Understanding the Pernicious Effects of Inflation

Posted On Wednesday, Aug 24, 2016

“Inflation is always and everywhere a monetary phenomenon.” - Milton Friedman, Nobel Prize-winning economist

Inflation has become quite the buzzword this summer in the aftermath of Raghuram Rajan’s surprise announcement that he is exiting the Reserve Bank of India. Now that Urjit Patel has been named to succeed Rajan as the head of the RBI – and appears likely to continue the inflation-fighting mandate set in motion by his predecessor – all the focus is on the central bank. They are, after all, managers of the “monetary phenomenon” to which Milton Friedman so famously referred in the quote above! Keeping that in mind, we felt it would be useful to our readers if we explore some of the intricacies of inflation and help you understand why, left unattended, inflation can morph into a pernicious disease infecting an entire economy.

The basic concept of inflation is simple – it erodes the purchasing power of one’s money. If one is earning 10% in a fixed-deposit, Rs. 100 turns into Rs. 110 after a year. This seems great, but if the general level of prices (i.e. the Consumer Price Index) increased 11% that year, this investor would be a net loser – to wit, the bag of rice that cost Rs. 100 last year now costs Rs. 111, and the investor only has Rs. 110 now with which to buy it.

[Side note: This circumstance, in which the level of inflation exceeds the level of interest rates, is called a negative “real interest rate” scenario. The real interest rate is simply the amount by which the interest rate exceeds inflation, and is effectively a measure of how much one’s purchasing power is increasing or decreasing. You may have read that a great success of the Rajan regime was that his hard-nosed focus on containing inflation turned a negative real interest rate environment in India into a positive one. This lends global credibility to an economy and tends to be very good for attracting foreign investment, among other things. If you’re interested in reading more on how real rates can affect investment opportunities, please see our Portfolio Manager Chirag Mehta’s recent piece in the Economic Times.]

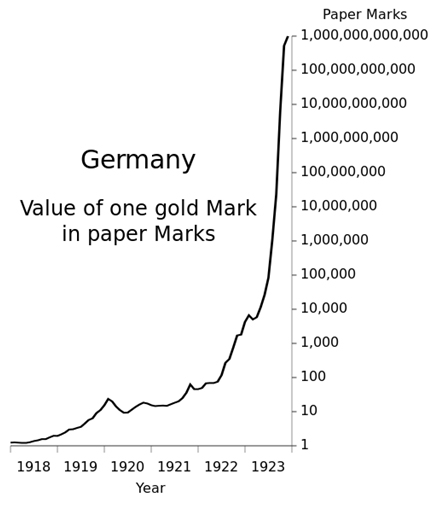

An important thing to understand about inflation is that it is capable of wreaking a devastating havoc on any economy, not just the Zimbabwes and Venezuelas of the developing world. In fact, at the time of the First World War, the German economy was one of the world’s most developed. The country suspended the gold standard and elected to finance its war spending entirely via borrowing, hoping to pay it back by winning the war and imposing reparations on the Allies. Alas the Germans lost, and they found themselves increasingly unable to pay back prior borrowing as well as the new reparations imposed upon them. The German Mark had gradually lost value versus the U.S. Dollar over the course of the war, and once the Germans resorted to simply printing gobs of Marks to buy either the gold or foreign currencies that were required to pay back their debts, the value of the Mark plummeted. There were no longer any real resources to back up these pieces of paper, and foreign investors lost all faith in the Germans to safeguard any value of the currency. The result was that in about four years, the number of Marks required to buy one U.S. Dollar went from 8 to four trillion!

A simple way to grasp the economic effects is to imagine you ran a bank which had lent out 1 million Marks to borrowers for a term of 5 years at the time the Mark was trading at 8 per USD. Within those five years, the value of that Mark dropped to the point that your borrowers could pay back their debts in entirety and all you could buy with the proceeds would be one-quarter of one-millionth of a single U.S. Dollar. In other words, your borrowers get off scot free and you are ruined. (While in this instance, some debts were reinstated at fractions of their prior value, you can read more about that fascinating episode in economic history and the myriad effects it had on that economy here.)

So if inflation is so bad, why not pursue policies of outright deflation? Isn’t it a good thing when the prices of items we buy start to fall? Well, yes and no. If we see deflation in certain areas as a result of productivity gains, like for instance computing, then the more widespread availability of technology like that can a boon for society. Unfortunately, that’s not always the cause of deflation. While deflationary circumstances tied to technological progress have historically coexisted with and driven economic growth, many deflationary environments through history have been equally as devastating as rampant inflationary ones – most notably the Great Depression of the 1930s, in which the stock market plummeted, millions lost their jobs, banks significantly curtailed lending because of credit risks, people hoarded cash because of bank failures, and global GDP dropped sharply.

History has shown that the Federal Reserve erred significantly by tightening monetary policy in the midst of the carnage and prolonging the global economic misery. This is why we typically see central banks elect to pursue policies of moderate inflation, consistent with a steadily growing economy. It is also why we see these developed world central banks going to extraordinary measures since the 2008 financial crisis in efforts to stimulate their economies, with policy rates in many areas having actually gone negative.

For a simple illustration of the effects of deflation, imagine the reverse of the inflationary scenario depicted earlier, so this time you are the borrower rather than the bank/lender. Note that while inflation erodes the value of money, deflation actually increases it. So if you have borrowed instead of lent the money, the real value of the debt you owe goes up, making it more difficult to pay back. Further, once people grow accustomed to deflationary circumstances, they begin hoarding money as they realize its value is increasing. The rice bag that costs Rs. 100 today may well only require Rs. 95 next year, so might as well play it safe and hold onto that valuable cash. Meanwhile, the producer of rice (or whatever other product is seeing price decreases) will stop producing as much, meaning they either stop employing as many people or cut wages, meaning there is less money to buy the product, meaning the price must fall further because no buyers can take advantage of the already-low price, meaning the producer must once again produce less. As you can see, what seems like an ordinary deflation can easily turn into an exhaustive death spiral! (On the flip side, small increases in inflation can create contained virtuous cycles in the opposite direction, hence central bank preferences for low and contained inflation.)

We have seen this deflation play out in Japan over the last few decades, after a massive bubble in stocks and real estate crashed in the early 1990s. Despite herculean efforts of monetary and fiscal authorities to stimulate the economy, the bubble’s bursting – which included a staggering 90% peak-to-trough drop in real estate prices – brought about a cultural shift in attitudes towards spending that persists to this day. Young Japanese workers have even been quoted in the media saying they’ve come to peace with the idea that they may never see a wage increase in their lifetimes! While there are signs this is changing, it has only come in fits and starts and no lasting solution has been achieved by the Japanese to date, as the country has dipped in and out of recession continually over the past 25 years.

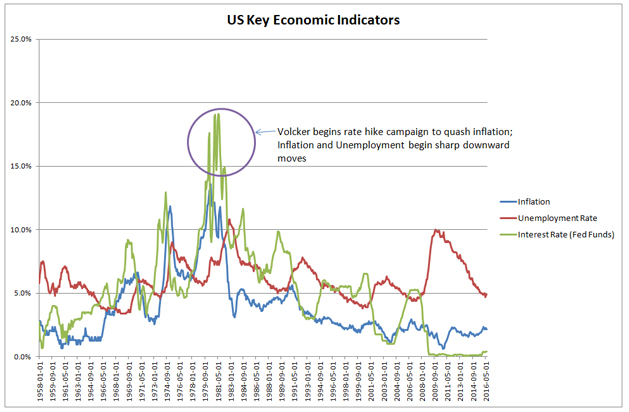

While nowhere near as severe as the German hyperinflation episode, the United States faced its own inflation dilemma in the 1970s when the economy was beset by stagflation, an environment in which both inflation and unemployment are at high levels amidst a “stagnant” economy. The dilemma faced by officials in a stagflationary environment is simple: lowering interest rates to spur economic growth risks exacerbating inflation, while raising interest rates to contain inflation runs the risk of slowing economic growth and thereby exacerbating unemployment. This situation in the U.S. was brought about following President Nixon’s move in 1971 to take the country off the gold standard (sound familiar?) in response to multiple countries demanding conversion of their dollars into gold. Without getting too much into the details, this move away from a hard-currency backing combined with several oil-price shocks (which is a price over which central banks have effectively zero control, rendering policy responses useless) cast several blows to the U.S. economy. By the end of the decade, the Fed’s credibility had been diminished and investor expectations of future inflation remained high – 15% or higher – no matter what policies the Fed pursued. The U.S. dollar had lost a considerable amount of its value, and American citizens found it increasingly more difficult to afford imported goods.

Enter Paul Volcker. Even non-seasoned investors may have heard his name in the past: Raghuram Rajan has drawn many comparisons to Mr. Volcker in his tenure at the head of the RBI. It is not a controversial statement to say that Volcker, who was Chairman of the U.S. Federal Reserve Bank from 1979-1987, is one of the greatest central bankers who ever lived. Volcker, like Rajan now, understood the vicious repercussions of unconstrained inflation and led a Fed policy of getting inflation completely under control. In order to accomplish this, he raised interest rates to dizzying heights (from 11% to 20%), precipitating a devastating recession in the United States that took unemployment up to double-digit levels and drew him widespread protests and few friendly editorials in the popular press. Within three years, however, inflation had dropped from 15% to 3% –this slowing of inflation is known as disinflation, distinct from deflation – and investors’ newfound credibility in U.S. monetary policy set off one of the longest and greatest bull market runs in both bonds AND stocks that any developed nation has ever seen.

Data Source: https://fred.stlouisfed.org/

Many other attributes made Volcker a great central banker, and the same can be said of Rajan despite his short tenure. Given the disastrous effects inflation can have on developed economies – let alone developing economies, as described in the Venezuela article linked earlier – the importance of sound monetary policy cannot be overstated. While we were exceedingly sad to see Mr. Rajan’s departure, the naming of his deputy Mr. Patel to succeed him gives us faith that the Reserve Bank of India can continue to gain inflation-fighting credibility with global investors, and with it usher in years of solid growth for the world’s fastest-growing economy.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More