It May Be time to Revisit Your Asset Allocation - Here's Why

Posted On Tuesday, Oct 19, 2021

After a sharp fall early last year, Equity markets have posted a significant 17-month bull run and continue to rally. This might encourage two primary schools of thought: FOMO (Fear of Missing Out) and FOLO (Fear of Losing Out).

Here’s what an investor driven by these emotions would probably tell you

FOMO: “Don’t miss out on investing in these top-performing mutual funds of 2021!”

“This ABC asset or sector is the top-performing now!”

FOLO: “The valuations look too pricey! Better to book profits now!”

“Markets are merely driven by liquidity! Wiser to move out now!”

So what is the honest truth?

✔ The top-performing funds of today may not be among the top tomorrow

✔ There is no winning Asset Class. Assets are cyclical.

✔ Valuations might look expensive compared to historical averages but are backed by economic activity upsurge, FPIs & retail investor capital inflows and corporate earnings.

Listening to the so-called “advice” of your friends and peers can put your wealth creation journey out of gear. It is critical to make decisions rationally and not let these emotional biases get in the way of our mutual fund investments.

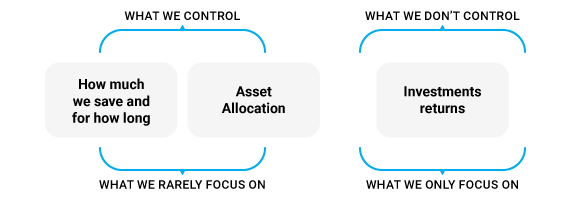

Generally, we focus on things beyond our control (Market Risk & Investment Returns) while we rarely focus on factors we can control. What you need is a well-crafted Asset Allocation Strategy to free you from timing the market and help you override emotions.

Arvind Chari, CIO, Quantum Advisors says, “Having an investment asset allocation plan can free your ‘mind and time’ to focus on other important things in life. I believe this is the biggest benefit of creating an investment and asset allocation plan. Having a suitable asset allocation plan & to follow it in a disciplined way is also important to achieve your financial goals. Many times investors understand the importance of asset allocation, but struggle to stick to the plan.”

As you may be aware, Quantum Mutual Fund has pioneered the low-cost, no-entry load, direct investing model. So while you have already taken the crucial first step by being a valuable investor with us, balancing your portfolio could go miles ahead in achieving your financial goals while minimizing risks.

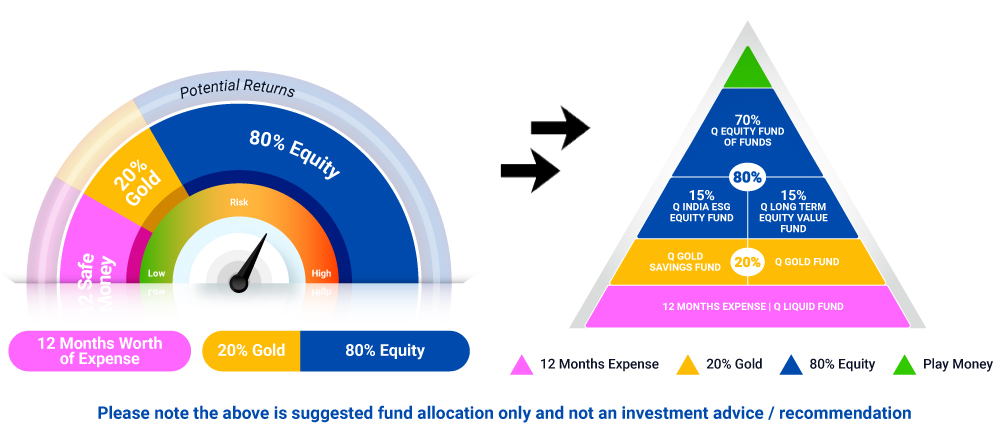

Relook at your portfolio and assess whether you are underweight in equities or need to further diversify with the risk-reducing characteristics of Gold. Rebalance your portfolio with our 12-80-20 DIY Asset Allocation Strategy.

What is our 12-80-20 Asset Allocation Strategy?

We stand committed to our resolve to simplify investing for you. 12-80-20 is a simple asset allocation tried and tested strategy that you can follow to help you reach your financial goals and reduce the risk of downside.

12 – The Safe Money

Before an investor starts investing in the equity markets, they have to set aside emergency money that can help them tide over unforeseen expenses and ward off debts. As a general guideline, you need to have enough money to keep up with your consumption pattern for 12 months. To maintain your emergency fund, you can use the Quantum Liquid Fund, an open-ended liquid fund that invests in government securities, certificate of deposit, commercial paper, treasury bills and AAA/A1+ rated PSU debt securities.

Quantum Liquid Fund – Salient Features

| Works on the 'SLR' principle, prioritizing safety and liquidity over returns. | ||

| Insta-redemption facility upto Rs.50,000 that allows you to redeem your investment immediately. | ||

| Does NOT invest in Private Papers / Corporate Instruments |

80-20 Equity-Gold Allocation

After setting aside an emergency corpus, consider to invest 80% of your portfolio in a diversified equity portfolio that has the potential to help you reach your financial goals over the long term. You can additionally capitalize on Gold’s risk-reducing and portfolio diversifying characteristics and consider to allocate the remaining 20% of your portfolio to Gold.

Quantum offers an easy 70-15-15 model to diversify your equity bucket. According to this strategy, you can build a portfolio that is free from any style bias or sector / theme concentration. Each equity investment within this portfolio adds a unique value to your portfolio.

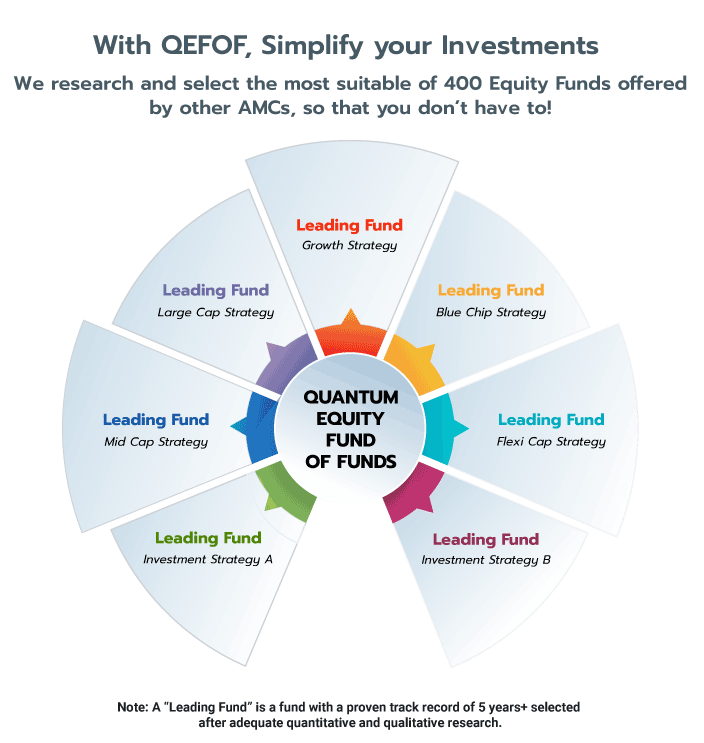

i) 70 % to Quantum Equity Fund of Funds (QEFOF)

Given the wide array of equity mutual funds (350+) available in the market, building your equity allocation and achieving optimum diversification can get confusing and cumbersome. There may be inconsistency in the performance of equity funds. Rankings are transitory. The top ranked mutual funds of today may not be among the top tomorrow. It’s better to focus on funds that have long term consistency, processes that work and other risk safeguards to ensure you achieve risk-adjusted returns to meet long term goals. This is where QEFOF can come to your rescue. This Fund is currently comprises 9 carefully selected equity mutual funds of other schemes with a proven track record. This fund offers you the opportunity to rebalance your equity portfolio adequately using the best large & mid-cap schemes with a 5-year track record selected by the research team.

True to the Quantum philosophy of doing what's best for investors and avoiding conflict of interest, QEFOF will never invest in the schemes of Quantum Mutual Fund. You can find comfort in our low expense ratio giving you value for your money. In addition, over the long term duration of 3 years or more, this fund is taxed as a debt fund which is 20% with indexation. This translates to a better post-tax return than a conventional equity mutual fund.

Quantum Equity Fund of Funds – Salient Features

| Benefit of indexation for long-term investment | ||

| Ease of tracking just one folio and one NAV | ||

| Robust qualitative and quantitative research | ||

| Underlying investment is in Funds with performance across market cycles | ||

| Periodical review meetings of chosen funds |

The higher weightage gives your portfolio a mix of the different equity funds with underlying varying investment styles and market capitalization, thereby securing your portfolio across different market cycles. Over a longer duration of 7-10 years, this fund offers potential for better risk-adjusted performance.

ii. 15% to Quantum India ESG Equity Fund (QESG)

Invest responsibly in the Quantum India ESG Equity Fund that offers you an opportunity to combine returns with purpose. Historical trends show that a business with good ESG practices has the potential to deliver good risk-adjusted returns. This is because responsibility and profitability are complementary.

QESG invests in sustainable businesses that are leaders in their industry when it comes to caring about their people, the planet, and their company's purpose and mission reflect that distinctly. This fund goes beyond desk research to give you 360-degree researched portfolio following the ESG principles true to label. Governance sits at the heart of our assessment and coupled with Environmental & Social factors, our ESG framework evaluates over 200 parameters.

Quantum India ESG Equity Fund – Salient Features

| Value & sector agnostic diversified portfolio | ||

| One of the first ESG fund launched in India and offering a proven track record to minimize downsides | ||

| Does not rely on third party research, uses in-house comprehensive & robust proprietary framework | ||

| Potential to protect returns in down markets |

iii. 15% to Quantum Long Term Equity Value Fund

Quantum’s flagship fund, Quantum Long Term Equity Value Fund (QLTEVF), was the first of its kind torchbearer, value-based direct-to-investor mutual fund scheme established in 2006.

While a major portfolio of your portfolio could be growth oriented, to avoid style bias, you can invest 15% of your portfolio in Quantum Long Term Equity Value Fund (QLTEVF). This will help your equity portfolio to potentially earn long-term risk adjusted returns during times of uncertainty. Limiting downside risk is the base for QLTEVF to make equity investing stress-free. The QLTEVF Fund Managers truly believe that ignoring short-term market movements and waiting patiently for value to emerge has allowed us to generate consistent returns over the long term.

The portfolio invests in companies with minimum liquidity criteria. It uses a bottom-up stock selection process to build a portfolio of companies that are market leaders in their respective domains. The companies are stress-tested for balance sheet strength and makes scheme portfolio resilient during down cycles and macro uncertainty.

While you cannot predict the future, you can invest in a sensibly valued portfolio that minimizes downside risks.

Quantum Long Term Equity Value Fund – Salient Features

| 15 year track record following the Value style of investing | ||

| Long term believer of India's growth story | ||

| Bottom up stock selection comprising of stocks tuned to grow with market recovery | ||

| Potential to limit downside risks |

iv: 20% to Quantum Gold Fund ETF or Quantum Gold Savings Fund

Gold continues to be a preferred portfolio asset diversifier. So far in this pandemic crisis, gold has played an important role as a source of liquidity and limited downside risk for all who diversified using the strategic asset of Gold during the Covid-19 triggered equity markets crash in Mar 2020. Quantum Gold Fund ETFs track the domestic price of Gold and is backed by physical gold, offering investors an innovative and cost-efficient way to invest in gold. You can simply allocate up to 20% to gold in your portfolio using Quantum Gold Fund ETF or start an SIP as low as Rs. 500 with Quantum Gold Savings Fund.

Quantum Gold Funds – Salient Features

| Ease of investing in Quantum Gold Fund (ETF) through a DEMAT account | ||

| Backed by pure gold of 99.5% finesse sourced from LBMA accredited refiner | ||

| All gold bars held by the fund go through an independent purity test | ||

| Option to invest in Quantum Gold Savings Fund through an SIP (Systematic Investment Plan) of as low as Rs. 500 |

To summarize, when you combine the assets, you get the potential for risk-adjusted returns over the long term and the risk can be substantially lower.

Need a Readymade Solution?

If you wish to invest in multiple mutual fund schemes and do not have the bandwidth to track multiple funds in DIY asset allocation, consider investing in the Multi Asset Fund of Funds (QMAFoF) that incorporates the proven 12-80-20 Asset Allocation Strategy.

Our fund manager has the flexibility to follow a regular rebalancing approach within each asset class of equity, debt and gold, thereby giving you the potential to generate risk-adjusted returns through diversification of investments.

Quantum Multi Asset Fund of Funds – Salient Features

| One fund, three Asset Classes of Equity, Debt & Gold | ||

| Better post-tax returns for long-term investments | ||

| Potential to earn real returns to help you cope better with inflation | ||

| Regular rebalancing within assets to offer risk-adjusted returns |

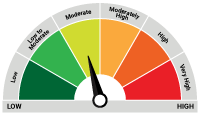

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold. |  Investors understand that their principal will be at Moderate Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Nov 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More