"Don’t put all eggs in one basket," is a maxim we often come across in the world of investing. The eggs herein are your investments, and the basket is asset class (viz. equity, debt, gold, etc.). The hidden message in the axiom is to spread your investments so that the risk of losing everything is reduced. The key is to strike a balance between risk and reward while you endeavour to generate wealth through your investment portfolio. Here's all you need to know about portfolio diversification…

What Is Portfolio Diversification?

Portfolio diversification involves spreading your investments across various types of assets, viz. equity, debt, gold, etc. and investment avenues therein. It is one of the basic tenets of investing that helps reduces the concentration risk, which might adversely affect your portfolio’s performance. You see, every asset class -- be it equity, debt, gold, or real estate -- commands a certain level of risk-return trade-off. As you may be aware, not all asset classes have moved in the same direction always. In certain years equities have rewarded investors handsomely (such as in 2012, 2014, 2017, 2020, and 2021). In years when equities encountered headwinds due to macroeconomic uncertainty and rising interest rates; gold, debt and fixed-income instruments have done well. As a thoughtful investor, it is important to be cognizant of the risk-return trait of the asset class and the investment avenue under consideration. It would be unwise to invest your portfolio unwarrantedly or randomly to one asset class.

Features of Portfolio Diversification

A diversified portfolio has the following features:

-

● A combination of various asset classes:

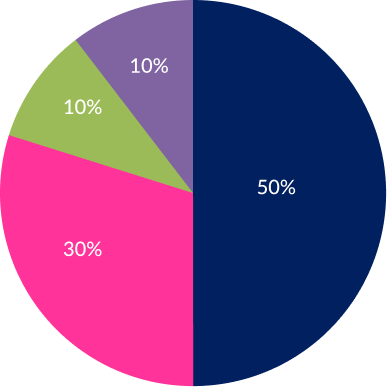

Diversified investments comprise a mix of equities, debt or fixed-income instruments, gold, or even holding cash for that matter.

Graph 1: Distribution of investible surplus across asset classes

Asset Allocation Example

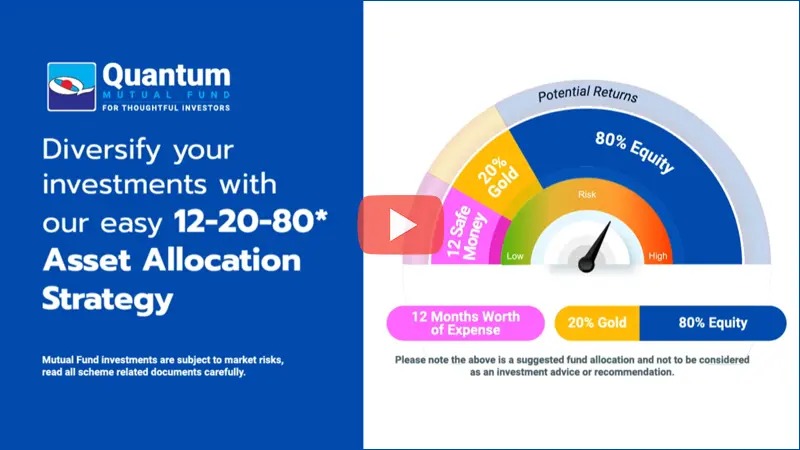

Spreading your investments across various asset classes that perform differently to each other under certain market conditions, reduce the risk your investment portfolio is exposed to. For instance, bonds don't fluctuate as much as stocks but generally offer lower returns than stocks. A tactically allocated portfolio between equities, debt, and gold bonds potentially generates a decent risk-adjusted return for you. A time-tested simple 12|20:80 Asset Allocation model could be followed for all lifelong investment needs if you are willing to take calculated high risk, irrespective of whether you prefer active or passive investing.

Safety Block

Set aside 12 month of your expenses in liquid fund to take care of emergencies.

Diversify Block

Invest 20% of your investable surplus into gold, that generally has an inverse correlation with equity.

Growth Block

Allocate the balance 80% of your investable surplus in a diversified equity portfolio.

- ● Diversification within each asset class: Besides making investments in various asset classes, care must also be taken to ensure that the portfolio is well-diversified within each asset class by choosing suitable investment avenues therein. For instance, in equities besides direct stocks, consider investing suitable sub-categories of equity mutual fund schemes, such as a Value Fund, ESG Equity Fund, and tax-saving Fund (also known as Equity Linked Savings Scheme or ELSS), among others. Similarly, the debt portfolio could be debt mutual funds (viz., Liquid Fund, Dynamic Bond Fund, etc.) bank fixed deposits, and government-backed small saving schemes.

- Various other ways of Portfolio Diversification: Apart from diversifying the portfolio by asset classes and investment avenues within asset classes, the investment portfolio could also be diversified in the following manner…

- • Diversify across time horizons: This is imperative for the liquidity of your investment portfolio. For example, as an investor, you could have short-term goals (less than a year and up to 2 years), medium-term goals (2 to 3 years) and long-term goals (more than 3 years). Considering the time-to-goal and distinct investment objective, consider owning separate portfolios. Broadly, keep in mind, equities are for achieving long-term goals (more than 3 years away), while debt instruments are for the short-to-medium term.

Mutual Funds to Diversify Your Portfolio

Mutual funds, which are run by experienced and professional fund management teams following processes and systems, are avenue to build an investment portfolio. Depending on your risk appetite, the investment objective, the goals you are addressing and the time to achieve those goals, you may consider adding them to your investment portfolio. Following are the various types of mutual funds:

Equity Funds

They invest in equity shares or stocks of companies. The objective is capital appreciation over the long-term. There are various sub-categories of equity mutual funds, such as Largecap Funds, Large & Midcap Funds, Midcap Funds, Smallcap Funds, Multi-cap Funds, Flexicap Funds, Value/contra Funds, Focused Funds, Dividend Yield Funds, ELSS...

They invest in equity shares or stocks of companies. The objective is capital appreciation over the long-term. There are various sub-categories of equity mutual funds, such as Largecap Funds, Large & Midcap Funds, Midcap Funds, Smallcap Funds, Multi-cap Funds, Flexicap Funds, Value/contra Funds, Focused Funds, Dividend Yield Funds, ELSS (also known as tax-saving mutual funds), and sector/thematic funds, each with a distinctive investment mandate and commanding a risk-return trade-off. These are generally suitable if you have a high-risk profile, an investment horizon of over 3 years and may prove rewarding in the long run.

Debt Funds

They invest in debt instruments like government bonds, company debentures, and other fixed-income securities. The objective of debt funds is to earn regular returns for investors but varies as per the sub-category. A total of 16 sub-categories of debt funds exist, such as Overnight Funds, Liquid Funds, Ultra-short Duration Funds, Short Duration Funds, Low...

They invest in debt instruments like government bonds, company debentures, and other fixed-income securities. The objective of debt funds is to earn regular returns for investors but varies as per the sub-category. A total of 16 sub-categories of debt funds exist, such as Overnight Funds, Liquid Funds, Ultra-short Duration Funds, Short Duration Funds, Low Duration Funds, Money Market Funds, Short Duration Funds, Medium-to-Long Duration Funds, Long Duration Funds, Dynamic Bond Funds, Corporate Bond Fund, Credit Risk Fund, Banking & PSU Debt Fund, Gilt Fund, Gilt Fund with 10-year Constant Duration, and Floater Fund all with dissimilar features and occupying a distinct place on the risk-return spectrum. But broadly compared to equity funds, they are less risky, but not risk-free.

Hybrid Funds

As the name suggests, Hybrid Funds invest in a mix of equity and debt & money market instruments. So, these funds aim to provide investors with the best of both worlds – capital appreciation of equity assets and the regular income of debt securities.

A Hybrid Fund could be...

As the name suggests, Hybrid Funds invest in a mix of equity and debt & money market instruments. So, these funds aim to provide investors with the best of both worlds – capital appreciation of equity assets and the regular income of debt securities.

A Hybrid Fund could be…

- Conservative Hybrid Fund (allocating a major portion of the assets - between 75% and 90% - in debt & money market securities),

- Aggressive Hybrid Fund (investing predominantly in equities (between 65% and 80% )and the remaining in debt)

- Balanced Hybrid Fund (allocating nearly equally between equities and debt)

- Balanced Advantage Fund or Dynamic Asset Allocation Fund (which holds the mandate to shift dynamically between equity and debt without any restriction on the minimum and maximum)

- Multi-Asset Allocation Fund (which invested in three asset classes, mainly equity, debt, and gold, with an allocation of at least 10% to each of these)

- Equity Savings Fund (which holds the mandate to mainly invest in equities, including derivatives for hedging purposes, but also explore arbitrage opportunities and has the flexibility to invest in debt & money market instruments when no arbitrage opportunities are available)

- Arbitrage Funds (that are mandated to take advantage of the mispricing of stocks or a stock index in different market segments, known as arbitrage – these funds have a minimum of 65% of gross exposure to equity)

Gold Mutual Funds

Gold is considered one of the most valuable precious metals in the world, and it continues to be a popular investment for ages. It is regarded as a safe haven in times of economic uncertainty, and an effective portfolio diversifier. You may own gold the smart way in the form of...

Gold is considered one of the most valuable precious metals in the world, and it continues to be a popular investment for ages. It is regarded as a safe haven in times of economic uncertainty, and an effective portfolio diversifier.

You may own gold the smart way in the form of gold ETFs and/or gold saving funds. The former is an ETF that aims to track the domestic price of physical gold, while the latter is a Fund of Fund scheme investing in underlying Gold ETFs, which benchmarks the performance against the prices of physical gold. A gold savings fund strives to produce parallel returns that closely resemble the underlying Gold ETF.

How to approach Portfolio Diversification?

For your portfolio diversification exercise, consider the following:

Your age

Your financial

circumstances

Your needs

Your risk profile

(i.e., whether you are very aggressive, aggressive, moderately aggressive, moderately conservative, or a conservative investor)

Your broader

investment objectives

The financial

goals you are addressing

And the time

time in hand to achieve the envisioned financial goals

This would prove to be a meaningful exercise -- a strategy by itself -- rather than building your investment portfolio randomly following what the next-door neighbours, friends, relatives and/or colleagues do with their investments. All of us have certain financial goals in life (viz. buying a dream home, a car, child’s future needs, your retirement, etc.) and it’s important to align your investments to those envisioned goals. When the goals are well-aligned and the investment portfolio is optimally diversified and structured, you would not have to worry about what happens in the world around you.

5 key benefits of Portfolio Diversification

Reduces dependency on a single asset class and investment avenue

Safeguards during turbulent phases of the market

Reduces the risk of the overall portfolio

Potentially earn efficient risk adjusted returns

Help to focus on your financial goals and achieve them

But make sure you don’t end up over-diversifying the portfolio

"Wide diversification is only required when investors do not understand what they are doing," says legendary investor, Warren Buffett, famously called the Oracle of Omaha. He also says that risk can be greatly reduced by concentrating on only a few holdings. You see, beyond a point, over-diversification offers no extra benefit, doesn’t help lower the risk, and on the contrary, makes the investments portfolio bulky/overcrowded and difficult to manage. Remember, "Too much of anything is good for nothing!" Hence, what you require is optimal diversification – and not over or under-diversification.

Finally, don’t forget to timely rebalance your investment portfolio regularly

Over time, some investments rise while others fall in value. Through review and rebalancing of the investment portfolio, you can negotiate between reward and risk to remain on track amid market ups and down, and ultimately achieve your envisioned financial goal/s.

Know more about Portfolio Diversification

-

Diversify Investment With Quantum's 12:20:80 Asset Allocation Strategy

Here’s a quick and easy guide as to how to diversify your investment across the three assets of equity, debt and gold using QuantumMutualFund ‘s tried & tested 12:20:80 AssetAllocation strategy. This will help you achieve your financial goals and minimize downside risks.

-

A well-diversified investment portfolio helps grow your wealth across market ups & downs

The game of cricket cannot solely rely on the performance of the individual players and needs teamwork. For a well-balanced meal, you need the right mix of carbs, fats and proteins. Similarly, to win in the investing game, you cannot solely rely on one asset class.

-

How Better Asset Allocation Strategy Can Help You Survive Through Tough Time of Market

Quantum Advisors' Ajit Dayal explains how his asset allocation strategy helped him to survive when market fell in September 2008 and protected destination of his portfolio.

-

Right Asset Allocation Strategy to Diversify Your Investment and Build Healthy Portfolio

Healthy investment portfolio is the right balance of all asset classes that you choose for your long term investment. It consists of right investments in a mix of equity, debt and gold asset classes to provide security to your future as well as liquidity when you need emergency funds.

Frequently Asked Questions

They are diversification across asset classes, diversification within asset classes, and diversification across mutual fund schemes.

Ideally, you should have exposure to three asset classes –debt, equity, and gold. A 12|20|80 Asset Allocation model is a time-tested simple that could be followed for all lifelong investment needs. In your mutual fund portfolio, avoid holding more than 10-12 schemes.

Debt, equity, and gold are three important components. In case of debt, a Liquid Fund can take care of your emergency needs (by setting aside 12 months of regular monthly expenses in it). The growth portion can comprise of equities (mainly through diversified equity funds), and gold, which generally has an inverse correlation with equities, may serve as diversification.

For tactical asset allocation across the three key asset classes, you may consider investing in Multi-Asset Fund. Under this type of fund, your money is invested mainly in three asset classes: equity, debt, and gold, depending on how the fund manager perceives the outlook for these asset classes. So, in a way, it saves you the trouble of rebalancing at your end and makes portfolio tracking easy. But you ought to have a high risk and an investment time horizon of 3 to 5 years before investing in a Multi-Asset Fund.

Similarly, an Equity Fund of Fund scheme enables you to own multiple schemes from different fund houses (or at times the same fund house). It provides you with exposure to various types of schemes and investment styles with a single fund.

Yes, there is always a risk involved, depending on how your investment portfolio is structured. The risk is never eliminated. You can only try to reduce the risk with optimal portfolio diversification.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual fund investments are subject to market risks read all scheme related documents carefully.