This Republic Day, build a Strong Foundation for your Equity Portfolio

Posted On Thursday, Jan 25, 2024

India is celebrating its 75th Republic Day. This day commemorates the adoption of the Indian Constitution, a document that enshrines ideals of equality and charts a roadmap for India’s future. As we celebrate this Day, it's an opportune time to reflect on whether you have a strong foundation for your investments, that can provide stability and security you need to achieve your financial goals.

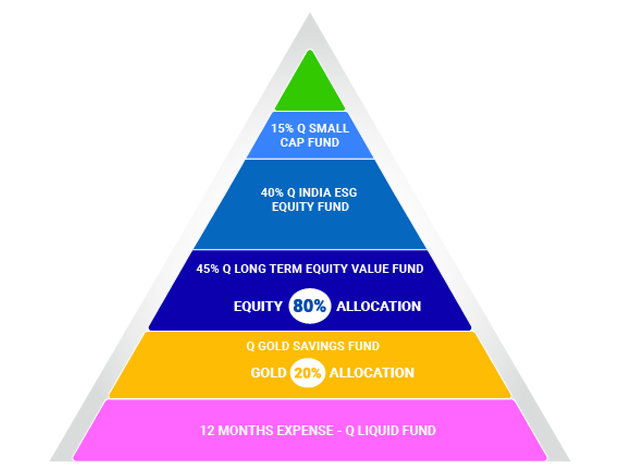

Strengthen the Foundation of your Equity Portfolio

Equity investments are ideal for wealth creation. However, by their inherent nature, it’s not easy to predict outcomes due to the macroeconomic uncertainties. While on one hand, you need to include mutual funds that provide high growth potential to your diversified equity basket, you also need a strong base that can provide stability to your portfolio.

Quantum Long Term Equity Value Fund serves as a foundation to your equity portfolio offering unique upside potential to provide predictable outcomes to help achieve your long-term goals with confidence.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Make this fund an anchor for your equity portfolio for the following reasons:

Robust Investment Process for Delivering Predictable Outcomes

Quantum Long Term Equity Value fund has a unique process driven approach to deliver predictable outcomes. This certainty of outcome is the result of a disciplined research and bottom-up stock selection process to select opportunities that are undervalued relative to historical performance. The fund is primarily mindful of valuations by setting pre-defined buy-sell limits. We select companies trading at a 25-40% discount to its 2-year forward intrinsic value, coupled with catalysts for realizing their estimated upside potential. The upside potential is the difference between forward intrinsic value and current share price.

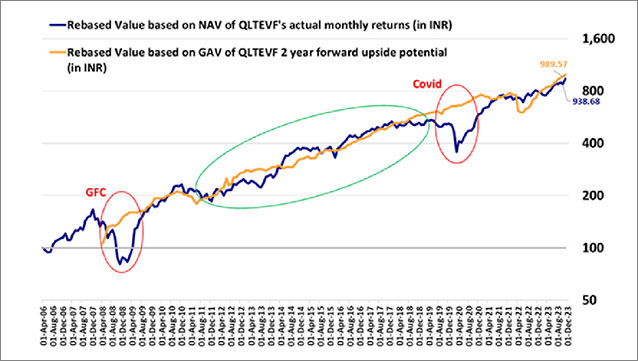

The Outcome of our Disciplined Research and Investment Process has a great ‘Fit’: ‘Stirred, Not Shaken’ by two massive Global Macro Events: GFC and Covid

***The above graph shows the estimate of rebased GAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2. Source: Internal Research, Bloomberg Finance L.P., As of Dec 29, 2023.

The fund has a 17-year track record of weathering market cycles while safeguarding investor wealth during significant global macro events, such as the Global Financial Crisis (GFC) and the Covid pandemic. Our estimated upside potential has closely matched actual performance over the years. The estimated increase of 9.8 times in 17 years, at a robust 13.8% CAGR, mirrors the actual growth of the Portfolio NAV, which increased by 10.1 times at a 14% CAGR over the same period.

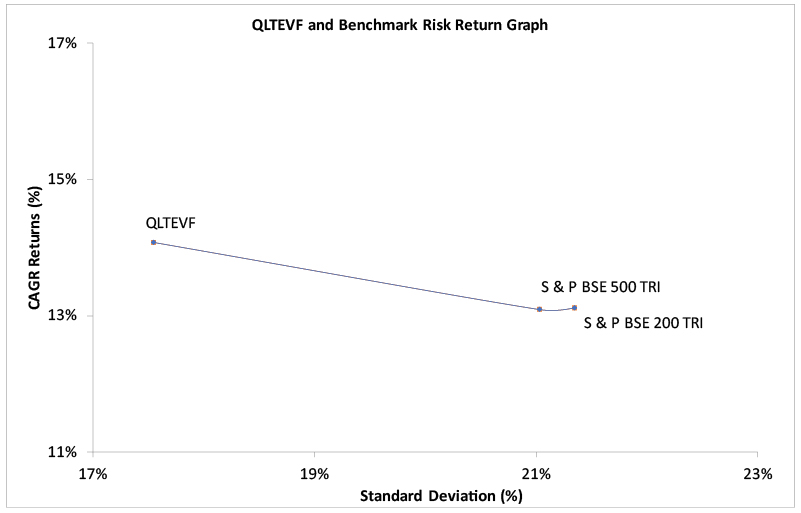

Growth with Stability – Validated by our track record

Historical data suggests, Quantum Long Term Equity Value Fund (QLTEVF) has delivered consistent risk adjusted returns over the long term compared with benchmark (S& P BSE 200 TRI and S&P BSE 500 TRI) i.e. good return at lower standard deviation. A low standard deviation indicates that the historical returns of the fund have been relatively stable and has experienced less variability from the mean, providing investors with more predictable outcomes. Therefore, this fund acts as an anchor to your equity portfolio along with potential for alpha generation over the long run.

| QLTEVF | S & P BSE 500 TRI (Tier-1) | S & P BSE 200 TRI (Tier-2) | |

| Standard Deviation (%) since inception | 17.55% | 21.03% | 21.35% |

| CAGR Returns (%) since inception | 14.07% | 13.09% | 13.12% |

Data as of Dec 29, 2023. The above comparison is based on scheme returns and standard deviation on a since inception basis in comparison with S&P BSE 200 TRI and S&P BSE 500 for the same duration. This chart to be read in conjunction with the complete performance given below. Past performance may or may not be sustained in the future.

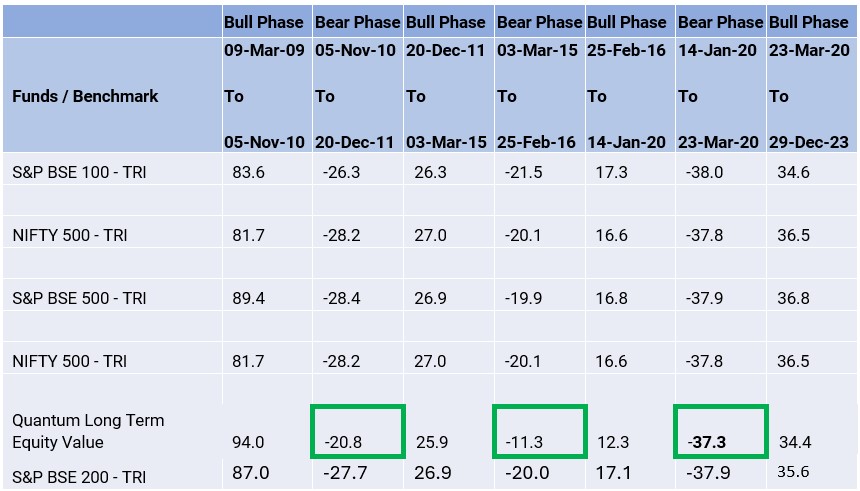

Fund Performance during Bull & Bear Market Phases

Direct Plan and Growth Options considered. Returns herein are point-to-point and in %. Returns over 1 year are compounded annualised. Past performance is not indicative of future returns. Data as of Jan 10 2024 (Source: ACE MF) This should be read in conjunction with the complete fund performance given below. Bear market is when markets have corrected over 20% from the highs and remain so for a while while Bull markets are new market high. The phases are selected to depict market cycles.

On comparing Quantum Long Term Equity Value Fund performance during bull & bear market phases as against benchmark, we find that it exhibits resilience, displaying its ability to manage the downside risk better.

This Republic Day, build a strong foundation with Quantum Long Term Equity Fund for certainty of potential outcomes backed by a time-tested investment process.

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (13th Mar 2006) | 14.07% | 13.09% | 13.12% | 12.78% | 1,04,350 | 89,491 | 89,826 | 85,139 |

| December 31, 2013 to December 29, 2023 (10 years) | 14.31% | 16.14% | 15.83% | 14.52% | 38,084 | 44,650 | 43,483 | 38,812 |

| December 30, 2016 to December 29, 2023 (7 years) | 13.03% | 17.23% | 17.04% | 16.73% | 23,571 | 30,428 | 30,079 | 29,533 |

| December 31, 2018 to December 29, 2023 (5 years) | 14.00% | 17.64% | 17.20% | 16.29% | 19,249 | 22,520 | 22,105 | 21,258 |

| December 31, 2020 to December 29, 2023 (3 years) | 19.75% | 20.44% | 19.35% | 16.23% | 17,157 | 17,451 | 16,984 | 15,687 |

| December 30, 2022 to December 29, 2023 (1 year) | 27.70% | 26.63% | 24.56% | 20.39% | 12,761 | 12,655 | 12,448 | 12,033 |

Data as of Dec 29, 2023. #S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark and Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : S&P BSE 500 TRI Tier II Benchmark : S&P BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of Quantum Gold Savings Fund Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More