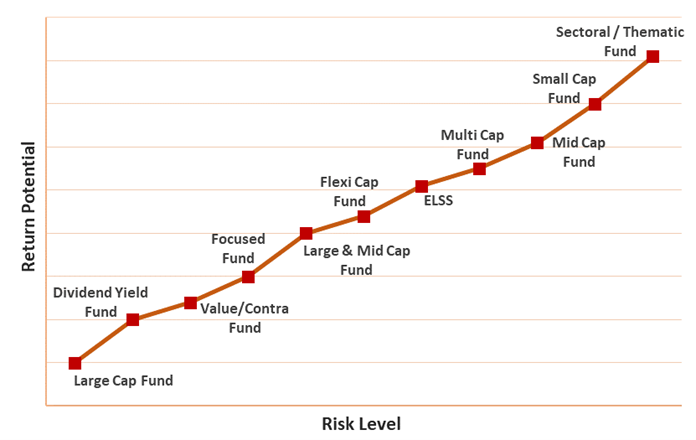

If you are a long-term investor in the Indian equity markets, looking for long term wealth potential and do not mind taking very high risk, then a Small-Cap Fund may be a suitable choice for your investment portfolio. Having said that, a thoughtful and prudent approach needs to be followed. You see, investing in Small-Caps isn’t for the fainthearted. Small-Caps tend to go from thrilling highs to dangerous lows. Meaning, that when markets boom, they could generate good returns, but in times of gloom and economic uncertainty, Small-Caps may plunge and erode investor’s wealth. For this reason, Small-Cap Mutual Funds find a place on the higher end of the risk-return spectrum, just a notch below the sector and thematic funds (see graph below).

Graph 1: Risk-Return Spectrum of Equity Mutual Funds

Note: For illustration purposes only

What are Small-Cap Mutual Funds?

Small-Cap Funds are equity-oriented mutual funds mandated to invest at least 65% of their assets in equity and equity related instruments of small cap companies. Small-Caps are companies ranking beyond 250 in terms of full market capitalisation. These companies are budding and are yet to establish themselves vis-à-vis the mid-cap and large-cap companies. Owing to limited access to several resources, the risk is very high, particularly amid challenging times of economic downturns. Nevertheless, with prudent management of the available resources and potential growth opportunities, Small-Caps have the potential to be tomorrow’s mid-caps and large-caps in the long term. Hence, a bottom-up approach works well when investing in the Small-Cap space. As far as the remaining 35% of the assets of a Small-Cap Fund are concerned, they may be deployed in mid-caps, large-caps, debt and money market instruments and/or even held in cash, depending on valuations and other aspects. Thus, the primary investment objective of a Small-Cap Fund is to generate capital appreciation by investing predominantly in Small Cap Stocks. However, there is no assurance that the investment objective of the scheme will be realised.

The Five Key Advantages of Investing in a Small Cap Fund are…

You can gain from a diverse portfolio of Small-Cap companies

Have the opportunity to tap value and potential growth opportunities in the Small-Cap space

Professional fund managers (with the help of a research team) navigate the exhaustive and complex universe of Small-Cap stocks to build a robust portfolio

Have the opportunity to tap value and potential growth opportunities in the Small-Cap space

You, the investor, potentially could clock good returns -- over a longer period small-caps have generally outperformed large-caps and mid-caps

Having said that, you ought to approach Small-Cap Mutual Funds carefully, considering a host of quantitative and qualitative parameters for it to be a rewarding experience.

Here are things to consider before investing in the

Best Small-cap Funds (and beyond)

Portfolio characteristics

(the top-10 holdings, top-5 sector exposure, how concentrated/diversified is the portfolio, the market capitalisation bias, the style of investing followed, the portfolio turnover, etc.)

Whether there is a

portfolio overlap of the Small-Cap Fund with another scheme

The overall efficiency

of the mutual fund house in managing investors' hard-earned money (i.e. the proportion of AUM actually performing. This shall reveal whether the fund house is an asset gatherer or a prudent asset manager.)

The quality

of the fund management team (the experience of the fund manager, and the experience of the research team)

In addition, it would prove useful to understand the investment strategies, plus the processes and systems followed at the fund house. Also, refrain from acting on unsolicited investment advice from friends, relatives, colleagues, neighbours, or any other inexperienced person or investing in an ad-hoc manner. Keep in mind, there is no ‘one-size-fits-all’ approach. Consider your age, risk profile (very aggressive, aggressive, moderately aggressive, moderately conservative, or conservative), investment objective, the financial goals you are addressing, and the time in hand to achieve those goals before investing in a Small-Cap Fund or any other scheme for that matter. Remember, investing is an individualistic exercise.

The Challenges of Investing in a Small-Cap Fund

Since small-caps

usually are under-researched companies and information or data to make investment decisions are limited or may come sub-standard, portfolio construction may be subject to judgement errors

The fund managers

of a Small-Cap Mutual Fund may face challenges in entering or exiting a position as small-cap stocks are not highly liquid

Since small-cap

companies could take time to grow, the holding period may be quite longer

risk is higher

than anticipated as compared to mid-caps and large-caps, particularly during economic downturns

Since a dominant

portion of the portfolio is in smaller companies, the performance is closely linked to the underlying small cap index

Who Should Invest in a Small-Cap Fund?

If you are looking for exposure to Emerging investment opportunities with structural growth in the economy, you can consider investing in a Small-Cap Fund. But given that a Small-Cap Fund is a very high risk high return investment proposition (because the stocks of such companies are highly volatile), make sure you have a very high risk appetite, and have an investment horizon of 5 years or more.

How Much to Invest in a Small-Cap Mutual Fund?

It would be unwise to go gung-ho and invest a large chunk in Small-Cap Fund(s). Only a small satellite portion -- around 15%-20% -of your entire equity mutual fund portfolio may be invested in Small-Cap Mutual Fund(s). Holding a Small-Cap Fund in the satellite holdings could potentially push the overall returns of your mutual fund investment portfolio. Whether to invest a lump sum or take the SIP route, the choice is yours. However, the latter may help handle volatility better with the inherent rupee-cost averaging and potentially compound wealth in the long term.

What are the Tax Implications of Investing in a Small-Cap Mutual Fund?

Being an equity oriented mutual fund scheme, on the realised capital gains made within the holding period of less than 12 months, referred to as the Short Term Capital Gain (STCG), the STCG tax will be at a flat rate of 15%.

| Type of Mutual Fund | Short-Term Capital Gains (STCG) | STCG Tax Rate | Long-Term Capital Gains (LTCG) | LTCG Tax Rate |

|---|---|---|---|---|

| Equity-oriented | Less than 12 months | 15% | 12 months and above | 10% (for realised gains above Rs 1 lakh) |

The above shall be applicable for all class of investors (provided such units are sold to the Mutual Funds and are chargeable to STT).

But if your holding period is 12 months or more in an equity-oriented mutual fund scheme, then it shall be referred to as Long Term Capital Gains and taxed at 10% if the realised gains are over Rs 1 lakh in the financial year. In other words, the realised LTCG of equity-oriented mutual fund scheme will not be taxed if the realised gains is less than Rs 1 lakh in that respective financial year.

So, the taxes on your mutual fund investments are not wholly tax-free. Engaging in thoughtful investment planning can help you can lower the overall tax impact.

Choose a Small-Cap Fund (or any other fund for that matter) carefully, and if in doubt, speak to your investment adviser before investing. Be a thoughtful investor.

Happy Investing!

| Name of the Scheme | This product is suitable for Investors who are seeking* | Risk-o-meter of Scheme |

|---|---|---|

|

Quantum Small Cap Fund An Open Ended Equity Scheme Predominantly Investing in Small Cap Stocks) Tier I Benchmark: BSE 250 Small Cap TRI |

• Long term capital appreciation • Investment in Small Cap Stock |

Investors understand that their principal will be at Very High Risk. |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

#The product labeling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.