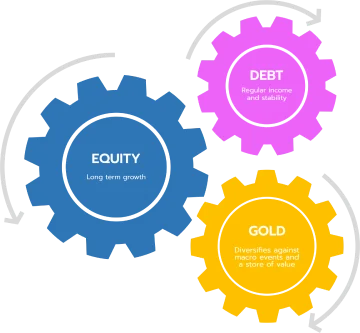

As an investor, if you are looking for tactical asset allocation with a single fund, a Multi Asset Fund could be a worthwhile option. The multi-asset allocation strategy followed by this fund diversifies the money into mainly three assets––equity, debt and gold thereby reducing dependence on a single asset class.

The allocation to equities provides an opportunity to generate wealth over the long term, debt adds stability (generates regular income), while gold acts like a diversification against macroeconomic uncertainty. Thus, a Multi-Asset Fund is truly balanced and aims to mitigate the risk by tactically investing in different asset classes.

How does a Multi-Asset Fund Tactically Allocate between Equity, Debt, and Gold?

The allocation between equity, debt, and gold is usually dynamic (meaning it changes) and is backed by the fund management teams’ outlook for the respective asset class. If favourable opportunities exist for wealth creation, the fund manager could skew the portfolio to equities, whereas when the valuations are expensive and the margin of safety is narrow, debt may be preferred (particularly when yields look attractive). Similarly, to hedge the portfolio in times of economic uncertainty, the fund manager could allocate some portion of the net assets to gold. The factors that are usually evaluated for allocation are:

Price/Earnings Ratio relative to the historical averages

The relationship between earning yield and bond yield to the historical averages

Macroeconomic factors prevailing globally and in India

Table: Asset Allocation of Quantum Multi-Asset Fund of Funds

| Instruments | Indicative allocations (% of total assets) | Risk Profile | |

|---|---|---|---|

| Minimum | Maximum | High/ Medium/ Low | |

| Units of Equity Schemes | 25 | 65 | Medium to High |

| Units of Debt / Money Market Schemes | 25 | 65 | Low to Medium |

| Units of Gold Scheme | 10 | 20 | Medium |

| Money Market instruments, Short-term Corporate debt securities, Tri - Party Repo, Repo / Reverse Repo in government securities and treasury bills only | 0 | 5 | Low |

The Quantum Multi-Asset Fund of Funds under normal circumstances predominantly allocates in the above manner to units of equity schemes, units of debt/market schemes, direct investment in money instruments (viz. short-term corporate debt securities, tri-party repo/reverse repo in government securities and treasury bills), and units of gold schemes.

Typically, what are the risks involved when investing in Multi-Asset Fund?

Given that tactical and dynamic allocation is made to equity, debt, and gold the key risk are:

Price risk

As the price/value /interest rate of the securities in which the scheme invests fluctuates, the value of your investment may go up or down depending on the various factors and forces affecting the capital markets and money markets. The NAV of the Multi-Asset Fund may be affected by the changes in the general market conditions, factors and...

As the price/value /interest rate of the securities in which the scheme invests fluctuates, the value of your investment may go up or down depending on the various factors and forces affecting the capital markets and money markets. The NAV of the Multi-Asset Fund may be affected by the changes in the general market conditions, factors and forces affecting the capital markets in particular, level of interest rates, various market-related factors and trading volumes, settlement periods and transfer procedures, currency exchange rates, changes in the government policies, taxation laws, any other policies, political and economic developments etc.

The risk associated with gold

The Risk of sub-standard quality of gold, plus the custody risk (loss, theft and damage) exists when investing in gold. But with investments in gold ETF, which mainly purchases 0.995 fineness and...

The Risk of sub-standard quality of gold, plus the custody risk (loss, theft and damage) exists when investing in gold. But with investments in gold ETF, which mainly purchases 0.995 fineness and above, plus sourcing it through LBMA-accredited refiner only, the risk associated with owning gold is reduced. The Quantum Gold Fund has a well-defined and specific good delivery norms policy to be followed by the custodian for acceptance of gold.

Allocation risk

The right mix of allocation of funds across asset classes in an optimal way is necessary to maximize risk-adjusted performance. But...

The right mix of allocation of funds across asset classes in an optimal way is necessary to maximize risk-adjusted performance. But at times the allocation may not be optimal. Hence, the Multi-Asset Fund also needs to rebalance at regular intervals to maintain the optimal allocation.

What is the Investment Objective of the Multi-Asset Fund?

The investment objective of the Quantum Multi-Asset Fund is to generate modest capital appreciation while trying to reduce risk (by diversifying risks across asset classes) from a combined portfolio of equity, debt/money markets and gold schemes of Quantum Mutual Fund. It may invest in the units of debt/money market schemes of other mutual funds to gain exposure to debt as an asset class to manage any investment and regulatory constraints that arise/that prevent the Scheme from increasing investments in the schemes of Quantum Mutual Fund. However, there can be no assurance that the investment objective of the Scheme will be realized.

What Are the Key Benefits of Investing in Multi-Asset Funds?

Diversification

The exposure to three assets ––equity, debt, and gold–––facilitates diversification, which is one of the important tenets of investing. You don’t have...

The exposure to three assets ––equity, debt, and gold–––facilitates diversification, which is one of the important tenets of investing. You don’t have to depend on only one asset class to generate returns.

Risk-Adjusted Returns

A fact is every asset class commands a distinct risk-return trade-off. Moreover, every asset class has its share of up and down years. Not all asset classes move in the same direction always. For example, in the years 2012, 2014, 2017, 2020, and 2021 equities, rewarded investors handsomely. But in years when equities encountered headwinds due to...

A fact is every asset class commands a distinct risk-return trade-off. Moreover, every asset class has its share of up and down years. Not all asset classes move in the same direction always. For example, in the years 2012, 2014, 2017, 2020, and 2021 equities, rewarded investors handsomely. But in years when equities encountered headwinds due to macroeconomic uncertainty and rising interest rates; gold, debt and fixed-income instruments have done well. The Multi-Asset Fund makes it possible to have exposure to asset classes that share a low positive correlation with one another. The tactical dynamic asset allocation to equity, debt, and gold, limits the downside risk while the aim is to generate risk-adjusted returns.

Rebalancing Portfolio

This is crucial to ensure that the investments are distributed across the specific asset categories to accomplish the investment objective of the scheme. The Multi-asset Fund actively engages in...

This is crucial to ensure that the investments are distributed across the specific asset categories to accomplish the investment objective of the scheme. The Multi-asset Fund actively engages in portfolio rebalancing depending on the deviation and the outlook for each asset class. This saves you, the investor, the hassle of timing the market and instead focus on 'time in the market'.

Makes Portfolio Tracking Easy

The exposure to three asset classes with one fund managed by competent professionals, makes portfolio tracking easy rather than having too many...

The exposure to three asset classes with one fund managed by competent professionals, makes portfolio tracking easy rather than having too many separate mutual fund schemes within each asset class, which ends up overcrowding the mutual fund portfolio.

Best Multi-Asset Funds in QAMC

Quantum Mutual Fund offers several mutual fund schemes in India that invest in equities, Gold, bonds, multiple asset. The company allows investors to start an SIP in any of its schemes with an amount as low as ₹500, besides offering an option to hold the units in the Demat mode.

Quantum Multi Asset Active FOF

An open ended fund of fund scheme investing in schemes of Quantum Mutual Fund.

Who Should Invest in a Multi-Asset Fund?

A Multi-Asset Fund is considered appropriate for investors who wish to seek risk-adjusted returns with tactical allocation to three asset classes––equity, debt and gold. Usually, the inverse correlation between these three asset classes helps to limit the downside risk (associated with the high-risk asset class). By assuming high risk, it is possible for investors to earn high returns (by way of long-term capital appreciation and current income). That said, consult your investment adviser before investing.

Know more about Portfolio Diversification

-

What is Multi Asset Fund of Funds?

In this video we will explain what is multi asset fund of funds and how you can diversify investment by investing in Quantum Multi Asset Active FOF?

-

One Fund That Invests in 3 Different Asset Classes

Learn about Quantum Multi Asset Active FOF which enables you to invest in Equity, Debt & Gold through a single investment thus helping you achieve diversification and reduce risk.

-

Time to Bet on the Winning Investment Strategy that is Multi Asset Fund Allocation

Chirag Mehta CIO, Quantum Asset Management and Gaurav Rastogi founder of Kuvera talks about the concepts and strategies of investment in the market.

Product Labelling

| Name of the Scheme | This product is suitable for Investors who are seeking* | Risk-o-meter of Scheme |

|---|---|---|

|

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold |

• Long term returns • Investments in physical gold |

Investors understand that their principal will be at High Risk. |

|

Quantum Multi Asset Fund

of Funds An Open Ended Fund of Funds scheme Investing in Schemes of Quantum Mutual Fund |

• Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |

Investors understand that their principal will be at Moderately High Risk. |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Frequently Asked Questions

A multi-asset class investment would contain more than one asset class, thus creating a group or portfolio of assets. Multi-asset class investments increase the diversification of an overall portfolio by distributing investments throughout several asset classes. This reduces risk (volatility) compared to holding one class of asset.

Quantum Multi Asset Fund of Funds - QMAFOF is an open ended Fund of Funds scheme which will invest in various Quantum Mutual Fund Schemes. These schemes of Quantum Mutual Fund will fall into different asset classes of Equity, Debt and Gold.

The investment objective of the Scheme is to generate modest capital appreciation while trying to reduce risk (by diversifying risks across asset classes) from a combined portfolio of equity, debt / money markets and Gold schemes of Quantum Mutual Fund.

The Scheme may invest in the units of debt / money market schemes of other mutual funds to gain exposure to debt as an asset class to manage any investment and regulatory constraints that arise / that prevent the Scheme from increasing investments in the schemes of Quantum Mutual Fund.

There can be no assurance that the investment objective of the Scheme will be realized.

The Scheme’s performance will be benchmarked against CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%). The Benchmark has been selected as the Scheme being Fund of Funds scheme predominantly investing in the units of Equity, Debt / Money Markets and Gold schemes of Quantum Mutual fund. Therefore, the aforesaid benchmark is most suited for comparing performance of the Scheme.

Mr. Chirag Mehta is managing the scheme.

Chirag Mehta has more than 19 years of experience in handling commodities. He has been managing this fund since July 11, 2012 Chirag is a qualified CAIA (Chartered Alternative Investment Analyst), and has also completed his Masters in Management Studies in Finance. He has interned at Kotak & Co. Ltd and has also attended the Federation of Indian Commodities Exchanges as part of his internship.

Please refer below table for the minimum amount required to invest or redeem in the Quantum Multi Asset Active FOF.

| Minimum Amount | Amount in Rs. |

|---|---|

| Initial Investment | Rs. 500/- and multiples of Re. 1/- thereafter |

| Additional Investment | Rs. 500/- and multiples of Re. 1/- thereafter / 50 units |

| Redemption/ Switch Out | Rs. 500/- and multiples of Re. 1/- thereafter OR account balance whichever is less / 50 units |