Equity Monthly View for November 2024

Posted On Wednesday, Dec 04, 2024

| Index | Performance (November 2024) |

| BSE Sensex | 0.5% |

| BSE Midcap Index | 0.3% |

| BSE Small cap | 0.4% |

| S&P 500 | 5.8% |

| MSCI Emerging Markets Index | -3.5% |

| Sectoral Performance | |

| BSE Healthcare | -0.5% |

| BSE Auto | -1.1% |

| BSE Information Technology | 5.8% |

| BSE FMCG | -1.8% |

| BSE Bankex | 1.0% |

| BSE Capital Goods | 2.3% |

| BSE Metal | -1.7% |

Data source: Bloomberg

After 5.7% (BSE Sensex) decline in the month of October 2024, Indian markets stabilised with frontline indices such as Sensex registering growth of 0.5%. The pace of FII selling which was in the vicinity of USD 10.9bn in October has reduced in the month of November to USD 2.2bn. FII Selling was largely concentrated in large cap space and as a result mid/small cap indices fared better than large caps post the sell-off. Globally, S&P 500 and Dow Jones outperformed the BSE Sensex driven by US presidential election and hope of corporate tax cuts/strong dollar. MSCI EM Index declined by -3.5% driven by China.

A key event from market perspective was the US elections. While it’s too early to gauge the impact of Trump policies; it clearly will influence global trade and there could be few areas where India may benefit. Case in point is India IT services, who have borne the brunt of increased cost of doing business due to talent localisation in Trump previous tenure. Incrementally, higher earnings by US corporates because of the policies adopted including tax cuts may lead to higher technology spends and opportunities for Indian IT firms. The weaker rupee/stronger dollar is a solid tailwind to the IT sector as exports from India become lucrative.

Global manufacturing may see an accelerated move away from China if any extra tariffs are placed on imports from China into US. India may be one of the beneficiaries. Pharma sector could be a key beneficiary in diversion of trade from China, especially generic drug and active pharmaceutical ingredient (API) suppliers.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 0.89% in its NAV in the month of November 2024; Tier-I benchmark BSE 500 and Tier-II Benchmark BSE 200 increased by 0.06% and 0.11% respectively. Financial and IT Services and not owning expensive consumer staples also helped our performance. Auto and not owning industrials were drag on portfolio. During the month, we continued to add to financial space, mostly banks and insurance. Cash in the scheme at the end of month stood at 15.3%.

Source: Ace Equity

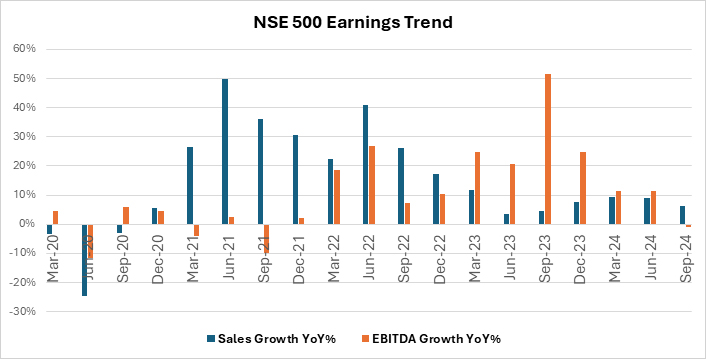

The recent earnings season witnessed steep earnings cuts in quite a few sectors. The key sectors which led the bulk of decline were in Energy, Cement, consumer discretionary and Insurance. The margin expansion witnessed last year, driven by lower input cost has clearly moderated and current EBITDA growth year-over-year is negative, highlighting margin concerns.

Large components within Energy sector reported poor earnings due to weak GRM (gross refining margins); infra focused themes are impacted due to lack of capex spends by government. Heightened competition coupled with slowdown in consumptions continues to put pressure on sectors such as paints/cement/fmcg. Going forward, we expect a gradual recovery in earnings as we progress through the year driven by cyclical recovery in many of these sectors.

Key updates w.r.t to some of portfolio companies/sectors in the month gone-by:

- For the lending companies, there has been an uptick in slippages and some of the companies have increased provision towards the same, resulting in lower profitability. Weak asset quality is primarily concentrated in MFI (Micro-finance) and segments within unsecured such as certain categories of personal loans and credit cards. Clearly for larger private banks, segments such as MFI, credit card and personal are small as % of total advances. And the quality of books written by the large banks remains superior compared to other players. With normalizing credit costs, we expect differentiation between banks with better underwriting to be more evident.

- In one of our portfolio companies in utility space there was a development wherein APM Administered Pricing Mechanism) gas allocation to the industry was reduced, impacting profitability. While this is a hit to profitability, incrementally we expect most of these players to gradually start increasing the pricing to end consumers. Even with reduced APM gas supply the blended pricing to end consumer remain attractive vs competing fuel.

In our view, valuation despite the market correction in the past two months remains elevated. Thus, we are cautiously deploying the cash in the fund. The key near term risks to watch out for are slowing domestic economy (which should pick up in the second half post certain policy intervention) and factors such as weaker global macros and geopolitical tension across the middle east. Thus, investors should maintain the right asset allocation at all points in time and prudently invest towards equity.

Source: Bloomberg, Ace Equity

|

Name of the Scheme | This product is suitable for investors who are seeking* | Scheme Riskometer | Benchmark Riskometer (Tier I) - BSE 500 TRI & (Tier II) - BSE 200 TRI |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More