- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Long Term Equity Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Equity Fund of Funds

- Quantum Nifty 50 ETF Fund of Fund

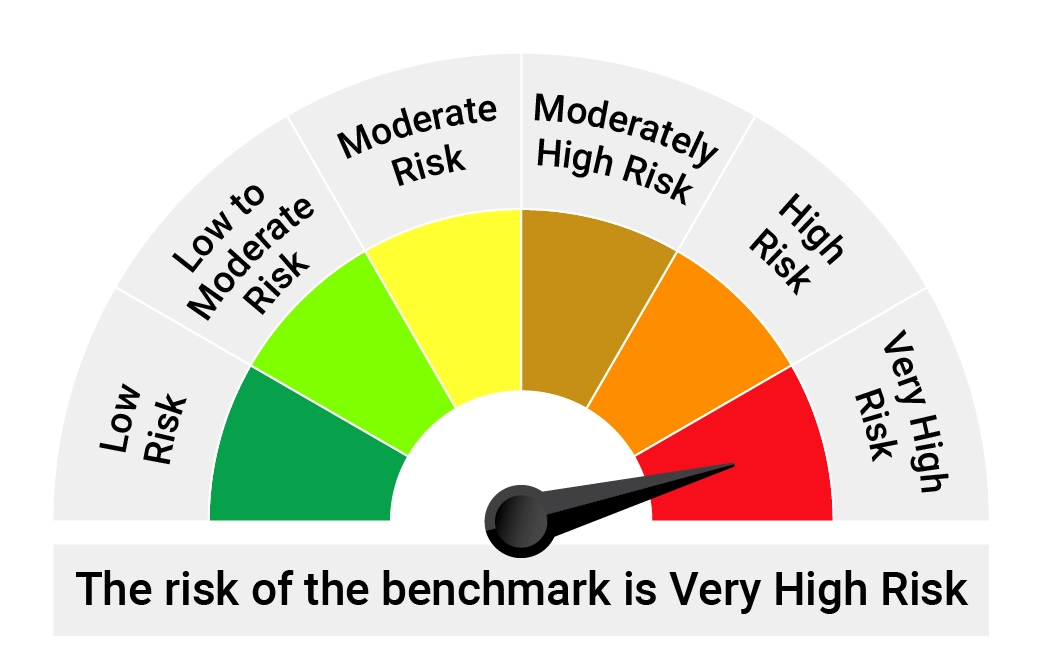

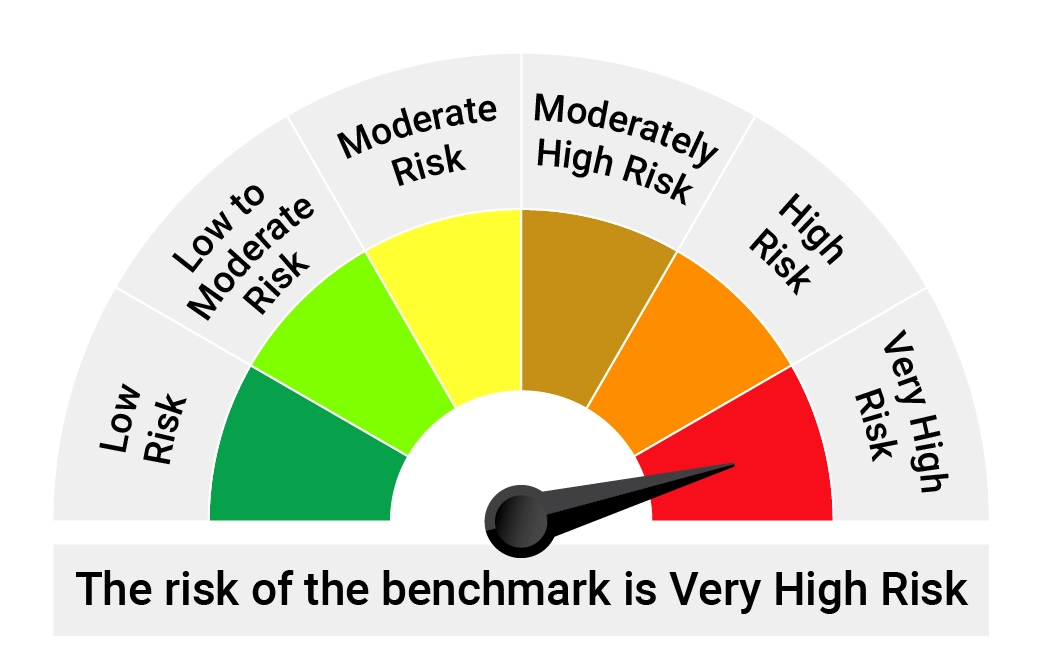

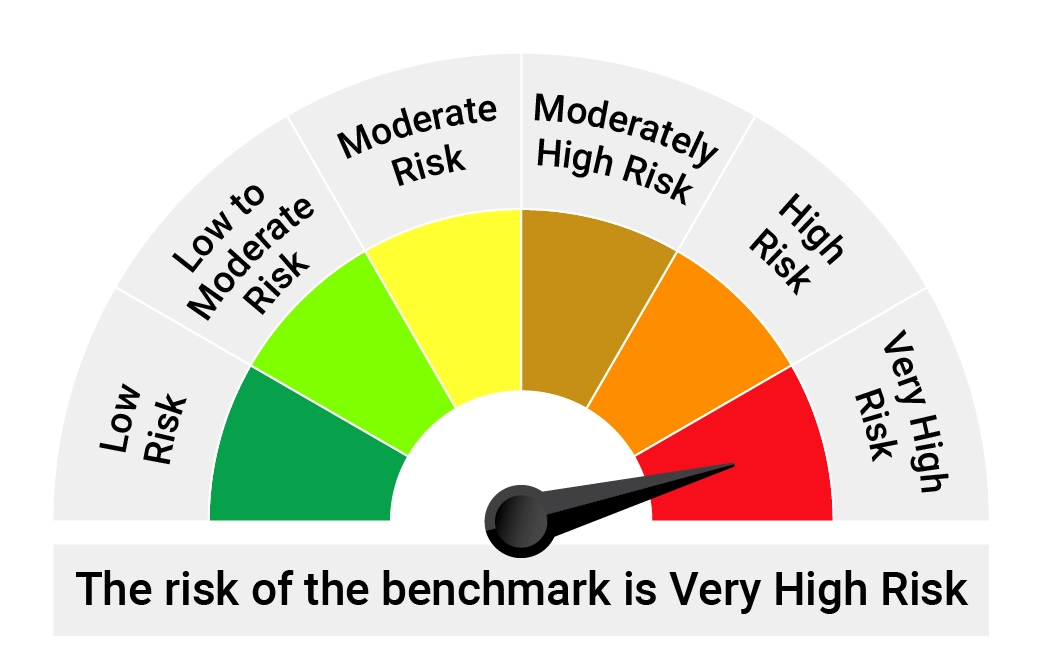

- Quantum Nifty 50 ETF

- Quantum Multi Asset Allocation Fund

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

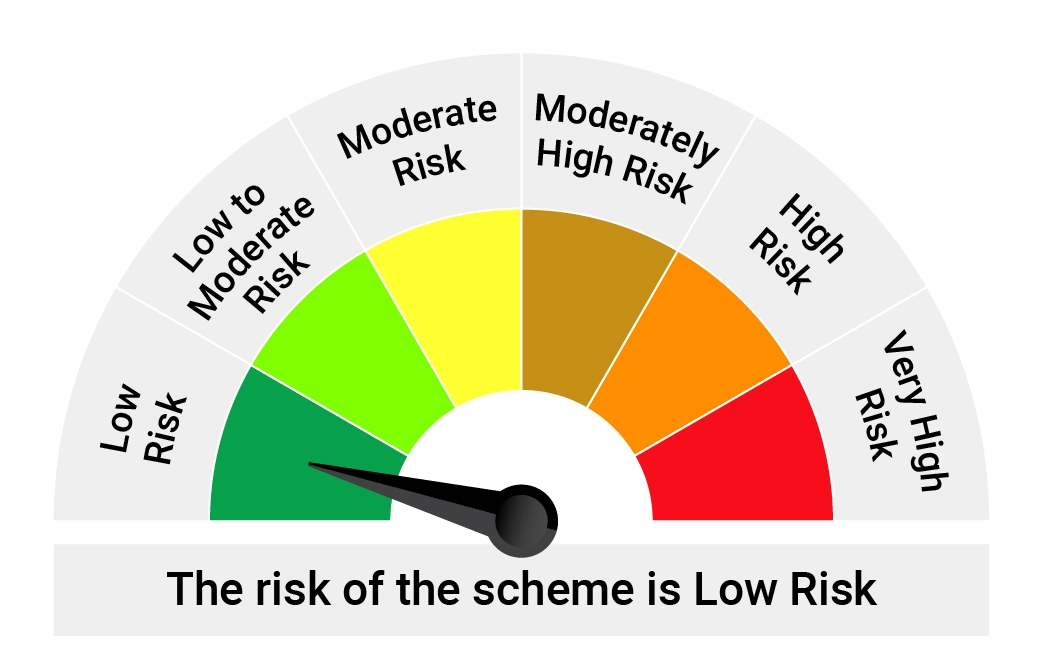

- Quantum Liquid Fund

- Quantum Multi Asset Fund of Funds

- Why Quantum

-

Investment Solutions

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Long Term Equity Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Equity Fund of Funds

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Fund of Funds

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

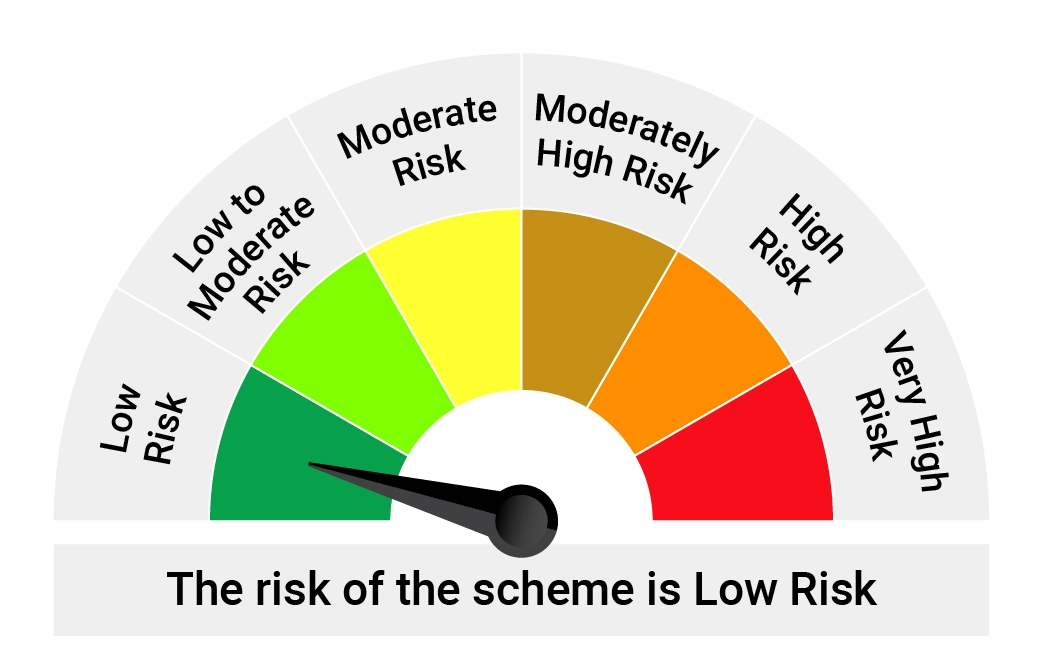

Quantum Gold Fund

Backed by Pure Gold of 99.5% purity

Annualized

Return

19.21 %

|

|

Quantum Gold Savings Fund

Flexibility of an SIP in a Gold ETF

Annualized

Return

18.86 %

|

|

Quantum ELSS Tax Saver Fund

Tax Savings & Wealth Creation combined

Annualized

Return

17.41 %

|

|

Quantum Long Term Equity Value Fund

True-to-label Value-oriented Equity Mutual Fund

Annualized

Return

17.32 %

|

|

Quantum Equity Fund of Funds

1 Fund, Access to 5-10 Third Party Equity Funds

Annualized

Return

13.9 %

|

|

Quantum ESG Best In Class Strategy Fund

One of India’s first ESG Thematic Fund

Annualized

Return

12.27 %

|

|

Quantum Nifty 50 ETF

Mirrors the Nifty 50 Index

Annualized

Return

11.63 %

|

|

Quantum Multi Asset Fund of Funds

Readymade Portfolio Allocation

Annualized

Return

11.32 %

|

|

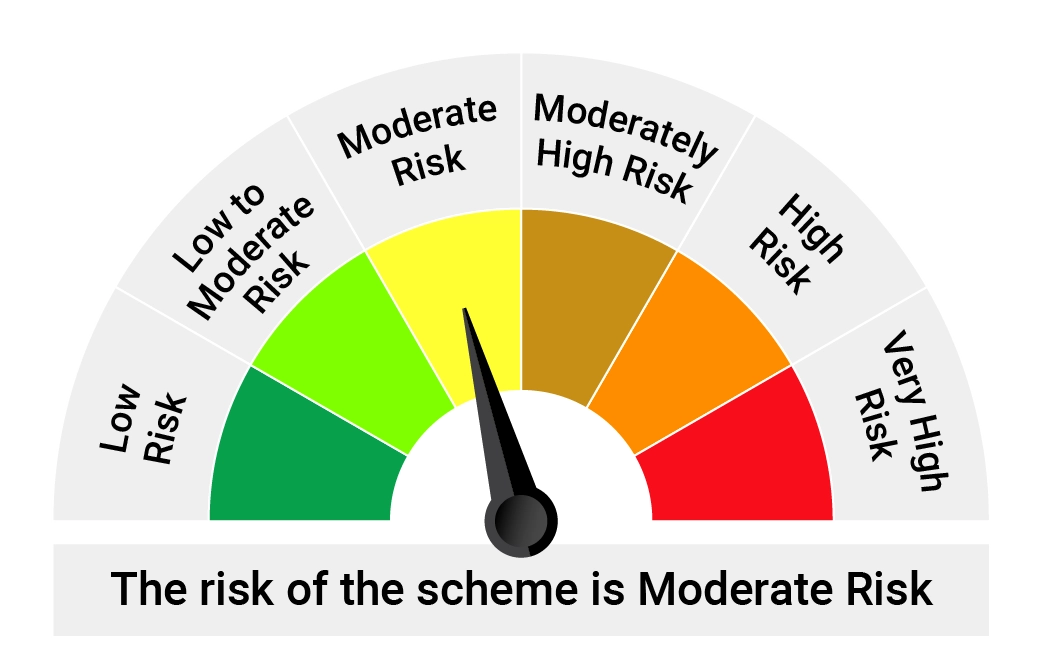

Quantum Dynamic Bond Fund

Duration Management to reduce Interest Rate Risk

Annualized

Return

7.97 %

|

|

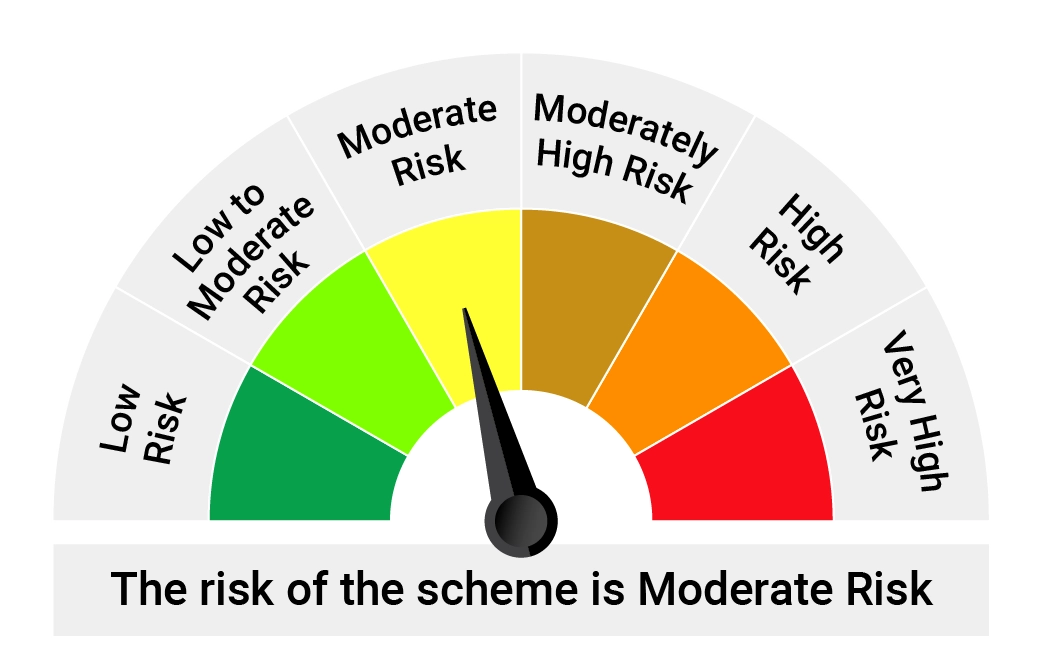

Quantum Liquid Fund

Your Safe Money for Emergencies

Annualized

Return

6.51 %

|

|

Quantum Nifty 50 ETF Fund of Fund

Convenience & Efficiency Combined

Annualized

Return

0 %

|

|

Quantum Small Cap Fund

A high-conviction, well diversified portfolio of quality small cap companies

Annualized

Return

0 %

|

|

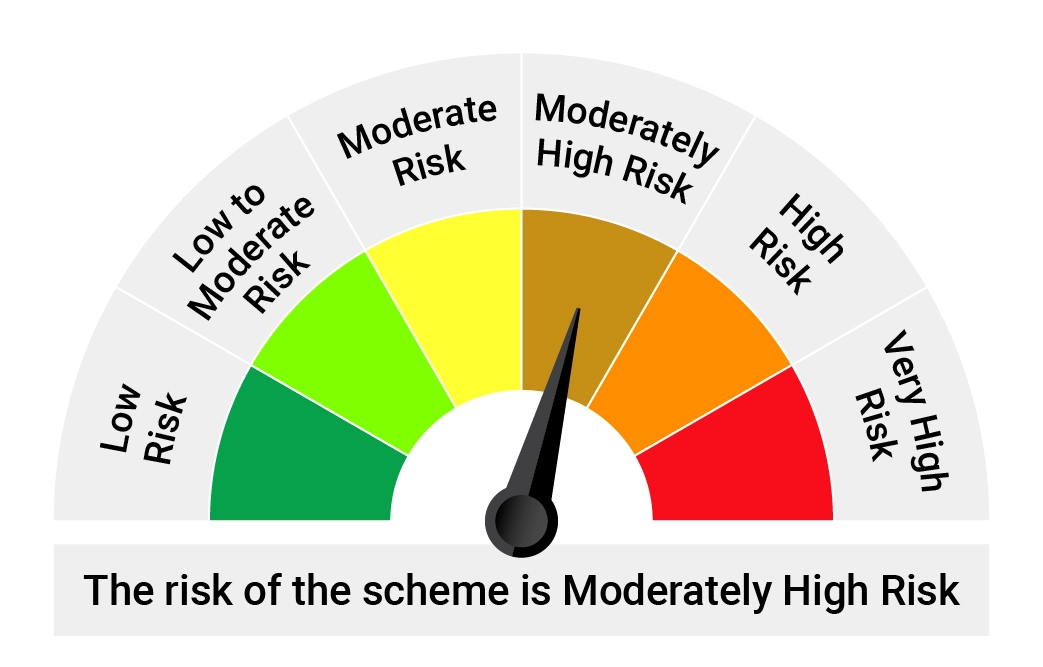

Quantum Multi Asset Allocation Fund

Win with the Power of 3 in 1 Fund - Equity, Debt & Gold

Annualized

Return

0 %

|

|

Quantum Ethical Fund

An open-ended equity scheme following an Ethical Theme

|

|

Quantum ELSS Tax Saver Fund

Tax Savings & Wealth Creation combined

Annualized

Return

17.41 %

|

|

Quantum Long Term Equity Value Fund

True-to-label Value-oriented Equity Mutual Fund

Annualized

Return

17.32 %

|

|

Quantum Equity Fund of Funds

1 Fund, Access to 5-10 Third Party Equity Funds

Annualized

Return

13.9 %

|

|

Quantum ESG Best In Class Strategy Fund

One of India’s first ESG Thematic Fund

Annualized

Return

12.27 %

|

|

Quantum Nifty 50 ETF

Mirrors the Nifty 50 Index

Annualized

Return

11.63 %

|

|

Quantum Nifty 50 ETF Fund of Fund

Convenience & Efficiency Combined

Annualized

Return

0 %

|

|

Quantum Small Cap Fund

A high-conviction, well diversified portfolio of quality small cap companies

Annualized

Return

0 %

|

|

Quantum Ethical Fund

An open-ended equity scheme following an Ethical Theme

|

|

Quantum Dynamic Bond Fund

Duration Management to reduce Interest Rate Risk

Annualized

Return

7.97 %

|

|

Quantum Liquid Fund

Your Safe Money for Emergencies

Annualized

Return

6.51 %

|

|

Quantum Gold Fund

Backed by Pure Gold of 99.5% purity

Annualized

Return

19.21 %

|

|

Quantum Gold Savings Fund

Flexibility of an SIP in a Gold ETF

Annualized

Return

18.86 %

|

|

Quantum Multi Asset Fund of Funds

Readymade Portfolio Allocation

Annualized

Return

11.32 %

|

|

Quantum Multi Asset Allocation Fund

Win with the Power of 3 in 1 Fund - Equity, Debt & Gold

Annualized

Return

0 %

|

|

^ All returns are average annual returns Since Inception and period ending September 16, 2022. Note that the Inception Date varies for every Fund / ETF and is the date when the first NAV was calculated.

* Since an ETF can only be purchased via a broker, a wrapper was created: Quantum Gold Savings Fund. This lets you invest in the underlying ETF via a subscription from the www.QuantumAMC.com website.

**Since an ETF can only be purchased via a broker, a wrapper was created: Quantum Nifty 50 Fund of Funds. This lets you invest in the underlying ETF via a subscription from the www.QuantumAMC.com website.

Source: www.QuantumAMC.com website for all Risk Factors, Disclosures

Add To Cart

| Total of Lumpsum Amount |

|---|

Broker Details

-

ARN CodeARN -

-

Sub Broker Code

-

EUIN CodeE -

-

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.