What is the Relevance of a Mutual Fund NAV?

Posted On Tuesday, Jan 25, 2022

If you are a Mutual Fund investor or plan to start investing in them soon, you might have wondered about the term mutual fund “NAV” and its relevance on your mutual fund returns.

While many of you may have heard the word “NAV”, a complete understanding is important as you evaluate Mutual Funds. Should you be opting for a Mutual Fund with a lower NAV? Or if the NAV has increased, does it mean the mutual fund is overvalued?

Simplifying Mutual Fund NAV

NAV stands for “Net Asset Value”.

Simply put, Net Asset Value (NAV) represents the per unit price of the assets held by a mutual fund on a particular day. It measures how much each unit of a mutual fund is worth.

Some investors make the mistake of looking just at a fund’s NAV, not knowing that the NAV or Net Asset Value does not entirely reflect the prospects of the scheme. To understand how the NAV works, let’s first understand how you calculate the Mutual Fund NAV.

How Do You Calculate The NAV

You see, at the end of each day, all mutual funds calculate the market value of their securities. Once this is done, they deduct all outstanding liabilities and expenses to calculate the net asset value (NAV).

Net Asset Value = [Assets – Liabilities] / Number of outstanding units. |

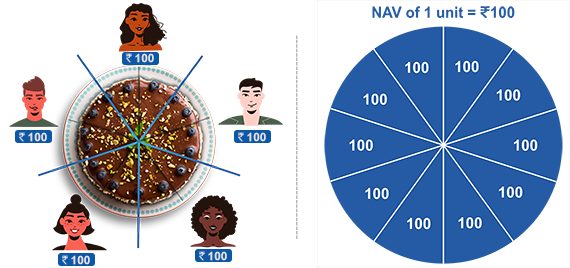

Let’s simplify this with an illustration.

Imagine that on your birthday, four of your friends pitch in Rs. 250 to get a birthday cake costing Rs. 1000.

If the cake was cut into 10 slices, each slice would cost Rs. 100. Each of you i.e., five people (four friends & you) would get 2 slices each.

If the same example were to apply to a mutual fund. Let’s assume there’s a mutual fund scheme with total assets under management (AUM) of Rs. 1000 with 10 outstanding units. The fund had 5 investors who held 2 units each. Thus, the NAV of the fund comes at Rs.100 (Rs. 1000 AUM divided by 10 outstanding units).

Debunking the Myth: Does Lower NAV Mean a Higher Profit?

Many investors think that the NAV or net asset value determines the profits you receive from the fund. So, they tend to believe that the lower the NAV of a fund the better an investment option it is!

But to break it to you, this has no truth in it. In fact, the NAV is not the only indicator of mutual fund performance.

A lower NAV does not in any way make a fund a better investment and a higher one does not make a fund a bad investment.

What is the Relevance of the NAV when Investing in Mutual Funds?

Let us understand with an example...

For ease of understanding, let us take two of our own funds.

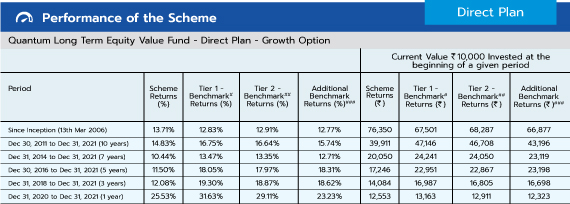

Quantum Equity Fund of Funds & Quantum Long Term Equity Value Fund. Have a look here.

| Fund Name | NAV (₹) (31st Dec 2021) | Launch date | AUM (₹) | 1-year returns (%) | 3-year returns (%) | 5-year returns (%) |

| Quantum Equity Fund of Funds | 54.92 | 20-Jul-09 | 77.82 | 30.70 | 17.30 | 15.69 |

| Quantum Long Term Equity Value Fund | 76.35 | 13-Mar-06 | 888.21 | 25.33 | 12.08 | 11.50 |

For illustration purposes only. Past performance may or may not be sustained in the future.

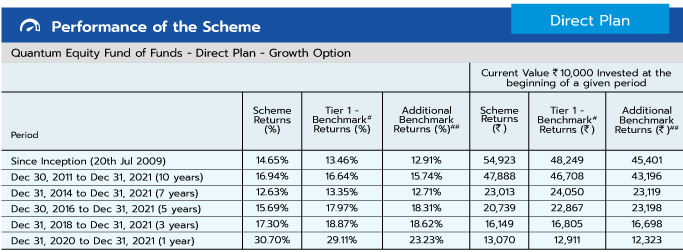

The performance of the funds to be read in conjunction with the complete performance as below.

The NAVs for both the funds, launched 3 years apart, are away from each other. And surely were away from each other all these years. Newer mutual funds generally have lower NAV than older ones.

But if you see, the returns are comparable.

Please do not misunderstand that we are saying one fund is better than the other. That is not our intention.

Our only intention is to ensure you understand that the NAV is not the only factor you must look at when choosing a mutual fund to invest in. They are mutual funds following diverse styles, while one is a value fund, the other is an equity fund of funds comprising of well-researched diversified portfolio of 5-10 third party equity mutual funds.

You have to keep in mind your objective, risk profile and the investment period in mind when making a choice.

For you to understand better, here are some pointers

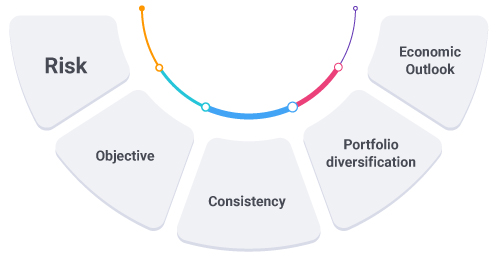

5 Things you should look at when you choose a mutual fund to invest in:

1. The Objective: Evaluate the financial goal you look forward to achieving by means of this investment and in what time frame.

2. Consistency: The real test of any fund is how consistently has it performed over years through different market cycles.

3. The Economic Outlook: Economic and industrial factors directly affect the performance of funds. A good fund helps you minimize the impact of macro-economic risks.

4. Risk: Assess the underlying risk of the fund with the Riskometer that determines the level of the risk across 6 levels from Low to Very High. Alternatively, you can also check parameters like standard deviation, Sharpe Ratio and Beta value to determine the risk-reward ratio.

5. Portfolio diversification: Check the portfolio composition and the level of diversification it offers. Does it diversify across market caps, investment styles or sectors?

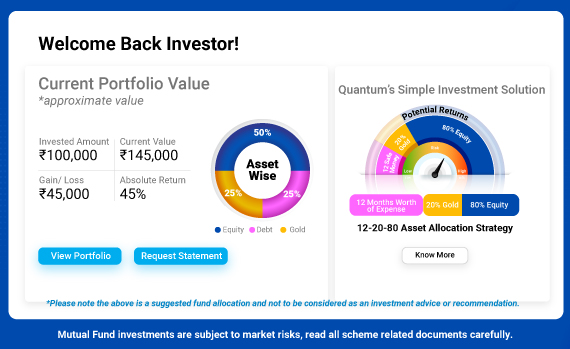

We believe you are now well informed to start investing in Mutual funds. Start investing with as low as Rs 500 a month.

Create your account today and use our easy Asset Allocation tool to build your portfolio in just a few clicks. It’s that simple!

Watch our 1 min podcast on what is Net Asset Value (NAV)?

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of December 31, 2021.

Past performance may or may not be sustained in future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. Nilesh Shetty. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. Nilesh Shetty has been managing the fund since Mar 28, 2011.

Click here to view other funds managed by them.

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as on December 31, 2021.

Past performance may or may not be sustained in future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

Mr. Chirag Mehta manages 5 Schemes of the Quantum Mutual Fund. For other schemes managed by Mr. Chirag Mehta, please Click here.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on December 31, 2021.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on December 31, 2021.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

| Quantum Equity Fund of Funds An Open-ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Primary Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |  Investors understand that their principal will be at Very High Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on December 31, 2021.

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on December 31, 2021.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More