Everything you need to know about Liquid Funds

Posted On Friday, Dec 31, 2021

| Table of Contents | |

| Sr no | Header |

1 | What are Liquid Funds? |

2 | Liquid Funds v/s Money Market Funds |

3 | Liquid Funds Cut Off Time |

4 | Liquid Funds Exit Load |

Have you ever been in a situation where you need cash in an emergency?

Well, we have all been there...

Emergencies can come out of nowhere and liquidity is the main concern in such times.

In such cases, or basically for any liquidity need that may come your way, Liquid funds can come to the rescue.

Liquid funds do not come with a lock-in period, but they do have an exit load for the first seven days and no exit loads if redeemed after seven days

A member of the Debt funds family, Liquid funds invest in debt and money market instruments up to 91 day’s maturity & generally considered to have relatively low interest rate risk. These include instruments like commercial paper, treasury bills, certificate of deposit, etc. These are the types of underlying securities in liquid funds.

The next logical question that an informed investor might have could be, how are liquid funds different than money market funds?

Liquid Funds vs. money market funds

As an investor, it is always beneficial to compare and understand how things work in different types of investments.

Hence, one must know about liquid funds vs. money market funds.

Here is a basic comparison for liquid funds vs. money market funds:

| Sr No | Liquid Funds | Money Market Funds |

|---|---|---|

| 1 | Invests in debt and money market instruments with maturity of upto 91 days only | Investment in Money Market instruments having maturity upto 1 year |

| 3 | Invest in instruments having Maturity up to 91 Days | Invest in instruments having Maturity up to 1 year |

It’s now time to move to the next very important aspect to look at when investing in liquid funds.

Liquid Funds Taxation:

Liquid Funds also attract taxation as they give returns to investors in the form of IDCW and capital gains.

Capital gains include the profits when redeeming units at a price that was higher than what he/she purchased the units in are very much taxable. So, liquid funds taxation is divided in the two following categories.

• Short-Term Capital Gains Tax:

When the holding period of the investment you make in Liquid funds is less than 3 years, it attracts short-term capital gains. Short-Term Capital Gains or STCG are added to your overall income and then taxed at the applicable income tax slab rate,

• Long-Term Capital Gains Tax:

When the holding period of your investment in liquid funds is more than 3 years, then the gains coming from such investment is considered long term capital gain and it attracts long-term capital gain tax. Here you get the benefit of "indexation", which simply means that the purchase price is increased to adjust for inflation, using a government provided index before calculating the capital gain.

These long-term capital gains are taxed at a rate of 20%, after indexation.

That was all you should know about Liquid Funds Taxation.

Now that you know about that, you should also know about the Liquid Funds Cut-off time.

Liquid Funds Cut Off Time:

There is a misconception in some investors about the Liquid Funds Cut-Off Time.

It is not to limit or restrict your buying or selling of units. The Liquid Funds Cut Off Time determines what NAV will be applicable for your buy or sell transactions.

In simple words, what NAV will be applicable to your Buy/Sell requests, depends on what time the fund house receives the application and for redemption or money for buying more units.

Here is a glimpse of the Liquid Funds Cut Off Time

| Scheme | Type of Transaction |

|---|---|

Liquid Funds | 1. Purchases / Switch-ins: A. In respect of valid application received upto 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription/ purchase (including switch in) as per the application are credited to the bank account of the Scheme and are available for utilization before the cut-off time ( 1.30 p.m.) - the Closing NAV of the day immediately preceding the day of receipt of application; B. In respect of valid application received after 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription / purchase (including switch in) as per the application are credited to the bank account of the Scheme on the same day or before the cut-off time of the next business day i.e. funds are available for utilization before the cut-off time (1.30 p.m.) of the next Business Day, the closing NAV of the day immediately preceding the next Business Days ; and C. However irrespective of the time of receipt of application at the official point(s) of acceptance, where the funds for the entire amount of subscription/ purchase (including switch in) as per the application are credited to the bank account of the Scheme on or before the cut-off time of the subsequent Business day i.e. the funds are available for utilisation before the cut-off time of the subsequent Business day, the closing NAV of the such subsequent Business Day shall be applicable. It may be noted that in case of Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Transfer of Income Distribution Cum Capital Withdrawal Facility, the units will be allotted based on the funds available for utilization by the respective schemes / target schemes irrespective of the installment date of the SIP, STP or record date of Income Distribution. Further, if the time of realization of funds can't be ascertained then the allotment of units will be as per the day and date of realization of amount of subscription. It may also be noted that allotment of units in the normal course will be based on realization of amount of subscription or the date of receipt of application or the date of instalment (in case of SIP) whichever is later if both realization and application dates are different. Redemptions/Switch-outs: • In respect of valid applications received up to 3 p.m. on a Business Day - the closing NAV of the day of receipt of application, shall be applicable. • In respect of valid applications received after 3 p.m. on a Business Day - the closing NAV of the next Business Day shall be applicable. Instant Redemption (Access) Facility(a) Where the application is received up to 3.00 pm – the lower of (i) NAV of previous Calendar Day and (ii) NAV of Calendar Day on which application is received will be considered; (b) Where the application is received after 3.00 pm – the lower of (i) NAV of the Calendar Day on which such application is received, and (ii) NAV of the next Calendar Day will be considered |

That was all about the Liquid Funds Cut Off Time.

Let’s move on to another important aspect anyone investing in Liquid Funds must know.

Liquid Funds Exit Load:

Liquid Funds exit load is the fee that an AMC or Asset Management Company charges to its investors, when they are redeeming or exiting their unit.

Do not confuse the Liquid Funds exit load with the expense ratio. They are both different.

Here are the graded Liquid Funds Exit Load numbers as decided by SEBI:

| Investor Exit Day | Exit load as a % of the redemption |

|---|---|

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

If you want to start investing in a liquid fund, we can help you with a good option

Quantum Liquid Fund

Quantum Liquid Fund invests majorly in money market instruments, Government Securities and Treasury Bills, issued by Public Sector Undertakings.

It is an open-ended liquid scheme, suitable for investors who are looking for income over the short term or ones looking to invest in debt/money market instruments.

Here is a glimpse of the performance for the fund:

| Performance of the Scheme | Direct Plan | |||||

| Quantum Liquid Fund - Direct Plan - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (07th Apr 2006) | 6.89% | 7.00% | 6.21% | 28,382 | 28,865 | 25,700 |

| Nov 30, 2011 to Nov 30, 2021 (10 years)** | 6.74% | 7.20% | 6.80% | 19,200 | 20,061 | 19,313 |

| Nov 30, 2014 to Nov 30, 2021 (7 years)** | 5.81% | 6.48% | 6.51% | 14,851 | 15,528 | 15,559 |

| Nov 30, 2016 to Nov 30, 2021 (5 years)** | 5.15% | 5.89% | 5.91% | 12,854 | 13,314 | 13,328 |

| Nov 30, 2018 to Nov 30, 2021 (3 years)** | 4.41% | 5.13% | 5.82% | 11,385 | 11,621 | 11,850 |

| Nov 30, 2020 to Nov 30, 2021 (1 year)** | 3.15% | 3.57% | 3.49% | 10,315 | 10,357 | 10,349 |

| Oct 31, 2021 to Nov 30, 2021 (1 month)* | 3.40% | 3.97% | 3.76% | 10,028 | 10,033 | 10,031 |

| Nov 15, 2021 to Nov 30, 2021 (15 days)* | 3.23% | 3.69% | 3.13% | 10,013 | 10,015 | 10,013 |

| Nov 23, 2021 to Nov 30, 2021 (7 days)* | 3.49% | 3.85% | 2.97% | 10,007 | 10,007 | 10,006 |

#CRISIL Liquid Fund Index, ##Crisil 1 year T-bill Index.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

*Simple Annualized.

**Returns for 1 year and above period are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

Returns are net of total expenses.

Returns are net of total expenses. The Scheme is managed by Mr. Pankaj Pathak. Mr. Pankaj Pathak is the Fund Manager managing the scheme since March 01, 2017. For other Schemes Managed by Mr. Pankaj Pathak please click here

So, you now know well enough about Liquid Funds to make informed decisions.

We told you today about liquid funds vs money market funds, liquid funds taxation, liquid funds cut off time, liquid fund exit load.

So, if you want to start investing in the Quantum liquid fund, you can start right here.

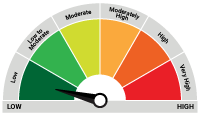

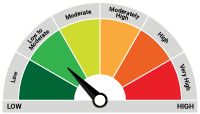

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

| Quantum Liquid Fund (An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) Primary Benchmark: Crisil Liquid Fund Index | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on November 30, 2021.

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More