from Indian Lens - A historical Perspective

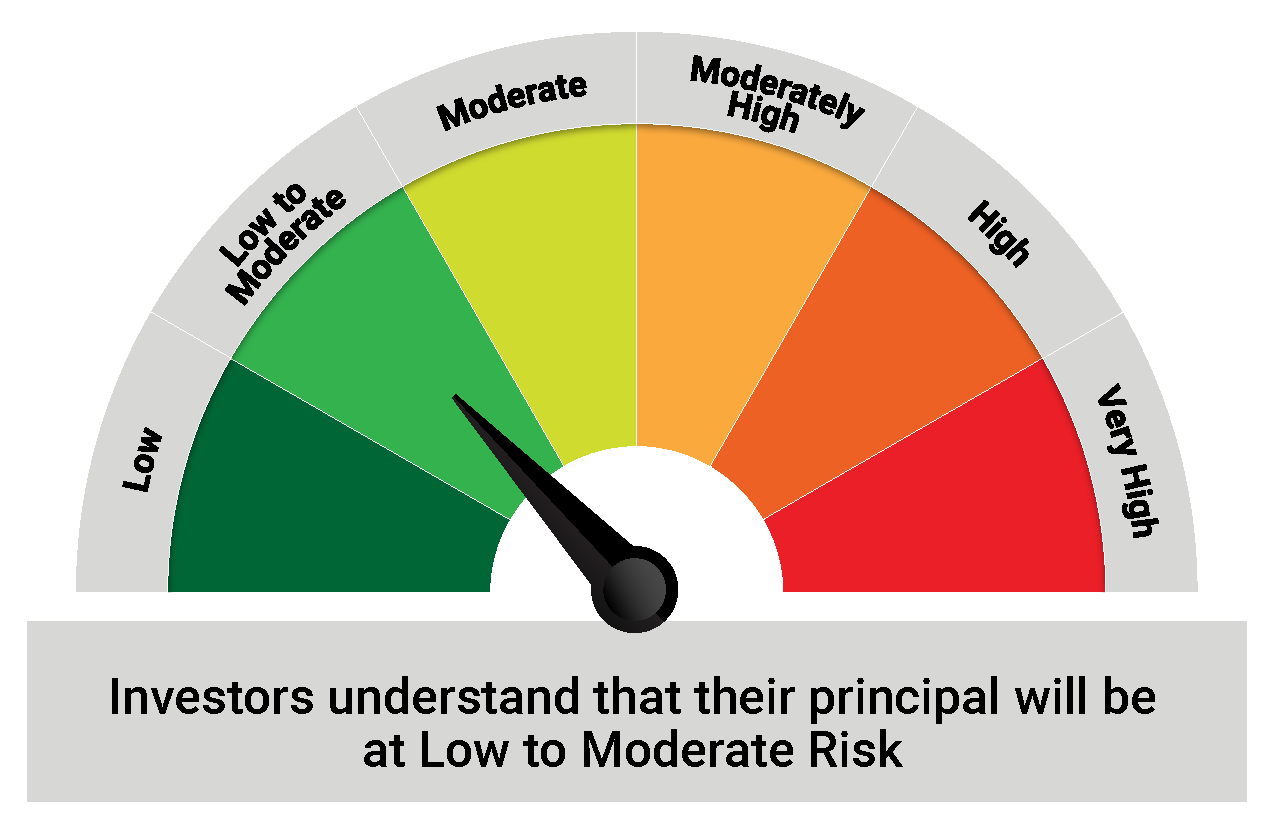

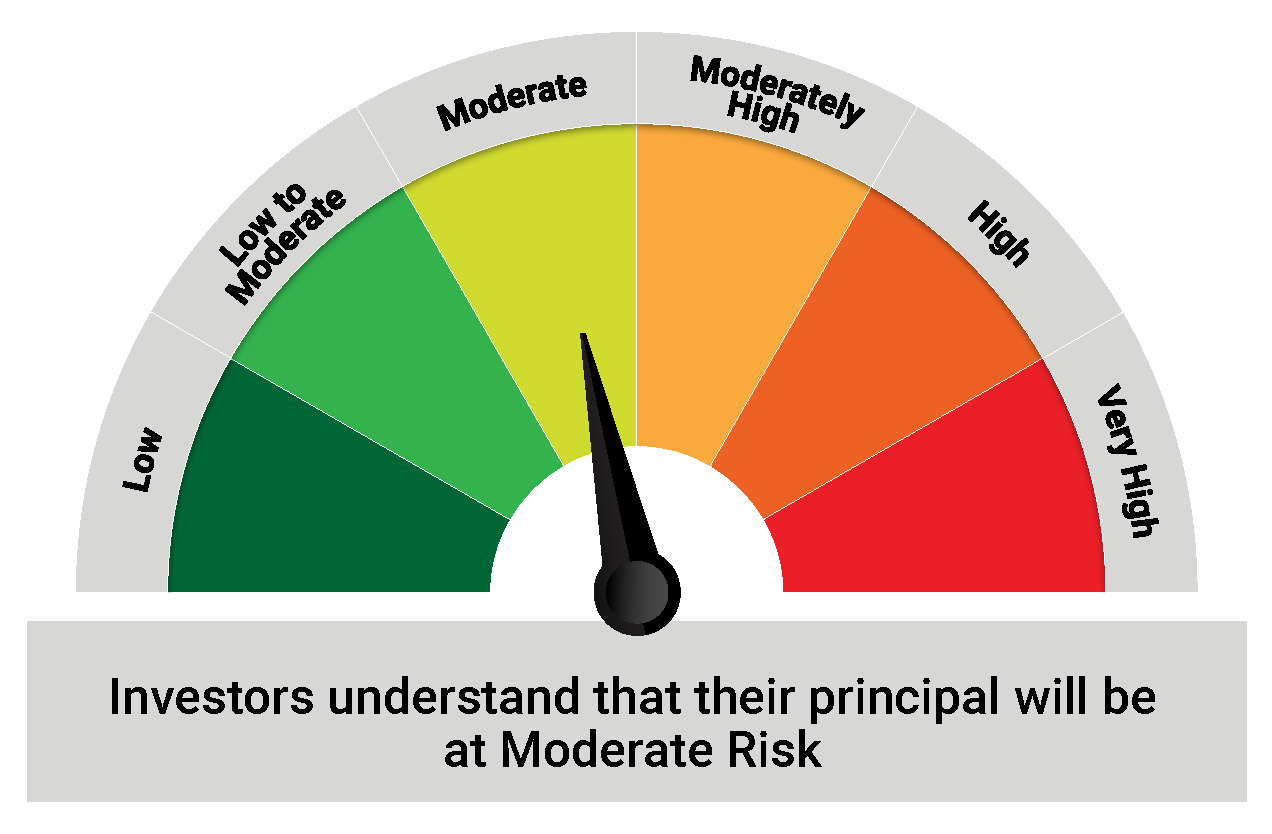

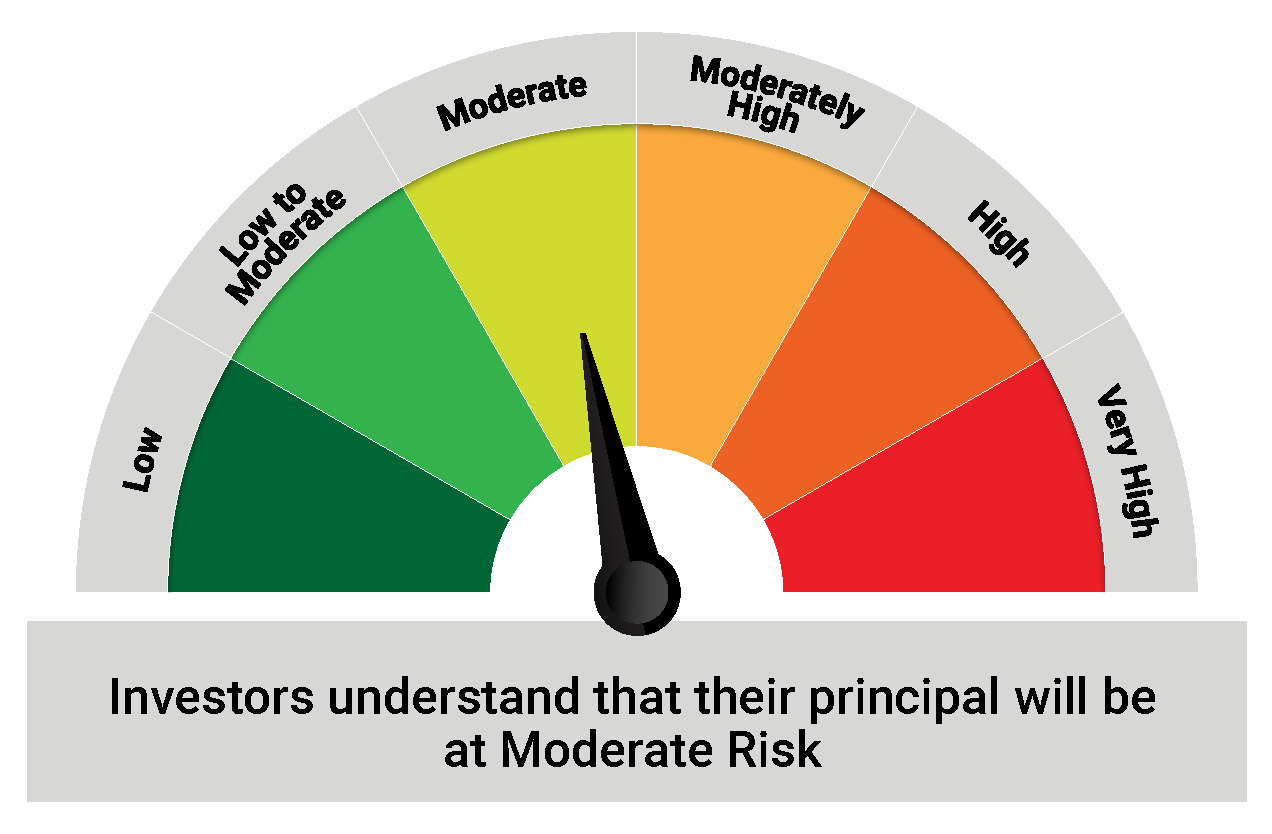

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme | Riskometer of Tier I Benchmark |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  |  |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More