Debt monthly view for November 2021

Posted On Thursday, Dec 09, 2021

After two successive months of hardening, bond yields cooled off in November. The 10-year benchmark government bond yield came down by 6 basis points during the month to close at 6.33%. Yields on other maturities both at the short and long end of the yield curve witnessed a larger fall of 10-15 basis points.

Much of this rally in the bond market in the last month can be attributed to the steep fall in crude oil price from its 3-year peak. A group of large oil consumers, including the US, China, India, South Korea, Japan and Britain, decided to use their strategic oil reserves instead of importing crude oil to cool off the prices. Following the announcement, the Brent crude oil price fell to ~USD 80/barrel vs USD 84.4/barrel at the start of the month.

It fell further by the month-end as a new highly mutated variant of coronavirus (Omicron) started spreading in various parts of the world. Although health agencies are still studying the new virus to determine its characteristics, fear of renewed travel restrictions and potential dampening of economic momentum due to the virus led to further drop in global oil prices which dipped to USD 71/barrel by the November end and is currently trading near USD 75/ barrel (price as of December 8, 2021).

In the bi-monthly monetary policy review announced on December 8, 2021, the monetary policy committee of the RBI kept the policy rates unchanged and maintained the ‘accommodative’ stance, reassuring its support to growth revival. On inflation, the usual risks have been noted in the statement but contrary to the market and our expectations, the CPI forecast has been lowered.

A fall in crude oil prices and a reduction in tax on petrol and diesel should lower the fuel and transportation inflation in the coming months. However, the overall inflation dynamics have worsened over the last few months.

A sharp unseasonal jump in vegetable prices and over 20% increase in telecom tariffs will more than offset the impact of tax cut on petrol and diesel. Corporates are also facing increased cost pressures and raising prices across all kinds of goods.

The headline CPI inflation stood at 4.48% in October 2021. Based on the recent increase in prices of various goods and services, CPI is expected to jump past the RBI’s 6% upper limit by early next year and is likely to sustain close to the 6% mark for most part of 2022.

We also believe that the Indian economy is recovering much better than expected and is showing signs of continued revival. This means that RBI should remove crisis level measures going forward by lowering the level of excess liquidity in the banking system and raising the repo and reverse repo rates (rates at which banks borrow from and lend to the RBI).

Despite its reluctance to act on the policy rates, the RBI did continue with the normalisation of liquidity operations. It announced to further expand the quantum of liquidity absorption under the 14 days variable rate reverse repo (VRRR) facility for which interest rates are determined by the market forces. This will be done in two tranches from the current Rs. 6 trillion to Rs. 7.5 trillion by December 31, 2021.

Consequently, from January 2022 onwards, liquidity absorption will be undertaken mainly through the auction route.

The RBI is already absorbing the bulk of surplus banking system liquidity via VRRR, where the cut-offs are closer to the repo rate of 4% than the overnight fixed reverse repo rate of 3.35%. Further expansion in this facility, will push the weighted average rate on excess liquidity higher towards the repo rate. Accordingly, the interest rate on short term debt instruments (up to 2 years maturity) should also move higher.

This would mean that accrual returns on very short term, low market risk products like overnight and liquid funds may rise in the coming months.

As, the RBI hikes rates , short term debt investors may prefer playing this rate hiking cycle by investing in liquid funds over keeping the money in bank savings accounts.

Investors should also avoid locking in their money for now in longer tenor fixed deposits.

Although the macro backdrop is unfavourable (high inflation, rising interest rate), valuations at 2-5 years part of the G-sec yield curve looks comfortable. In our opinion, this segment is already pricing much of the liquidity normalisation (lowering of liquidity surplus) and a start of the rate hiking cycle by early next year.

Given the steep bond yield curve, 2-5 years bonds also offer the best roll down potential and thus a reasonable margin of safety from rising bond yields. For instance, currently, the yield on the 5 years government bond is at 5.71% and that on the 4 years bond is at 5.35%. After one year, the current 5-year bond will have a residual maturity of 4 years. Assuming no change in market interest rates, the yield on the current 5-year bond should rolldown by 36 basis points to 5.35% in one year period.

The bulk of our holding in the Quantum Dynamic Bond Fund is in the 2-5 years maturity segment.

We recognize that the monetary policy is in a transition phase in India and across the world. If history is any guide, these transitions from easing to tightening monetary policy tend to become chaotic with a lot of sentimental market movements on both sides. Thus, we should be prepared for increased volatility in the bond market over the next few months. With this view, we have created some cash in the Quantum Dynamic Bond Fund portfolio to lower the impact of any adverse market movements.

We are closely monitoring the developments around the new Covid-19 variant and its impact on the monetary and fiscal policies. We stand vigilant to react and change the portfolio positioning in case our view on the market changes.

From investors’ perspective, we believe a combination of liquid to money market funds to benefit from the increase in interest rates in the coming months; along with an allocation to short term debt funds and/or dynamic bond funds with low credit risks should remain as the core fixed income allocation.

We believe bond fund investors should have a longer holding period to ride through any intermittent turbulence in the market.

Source: Worldometer.info

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

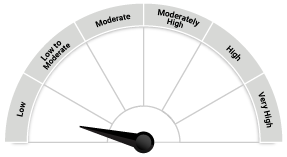

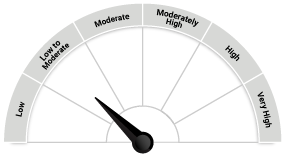

| Quantum Liquid Fund (An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

| Quantum Dynamic Bond Fund (An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More -

Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

September was a pivotal month for fixed income markets, both globally and domestically.

Read More