The Inflation Tantrum

Posted On Monday, May 24, 2021

Inflation is a phenomenon that scares governments and policymakers across oceans. So much so that almost every central bank in the world targets to keep inflation at ‘appropriate levels’. For the most part of the monetary history, monetary authorities tried to control inflation from rising. But this changed in the last decade.

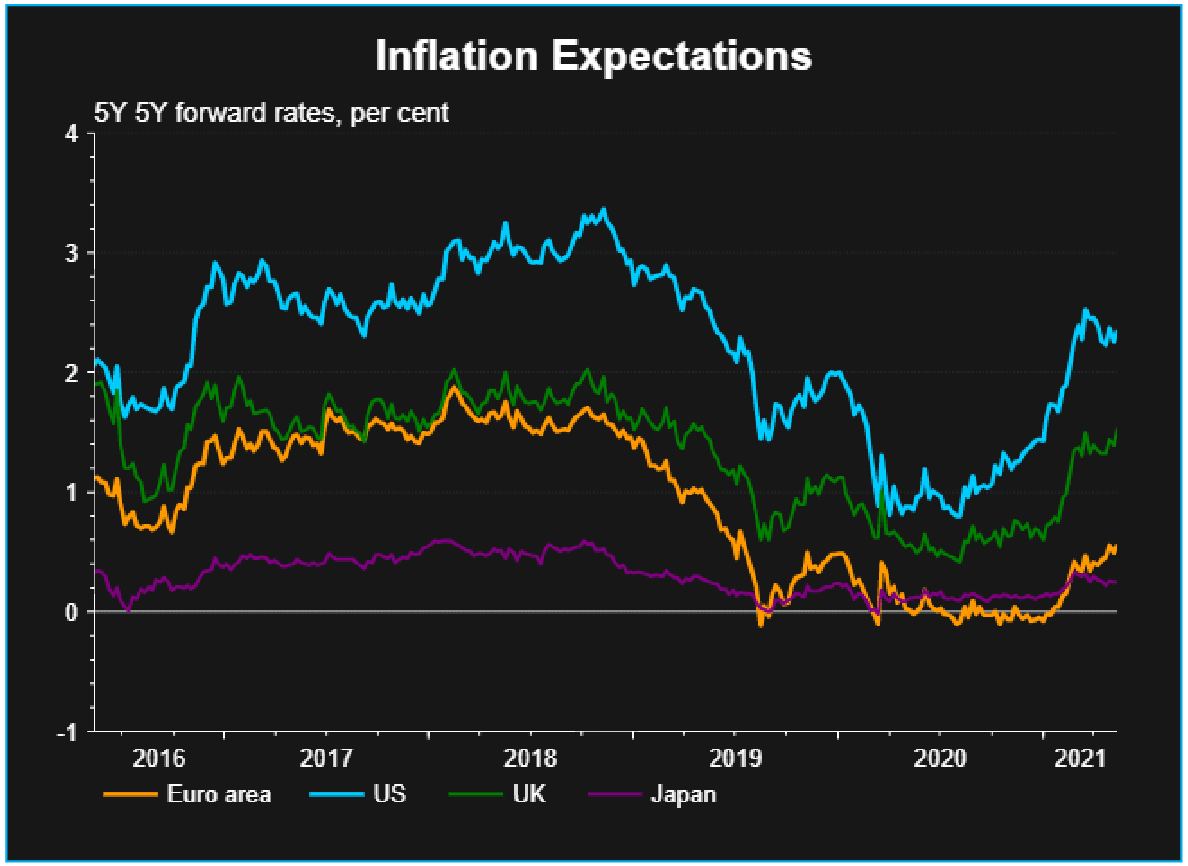

In the aftermath of the global financial crisis of 2008, inflation remained below the central banks’ targets in developed economies. DM Central banks kept the monetary policy ultra-easy and printed a lot of money to fuel inflation. However, they failed to achieve any notable success.

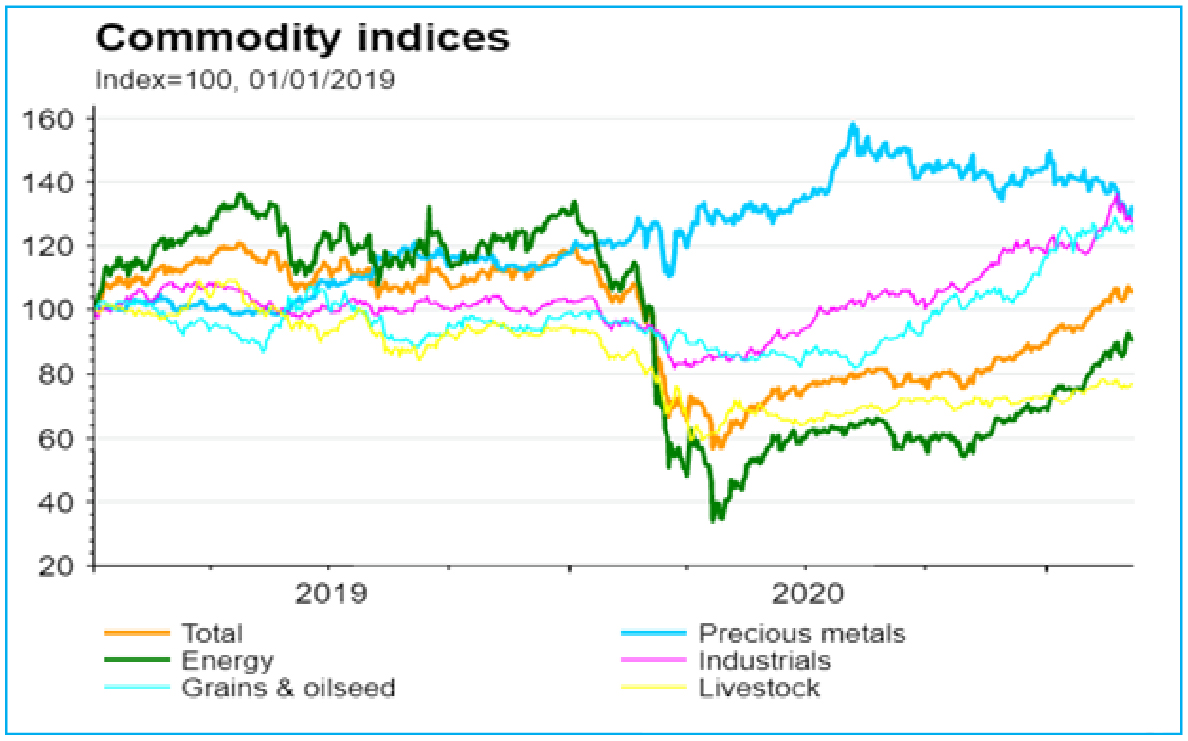

In the wake of the Covid-19 pandemic, this tide seems to be turning again. Enormous amounts of fiscal and monetary stimulus have started to fuel inflationary expectations. Global commodity prices have already moved up substantially in the last one year. Many argue that commodity prices have entered into a long-term rising cycle. Companies are passing on the increase in input costs to consumers.

Chart – I: Commodity Prices grinding up on improved demand outlook & disrupted supply chain

Source: Refinitiv Datastream | Data as on March 2021

Chart – II: Easy monetary and fiscal policy fueling inflationary expectations

Source: Refinitiv Datastream | Data as on March 2021

In the US, CPI inflation is expected to surpass the Federal Reserve’s 2% target by a sizable margin this year. The US Federal reserve, till now, has characterized this pickup in inflation as ‘transitory’ and guided to maintain the monetary accommodation for a longer period. However, if the inflation trend sustains, there is a risk of change in FED’s tone.

Dallas Federal Reserve Bank President Robert Kaplan on April 30, 2021, called for “beginning the conversation about “tapering” central bank support for the economy, warning of imbalances in financial markets and arguing the economy is healing faster than expected”.

Taper Tantrum 2.0

US monetary policy has an enormous spillover impact on emerging economies. In 2013, a mere hint of tapering the bond purchases by the US Fed caused turmoil in emerging economies. In 2018 also EMs faced the brunt of interest rate increases in the US.

India was one of the worst-hit economies during the “taper tantrum” episode of 2013. Foreign investors rushed to withdraw money from the Indian markets. The value of INR relative to USD fell by more than 20% in a short span of 3 months between May to August 2013. The 10-year Indian government bond yield which was around 7.1% in May 2013 spiked to 9.2% by mid of August 2013.

India’s macroeconomic position and external accounts are in much better shape now than what it was in 2013. The current account balance is estimated to be in surplus of about 1% of GDP (Quantum Research Estimates) in the last fiscal year 2020-21. It is expected to fall in the minor deficit of about -0.8% of GDP (Quantum Research Estimates) in the current fiscal year 2021-22.

Table – I: India not ‘Fragile’ anymore?

| India Macro Conditions | Pre and during Taper Tantrum of 2013 | Current Inflation Tantrum 2021 |

| GDP Growth | Post GFC stimulus pump primed growth but fizzed off | Below potential going into COVID. Recovering better than expected |

| Inflation | High Producer and Consumer Inflation | Under control within RBI target |

| Oil Prices | Hovering around $100/brl | Average Below $70/brl |

| Current Account Deficit | Very high; >3% of GDP | Current Account Surplus |

| FX Reserves and External Debt | Low reserves. High corporate FX debt due for maturity | FX reserves well above Total External Debt. Low Corporate FX leverage |

| Foreign Portfolio Flows | Bond Tourists Weak FDI | Long term real money flows / Strong FDI |

| Real Interest Rates | Deeply negative $100/brl | Negative |

| Currency Valuation | Over-valued | Over-valued |

Source: Quantum Research

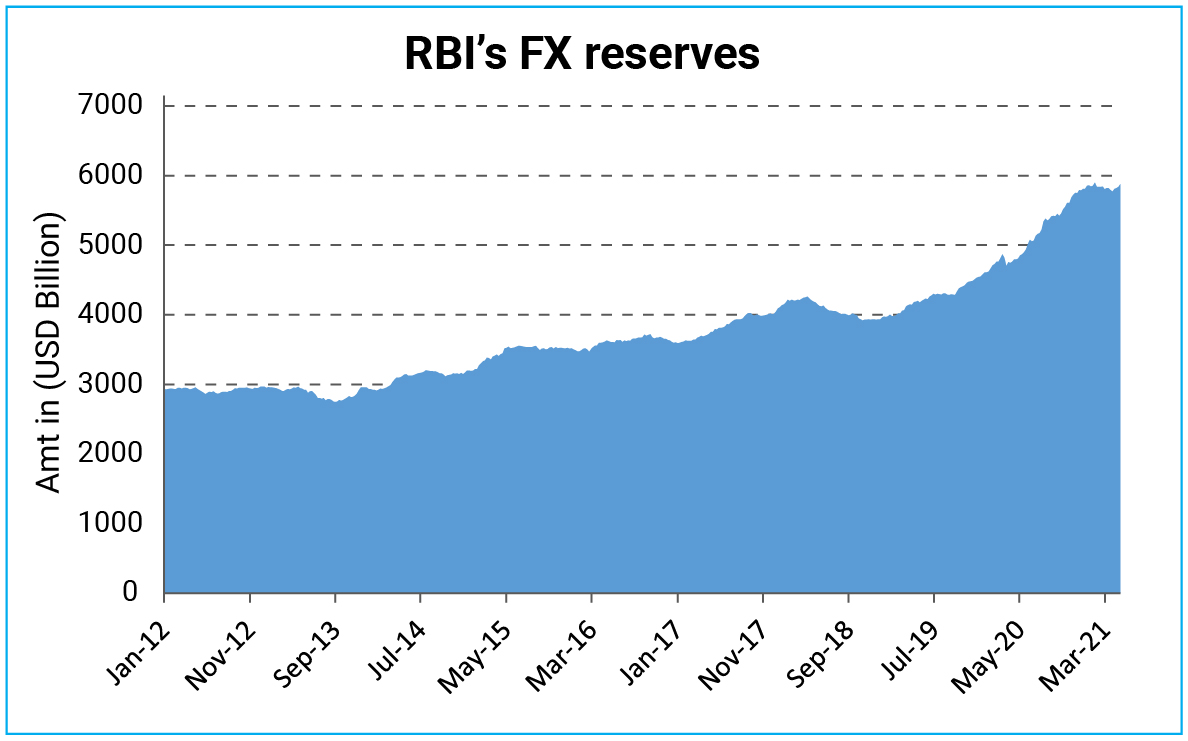

The RBI has, over the years, built a significantly large war chest of foreign exchange reserves to deal with any external shock. Nevertheless, Indian markets might not be immune to any large shock in the global sphere.

Chart – III: Forex reserves to provide cushion to INR against external shock

Source: RBI, Quantum Research | Data up to April 2021

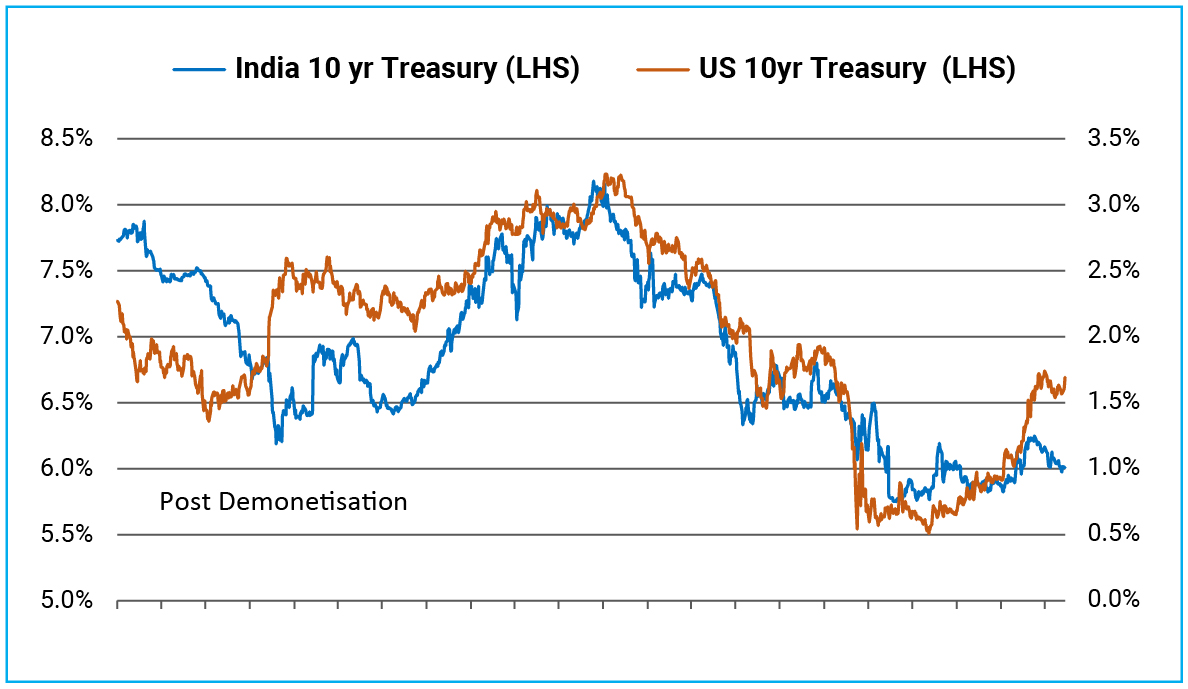

A sudden change of monetary policy direction in the US is the biggest risk for the Indian bond market in 2021. Given the fact that the global economy is still recovering from a once in a lifetime shock, this seems like a very low probability event at this juncture. However, it is imperative for investors in emerging markets like India to keep this risk in mind. If US 10-year treasury yields indeed head up towards the 2.0-2.5% range, global asset markets will face some turmoil.

Chart – IV: Rising US Treasury yield risk to Indian Bonds

Source: Bloomberg, Quantum Research | Data up to 30th April 2021

Past performance may or may not sustain in future.

Outlook – RBI ‘all in’ to keep yields low

The RBI’s actions remain the key driver for the Indian bond market. Amidst the resurgence of Covid-19 infections, it intensified its market interventions to pull bond yields lower. It purchased government bonds worth Rs. 250 billion under the GSAP 1.0 and has already announced the second tranche of Rs. 350 billion to be conducted on May 20, 2021.

However, the more significant point is that the RBI didn’t restrict itself to the scheduled GSAP purchases. It also conducted an operation twist worth Rs. 100 billion out of the GSAP ambit and continues to send strong yield signals by canceling and devolving government debt auctions from time to time.

All these combined have brought down bond yields in the last two months. The 10-year G-sec yield fell from 6.18% on March 31, 2021, to 6.03% on April 30, 2021, and to 6.0% on May 12, 2021.

RBI’s bond purchases should bode well for long-term bonds and should put a cap on yields in the near term. While the excessive bond supply may continue to put pressure on the market. Bond yields may remain range-bound in the near term.

Over the medium term, inflation and potential monetary policy normalization will play a more important role in shaping the interest rate trajectory. The resurgence of Covid-19 in India has brought back uncertainty around the future course of fiscal and monetary policy. These would now depend on the duration and severity of this health crisis.

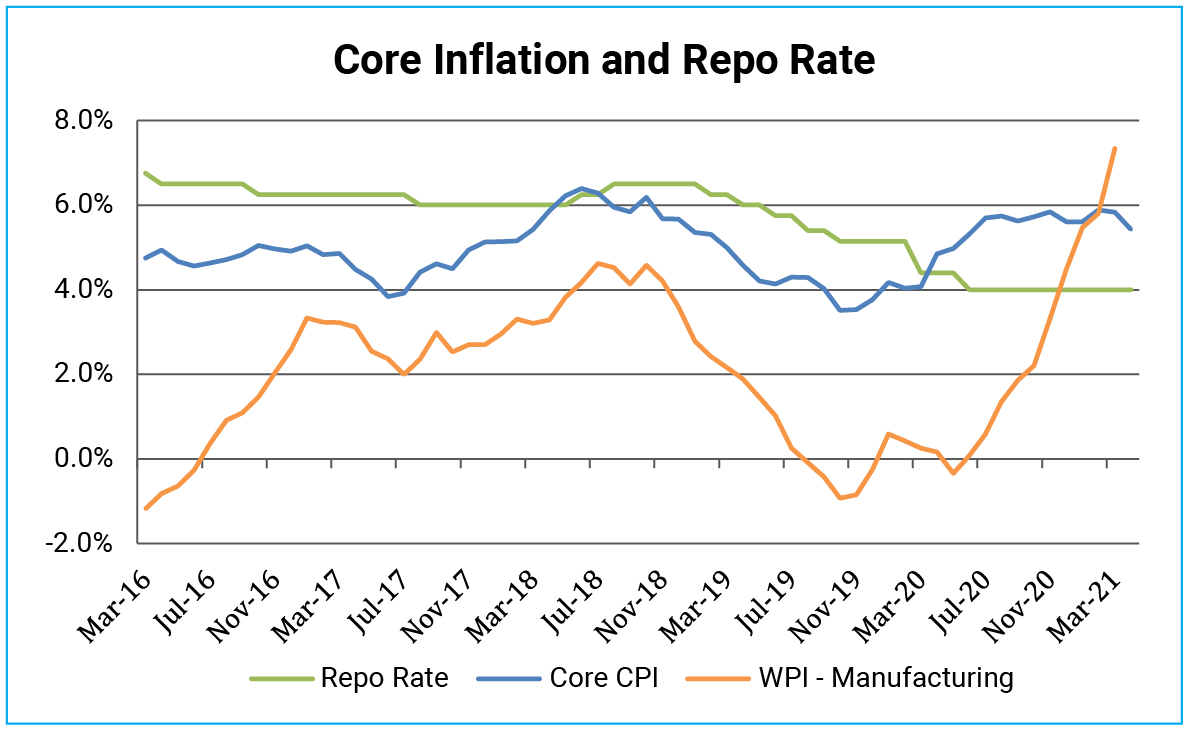

Chart – V: Inflation risk to make policy choices difficult

Source: MOSPI, Bloomberg, Quantum Research | Data as of April 2021

Past performance may or may not sustain in future.

Increased uncertainty on economic recovery will push the potential monetary policy normalization further into the future. Earlier there was an expectation that the RBI will start withdrawing surplus liquidity and hiking the reverse repo rate towards the end of the current year. This could get postponed to the next year. However, as things start to stabilize on the health front, the market will again shift its focus back to the rising inflationary pressures and path of policy normalization.

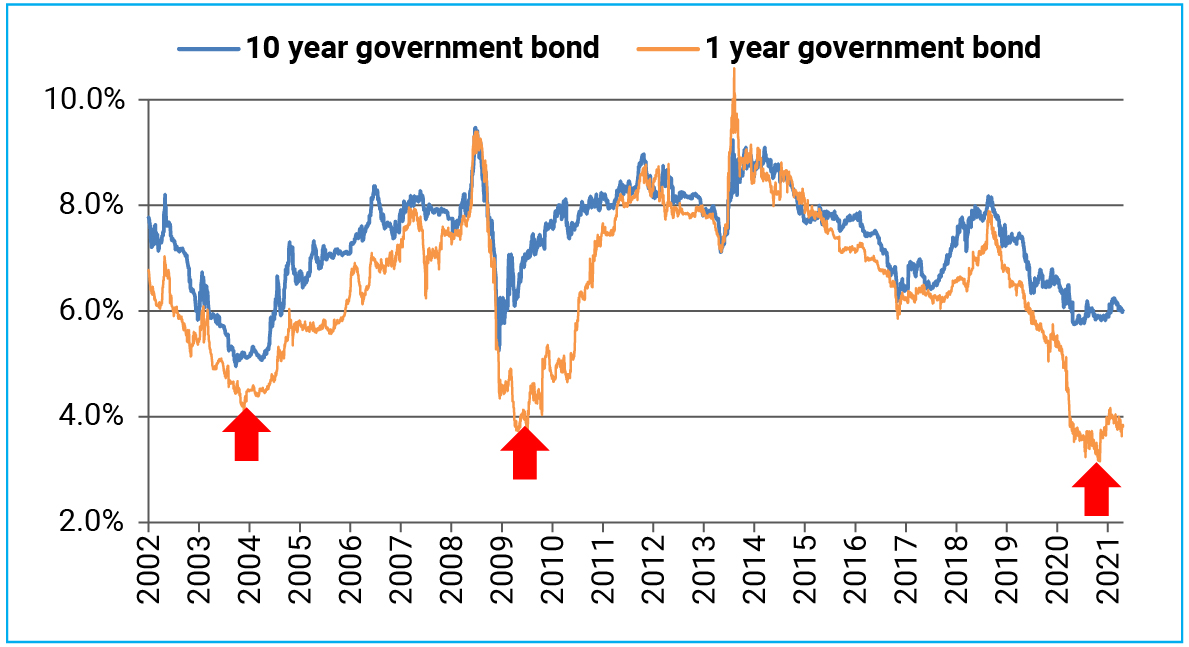

We continue to believe that bond yields have already bottomed out in this cycle and expect it to move higher gradually over the next 1-2 years.

Chart – VI: Bond yields near-decade lows, poised to move higher

Source: RBI, Quantum Research | Data as of 12th May 2021

Past performance may or may not sustain in future.

Portfolio Strategy and Recommendation

In the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on tactical trading opportunities within a narrow range. QDBF does not take any credit risks and invests only in sovereigns and top-rated PSU bonds, but it does take high-interest rate risk from time to time.

We used this rally in the bond market to book profits on tactical long bonds position. We also lowered the interest rate risk of the portfolio by repositioning to short-term Gsecs and cash which are less sensitive to interest rate changes. This position appropriately reflects our cautious view of the market.

In the Quantum Liquid Fund, we continue to focus on short-term treasury bills and good quality PSU debt securities. With the delay in liquidity normalization, the yield on short-term money market rates may remain lower for longer.

Investors should acknowledge that the best bond market rally is now behind us. At this time it would be prudent to lower the return expectations from fixed income products – as money market yields, fixed deposit rates will remain low and potential capital gains from long bond funds will be muted.

Conservative investors should remain invested in categories like liquid funds where the impact of interest rate rise would be favorable. However, while selecting a liquid fund be cautious of the credit quality and liquidity of the underlying portfolio.

At this point where fixed deposit rates have come down to historical lows, liquid funds could be an option (with market risk) in comparison to locking in long-term fixed deposits. Liquid Funds invest in up to 91-day maturity debt securities which get re-priced higher when interest rates rise. Fixed deposits interest rates remain fixed for the entire tenor thus lose out during a rising interest rate cycle.

Investors with a higher risk appetite and longer holding periods can consider dynamic bond funds where the fund manager has the flexibility to change the portfolio when market views change. These funds are best suited for long-term fixed income allocation goals. However, do remember that bond funds are not fixed deposits and their returns could be highly volatile and even negative in a short period of time.

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on April 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for July 2025

Posted On Monday, Jul 07, 2025

The market continued the upward trajectory with BSE Sensex gaining by 3.0%. The BSE mid and small cap indices rose by 3.9% and 4.4% respectively.

Read More -

Debt Monthly for July 2025

Posted On Monday, Jul 07, 2025

Flashpoint Middle East: War, Oil, and the Strait of Hormuz Risk: In June 2025, the Israel-Iran conflict erupted into full-scale war, sparking widespread geopolitical instability.

Read More -

Gold Monthly for July 2025

Posted On Wednesday, Jul 02, 2025

We are already halfway through 2025, and it will be safe to look back and say, ‘It was all Yellow’

Read More