Investing In The ‘New Normal’

Posted On Friday, Aug 20, 2021

There has been a lot of debate about the dramatic re-emergence of inflation and its impact on monetary policy. Economists, market experts, media commentators, and even policymakers are divided about the sustainability of the current elevated inflation trend. Yet, central bankers across developed and developing economies have termed it as a ‘transitory’ phenomenon.

This gives them flexibility to be more tolerant of inflation and continue with the historically low policy rates and abundant liquidity policy. This can be seen in the following statement by the RBI governor Shaktikanta Das, made during the monetary policy announcement on August 6, 2021:

“The recent inflationary pressures are evoking concerns; but the current assessment is that these pressures are transitory and largely driven by adverse supply side factors... At this stage, continued policy support from all sides – fiscal, monetary and sectoral – is required to nurture the nascent and hesitant recovery”.

And the Normalization Begins

Although the Monetary Policy Committee (MPC) maintained status quo on policy rates, the split in the MPC voting in the August 2021 meeting from 6-0 to 5-1 on keeping policy stance ‘accommodative’ and the announcement to increase the quantum of Variable Rate Reverse Repo (VRRR) auctions suggests that thinking within the RBI on normalizing monetary policy has begun.

Over the next six months, we would expect RBI to reduce the excess liquidity in the banking system. We would expect an increase in the reverse repo rate from 3.35% to 3.75%, a subtle move away from the accommodative stance to neutral and then to a gradual beginning of rate hikes.

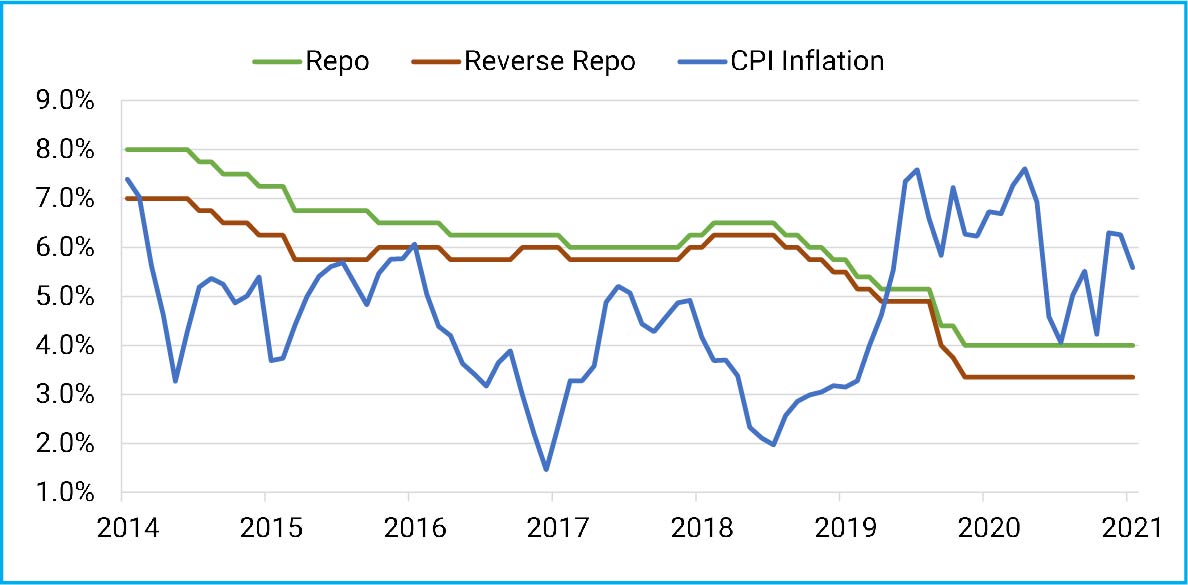

Chart – I: Policy Rates set to move higher

Source: CMIE, Quantum Research | Data up to July 2021

This sequence of monetary policy normalisation is now almost consensus. Certain segments of the bond markets have already priced in some of the near-term impacts of these forthcoming actions. However, performance of the fixed income assets over the next 2-3 years will be determined by the extent of policy normalisation and its impact on interest rates over the long term. This takes us to another pertinent question - What will be the new normal for interest rates?

The New Normal

In a recent article, Arvind Chari (CIO, Quantum Advisors) shared his perspective on what would be the new normal for interest rates in post-pandemic India. He argued that the RBI will be slow to act and try to indicate to the markets that a policy rate of 5.0% in itself may be the ‘new normal’. (https://www.qasl.com/post/the-post-pandemic-new-normal-for-rates-in-india)

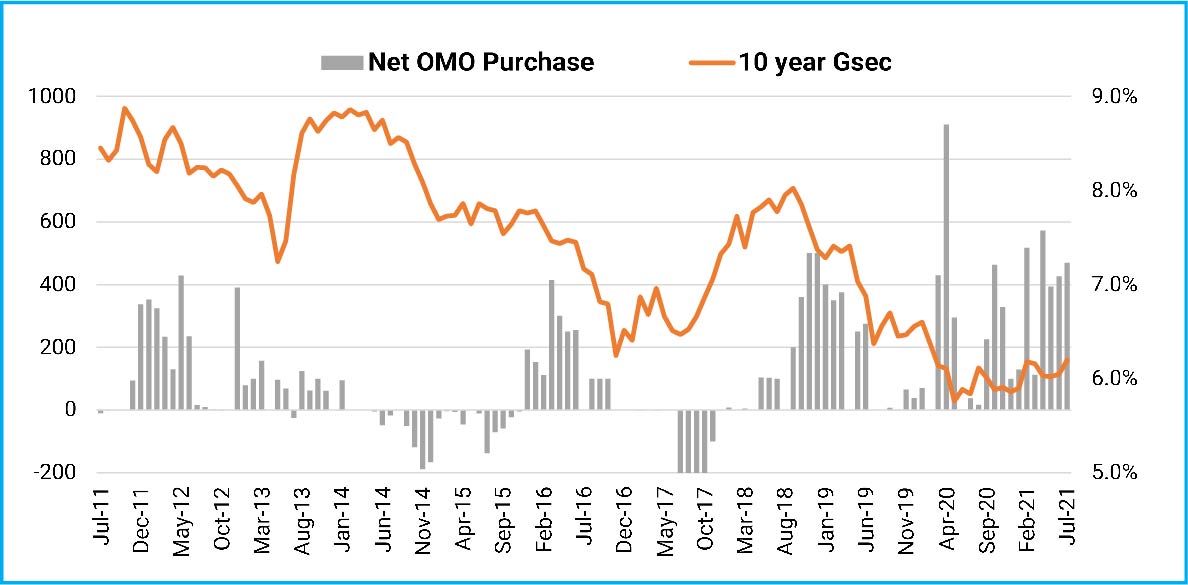

Furthermore, RBI governor Das’s characterisation of the yield curve as a ‘public good’ suggests that even when policy rates eventually rise, the RBI will continue its market interventions and keep firm control on government bond yields.

Chart – II: OMOs to control bond yields

Source: RBI, Bloomberg | Data Upto July 2021

OMO= open market operations - Government bond purchases by RBI

As we look out over the next year, we do see interest rates moving higher. Reduction in surplus liquidity and hike in policy rates should push the short-end bond yields significantly higher than where they are today.

However, if indeed, the Repo rate gets held at 5%, interest rates will settle much lower than their long-term historical average. This will have significant implication for returns from fixed income instruments over the medium to long term. Investors should adjust their expectation to the new reality that interest rate on fixed deposits and returns on debt mutual funds will be lower than what they used to be.

Looking Beyond Macros

From the bond market's perspective, it is time to look beyond the current macro developments and potential policy changes. The Yield curve is currently steepest since the aftermath of the global financial crisis.

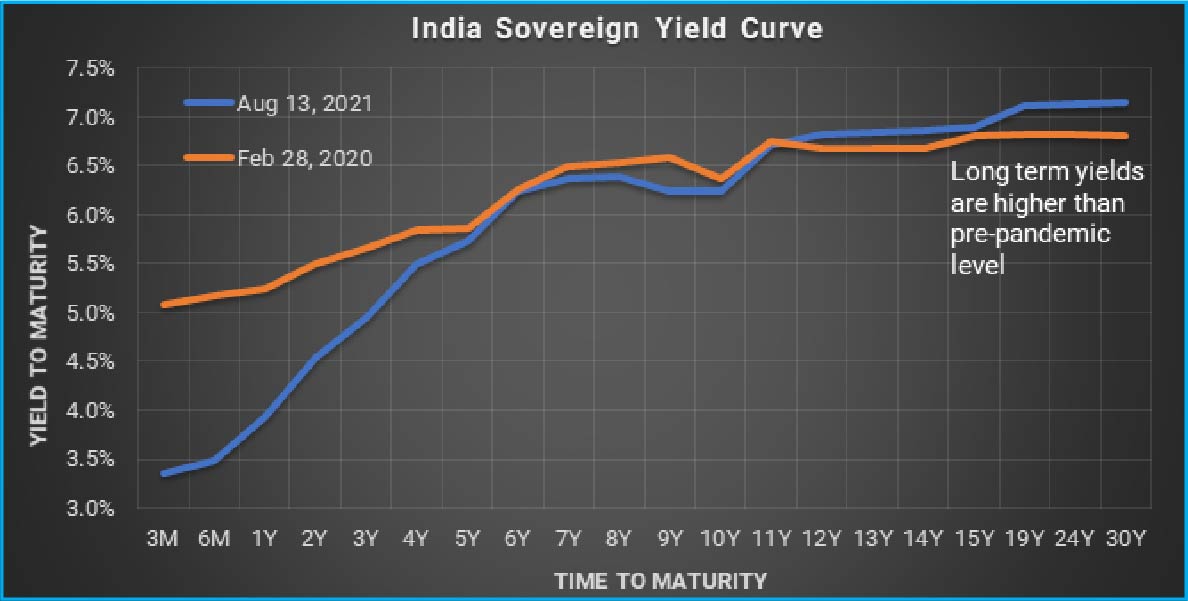

Chart – III: India Sovereign Yield Curve is steepest in a decade

Source: Refinitiv, Quantum Research

This means there is very low yield/accrual at the short end of the yield curve while the longer end is still offering a fairly high yield in the current low-rate environment.

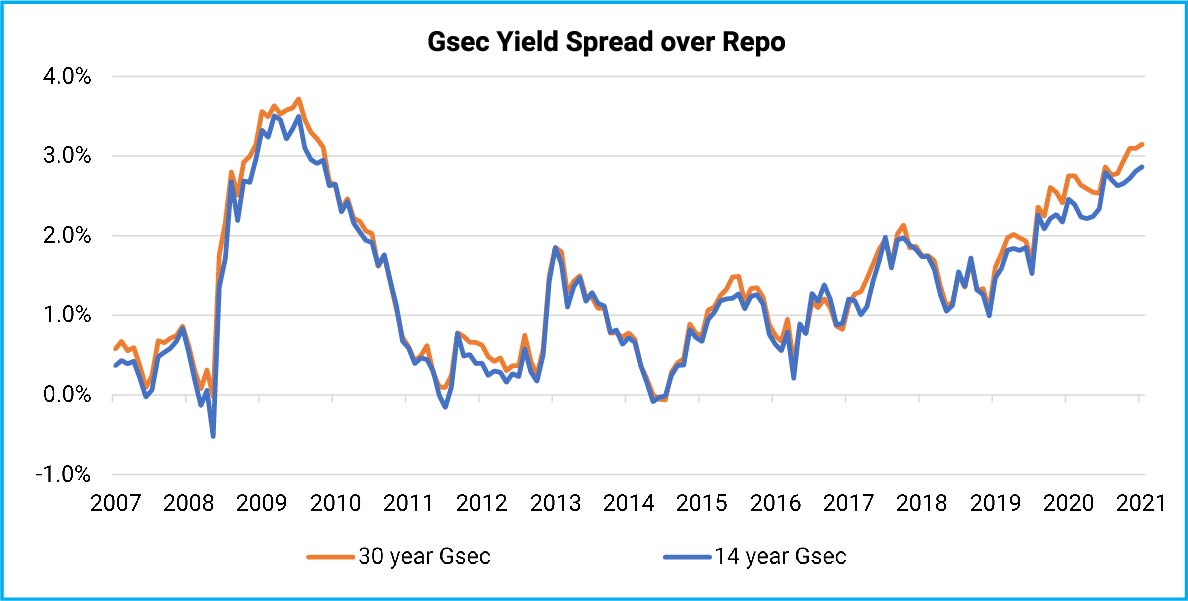

For instance, the 30-year government bond is currently trading at ~7.2%. It implies a yield spread of +320 basis points over the current Repo rate of 4% and +220 basis points over a ‘prospective’ Repo rate of 5%, which may possibly be attained by the end of next year. Even the 15 year government bond is currently trading at ~6.9% would be at a much higher spread over the ‘new normal’ policy rate than its long-term average.

Chart – IV: Term Spreads are at decade high

Source: Refinitiv, Quantum Research | Data up to August 13, 2021

On the surface, this looks like a great investment opportunity. However, excessive allocation to long-term bonds will expose investors to high market risk in a rising rate environment and could result in a considerable loss in portfolio value if things go the other way. Thus, it is critical to have a balanced and dynamic approach in building a fixed income portfolio.

Balanced and Dynamic Allocation.

Given the above market view and need for balanced risk exposure, Quantum Dynamic Bond Fund (QDBF) is currently positioned as a barbell. Under this strategy, a part of the portfolio is invested in 25-30 year bonds; while a large portion is invested in very short term (below 2 year maturity) bonds. The portfolio is also maintaining a larger than usual cash buffer at this point to exploit any market mispricing emerging out of changing policy direction.

In our opinion, the longer term bonds are attractively priced and have potential to gain over the medium to long term. Exposure to short-term bonds is a balancing position to lower the overall portfolio duration or sensitivity to interest rate changes. We have tried to avoid the intermediate maturity segment, which in our opinion is highly sensitive to change in policy direction and likely to be a poor performer in the next 6-12 months.

“Uncertainty is the only certainty about future”

We understand that the economy and markets are currently adjusting to an unprecedented shock. There are too many moving parts and things are still evolving. Thus, any forecast about the future is susceptible to change based on policy responses from the government and the RBI and the changes in global markets.

We stand vigilant to review our outlook as and when new information comes. We retain our right to remain dynamic in our portfolio construction to respond to the evolving economic and market conditions.

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- The Inflation Tantrum

- The Bond Shakeout

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on July 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More