Debt monthly view for April 2022

Posted On Monday, May 09, 2022

May 09, 2022

The bond market is having a turbulent year 2022 so far. It faced back-to-back shocks from hawkish central banks’ commentaries around the world, the geo-political conflict between Russia and Ukraine, a spike in crude oil prices, global food shortages and price spike, and further breakdown of global supply chains.

In India, Monetary Policy made a complete U-turn from ultra-dovish in February to a surprise rate hike in May. The RBI surprised the market with an off-schedule 40 basis points hike in the policy Repo rate (Rate at which banks borrow from the RBI.). The Repo rate now stands at 4.40%. It also raised the Cash Reserve Ratio (CRR - portion of deposits banks have to keep with the RBI as reserves) by 50 basis points from 4.00% to 4.50%.

Together with the introduction of the Standing Deposit Facility (SDF) in April 2022 policy at a rate of 25 bps below the repo rate, the floor policy rate has increased by cumulative 80 basis points. Currently, the SDF rate stands at 4.15% vs the floor policy rate – reverse repo rate of 3.35% before the April Monetary Policy.

There is a sense of urgency within the RBI to unwind the ultra-easy monetary policy of low rates and high surplus liquidity, quickly. There is also a realization that the RBI will not be hesitant to use ‘surprise’ as a policy tool.

Clearly, the RBI has joined other global central banks in the war against inflation. We expect that the RBI would frontload the rate hikes with another 75-100 basis points hike by the year-end.

The next question is - how far will the RBI go?

The rate hiking cycle has just begun. It’s too early to frame any clear view about the total quantum of rate hikes or the terminal policy rate.

However, there are evidence suggesting that the rate tightening cycle may not be too long this time (refer Investing In The New Normal).

Much of the inflation we see is the result of supply chain bottlenecks. While demand condition is still poor due to high unemployment and income losses.

With the economy running below potential, the RBI may not be able to hike too much. We expect the terminal repo rate (peak rate) in this hike cycle to be below 6%.

On the policy rates, RBI’s actions are somewhat in line with their commentary on the April monetary policy. While the hike in cash reserve ratio (CRR) is a little confusing given the RBI’s earlier guidance of gradual withdrawal of liquidity over a multi-year time frame.

CRR hike of 50 basis points will take away around Rs. 870 billion of excess liquidity in one shot. Apparently, RBI is not comfortable with the current level of excess liquidity persisting for very long.

In his statement governor said – “Liquidity conditions need to be modulated in line with the policy action and stance to ensure their full and efficient transmission to the rest of the economy.”

This implies that the RBI will continue to reduce the surplus liquidity along with the rate hikes to ensure the transmission of higher rates into the economy. However, overall liquidity may remain in surplus to support the credit offtake and economic growth momentum.

The Governor said – “the RBI will ensure adequate liquidity in the system to meet the productive requirements of the economy in support of credit offtake and growth.”

As on May 9, 2022, the surplus liquidity parked under the RBI’s variable rate reverse repo (VRRR) and SDF windows is around Rs. 6 trillion (3.5% of NDTL).

As the RBI Report on Currency and Finance for the year 2021-22, when surplus liquidity persists at above 1.5% of NDTL, for every percentage point increase in surplus liquidity, the average inflation could rise by about 60 basis points in a year.

So, in an inflationary environment, the RBI would bring down the liquidity surplus to below 1.5% of NDTL. Based on the current Net Demand and Time Liabilities of the banking system the upper threshold on surplus liquidity would be around Rs. 2.5 trillion.

Thus, we should expect further liquidity absorption to the tune of Rs. 3.5 trillion over the coming months. We would not be surprised if the RBI hikes the CRR by another 50 basis points in the June meeting. We should also consider the possibility of bond and/or foreign exchange sales to drain out liquidity.

Currently, the 10-year government bond is trading at a yield of 7.47% while the 5-year bond is trading at 7.27%. Most of the medium to long-duration bonds are trading at a yield higher than their pre-pandemic levels when the repo rate was at 5.15%. At current yield levels, much of the rate hike is already priced in the medium to long-duration bonds.

Instead, what we worry about are the severe demand-supply gap, geopolitical uncertainty and its impact on global supply chains and commodity prices, and the pace of rate hikes and balance sheet reduction by the US Federal Reserve.

We reiterate that the path forward for bonds is filled with uncertainties. Things are still evolving on the geopolitical front and the unwinding of ultra-easy monetary policy has just started. So, there will be surprises, there will be miscommunications and there will be market overreactions.

In the Quantum Dynamic Bond Fund, we have been avoiding long-term bonds for some time due to our cautious stance on the markets. After the steep sell-off in the last two months, valuations have become attractive on medium to long-term bonds. However, given the high uncertainty as mentioned above, we will continue to be cautious in adding into long-duration bonds as a core portfolio position.

We would remain open and nimble to exploit any market mispricing by making a measured tactical allocation to any part of the bond yield curve as and when the opportunity arises.

We stand vigilant to react and change the portfolio positioning in case our view on the market changes.

In an environment of high uncertainty, it would be prudent for investors to avoid excessive credit and interest rate risk.

In our opinion, a combination of liquid to money market funds and short-term debt funds, and/or dynamic bond funds with low credit risks should remain as the core fixed income allocation.

After more than a 100 bps sell-off in the bond market over the last year, the return potential of debt funds has improved significantly. However, it would not be a smooth ride as markets will continue to have bouts of volatility.

We suggest bond fund investors have a longer holding period to ride through any intermittent turbulence in the market.

Source: Worldometer.info

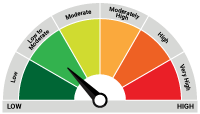

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on April 30, 2022.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for July 2025

Posted On Monday, Jul 07, 2025

Flashpoint Middle East: War, Oil, and the Strait of Hormuz Risk: In June 2025, the Israel-Iran conflict erupted into full-scale war, sparking widespread geopolitical instability.

Read More -

Debt Monthly for June 2025

Posted On Tuesday, Jun 10, 2025

United States: U.S. Treasury yields rose sharply, with the 10-year crossing 4.59% due to hawkish Fed signals and fiscal concerns.

Read More -

10 Years of QDBF – Navigating Debt Markets with Consistency and Caution

Posted On Monday, May 26, 2025

This May, as the Quantum Dynamic Bond Fund (QDBF) completed 10 years on May 19, 2015, we’re not just celebrating a milestone—we’re celebrating a decade of trust, discipline, and resilience.

Read More