Decline in Gold Demand in India: Positive Real Rates of Return

Posted On Tuesday, Aug 23, 2016

The Rio Olympics has witnessed its spectacular closing ceremony with India finishing with one each of Bronze and Silver medals. However, the precious Gold medal has, yet again, eluded India, making it two consecutive Olympics without a Gold medal. In a way, the Olympics have yet again invigorated our cravings for gold. The importance of gold can be seen when it is associated with significant engagements like golden anniversaries, golden jubilee, gold credit cards etc. Gold is also often offered to Indian deities. The Indian calendar even has auspicious days to buy gold like Dhanteras and Akshay Tritiya. That said Indians are known to buy gold anytime of the year and not only during special occasions like weddings or festivals. The primary reason to buy gold is that it is an equivalent to cash and thus can be considered to be a good liquid investment.

Despite the strong connection to gold, demand for gold in India has dived by about 30–40%* this year. Many attribute rising and volatile gold prices as a reason why Indians are shying away from gold. However, there’s more to this story. The real reason for this decline in gold demand is the positive real rates (returns earned after adjusting inflation) offered to Indian investors. The economic policies pursued by Raghuram Rajan have continuously stressed on lowering inflation. The Central Bank has consciously argued for a positive real interest rate for depositors and has thereby ensured that depositors earn a real rate of 1.5-2% above the prevailing interest rates. For this, the RBI targets to reduce inflation to 5% by March 2017, and further to 4% by March 2018 (with a leeway of 2% below or above the target), and thereafter sustain it at 4%. RBI’s policies of maintaining rates based on prevailing inflation have ensured on keeping the real rates positive for depositors.

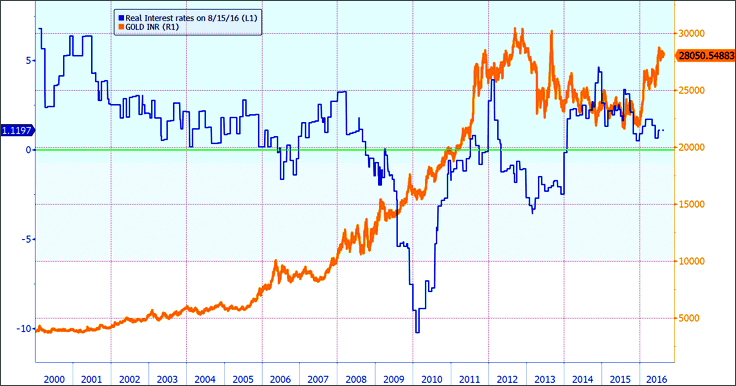

Whenever the real rates are positive, investors focus more on gaining financial assets, while negative real rates always draw investors’ focus towards physical assets (like real estate and gold) to protect their purchasing power. Indian investors have seen a positive real rate after several years of negative real rates barring a small uptick in 2011-12, as can be seen in the chart below:

Source: Bloomberg

Note: Gold prices in INR excludes import duty, levies and taxes

Real interest rates are calculated as a difference between SBI 1 year deposit rates and CPI Inflation

Past performance may or may not be sustained in the future.

The positive real rate is welcomed by investors and this is evidenced by heavy investments in equities, fixed deposits and mutual funds. According to Economic Times dated 11th August 2016 “Equity mutual fund schemes witnessed an inflow of over Rs.2,500 Crore in July, taking the total to nearly Rs.12,000 Crore in the ongoing financial year.”

Will this trend persist?

The simple answer to this question is that it will entirely depend on the real interest rates in the economy which will be guided by the monetary policy pursued by the RBI. As we know, the person responsible for waging war against inflation and instilling positive rates viz., Raghuram Rajan will not continue his stint as the RBI Governor. However, the new governor Urjit Patel can be considered to be his protégé and may continue on the same path. That said, If the inflation goes to the higher end (6%), it could reduce the real interest corridor from current 1.5–2% to a lower level, which may not motivate investors and thereby drive them back to physical assets. Given this possibility, we need to tighten our seatbelts for a gold rush in India in case there is anyway a compromise on positive real rates we see today. Experts believe that real rates and inflation could be sacrificed to make way for other important development and growth plans. This could in turn lead to an increase in gold demand in India. However, we need to keep the gold demand in check. If the demand rises over a threshold, then we may need to import more gold to that extent. This would imply more pressure on the current account deficit which in turn could hurt the value of the Rupee.

Volatile gold prices have dampened demand until now. To avoid a significant rise in demand and price of gold, it is imperative to maintain the current real rate. Otherwise, a gold rush is imminent.

* Source: World Gold Council’s report “In first quarter of 2016, gold demand in India was down 39 per cent to 116.5 tonnes compared to January-March period of 2015… ”

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Debt Monthly for March 2026

Posted On Monday, Mar 02, 2026

As FY26 draws to a close, India’s bond markets sit at the crossroads of macro stability

Read More -

Gold Monthly for March 2026

Posted On Monday, Mar 02, 2026

Gold entered February 2026 consolidating around $4,800, after a steep fall from its late-January peak of $5,598

Read More