Risk or Returns? Learn How Thoughtful Investors Balance Both

Posted On Friday, Sep 30, 2022

Everyone wants to make money in the equity markets but only a few understand risk which is crucial when investing. Returns only tell part of the story, do you however take into consideration that risk that you are taking to make those returns?

As a preliminary step before you start investing, it is important to make provision for the risk in your investments. To evaluate the risk, there are two important factors that include your age and risk tolerance. Depending on your age, your risk tolerance changes. At a young age, your risk tolerance is high, and it gradually decreases as you grow older.

A thoughtful investor is one who is able to balance risks and returns to sail through every market environment, thereby building wealth in the long run.

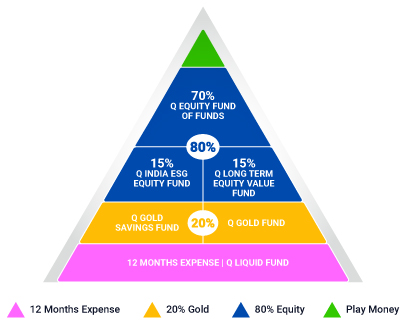

At Quantum we recommend the 12:20:80 (Bara Bees aur Assi) Asset Allocation Strategy to build a diversified portfolio. The strategy has three crucial building blocks comprising Equity, Debt and Gold. With our handy Asset Allocation Calculator, you can balance/rebalance your portfolio in just a few clicks to own a diversified basket of investments using actively or passively managed funds.

12:20:80 Asset Allocation for Active Investors

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Emergency Funds – Investing in liquid mutual funds usually involves less risk-and less returns than investing in equity markets. Nevertheless, before you start investing in equity mutual funds, build your portfolio foundation with an emergency fund. Owning an emergency fund helps you prepare for uncertain times and will help minimize risk exposure and prioritize liquidity for a rainy day. While ideally, you can keep aside an emergency fund equivalent to 12 months of monthly expenses, you can add or decrease emergency reserves depending on your risk tolerance and age. Lower the risk tolerance, higher the emergency reserves, and vice versa.

Owning Liquid Funds also provide stability, and help reduce the risk of downside in riskier asset classes like equity investments. It also forms as a temporary holding place while you are awaiting other investment opportunities to arise.

Diversifying Block – Gold serves as a Portfolio Diversifying Block to add stability to the portfolio in times of uncertainties. When there is stress in equity markets, having Gold in your portfolio can help reduce downside risk as Gold and Equity is generally inversely correlated to each other. If you believe in the potential of the yellow metal, you can simply allocate to the efficient financial forms such as the Quantum Gold Fund or Quantum Gold Savings Fund.

Growth Block (Equity) – As part of an active investing approach, you can build a diversified equity mutual fund basket using across various styles such as value or growth and across market caps (large, mid/small). This strategy helps complete your equity portfolio with just three funds in the 70:15:15 ratio as part of the overarching 12:20:80 strategy.

Invest 15% to the Quantum Long Term Equity Value Fund – our flagship fund using a value investing style, another 15% to the Quantum India ESG Equity Fund which follows the growth style of investing using ESG parameters (Environmental, Social and Governance) to filter companies. Finally, a larger portion is dedicated of your equity basket can be allocated to the Quantum Equity Fund of Fund – a diversified equity basket comprising of 5-10 underlying funds of other equity mutual funds carefully chosen after adequate qualitative and quantitative research.

Let’s further understand value and growth style of investing and how do they help in building your equity portfolio:

Fig 1: Difference between Value and Growth

Value Investing | Growth Investing |

Value Investing focuses on identifying and investing in stocks that are trading a price lesser than its intrinsic value. | Growth investing focuses on identifying and investing in stocks that have the potential to over the long term. |

Value investing includes companies with a higher margin of safety. | Growth investing includes companies with a track record for performance and growth. |

Value investing combines reasonable growth with better potential to lower downside risk. | Growth investing combines the benefits of high grogh rwth and hieturn on equity (ROE). |

Why it’s a Good Time to hold on or Add Value?

A Value Fund is likely to thrive in the following situations:

• Normalized interest rate environment and when there is a more broad-based economic growth.

• A combination of comfortable valuations and a potential for an earnings upgrade.

• Rising interest rates, pickup in economic activity and a sticky inflation

With a cyclical recovery in place, our analysis suggests that value will continue to perform for the next few years.

Value-oriented mutual funds made a strong comeback in the past two years amid the ongoing uncertainty in the market. Since 2020, during the Covid-related correction, value funds have started delivering returns.

Going ahead, we cannot predict how the Central Bank will respond to the inflationary pressures? Will the RBI continue to increase interest rates? High interest rates can impact both Valuations and profitability. In times of rising interest rates, value investing can have the potential to perform.

Let’s see an illustration of how a sensibly valued stock is expected to offer better downside protection than a growth stock in a rising interest rate environment.

Fig 2: Impact of Interest Rate Hikes

| Company A | Company B |

Growth for next 20 years | 20% | 10% |

Present value @12% discount rate | Rs. 3717.92 | Rs. 1512.91 |

Present value @15% discount rate | Rs. 2684.88 | Rs. 1177.90 |

Impact of 300 bps increase in discount rate | -28% | -22% |

Assumption: Both companies generate cash flow of INR 100 in year 1. The above table is for illustration purposes only.

A Value Fund uses a margin of safety approach to investing. During a market correction, when growth equity funds are underperforming, a value fund generally falls at a lesser level.

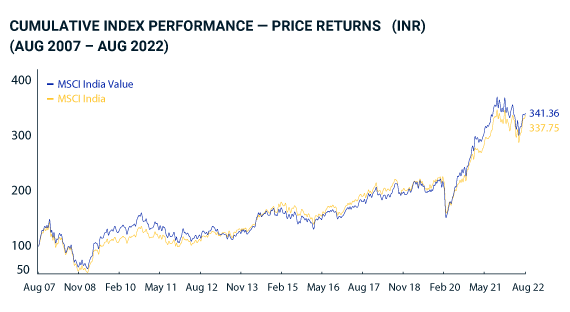

As you see in the graph below, value investing has turned back in favour.

Fig 3: Value Investing is Making a Comeback

Source: MSCI Value Index India. YTD Data as of August 31, 2022.

Past performance may or may not be sustained tomorrow.

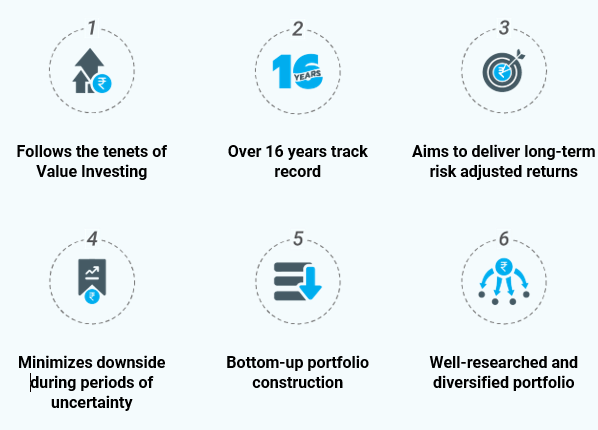

Invest in the Quantum Long Term Value Fund, a true-to-label fund since 2006, that is positioned for broad based economic revival while at the same time has the potential to survive the downturn.

Why Invest in Quantum Long Term Equity Value Fund

While it’s a thoughtful approach to hold on or add to a value fund these uncertain times, do not allow your portfolio to be biased to any investing style or market cap. Markets are cyclical, different styles work during different phases.

Regardless of the style of investing – growth or value, active or passive, a thoughtful investor does not solely focus on returns, but focus on how best to not lose money so as to earn risk adjusted returns in the long term.

The way to do this is to focus on building a diversified portfolio that is not biased to any market cap or investment style and offers a risk-return balance. Diversify such that it offers your portfolio the potential to grow, at the same time, helps in capping losses during a downside market. Finally, keep a long-time horizon of 5 years or more using an SIP or lumpsum mode to brace for market fluctuations.

|

|

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 31, 2022

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 31, 2022

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More