Calculating

CalculatingAchieve your Financial Objectives –

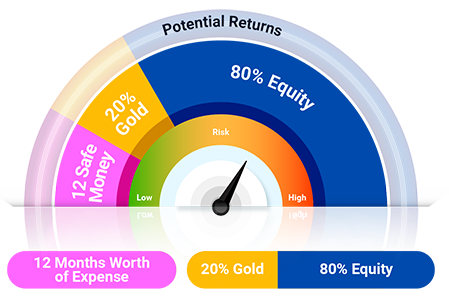

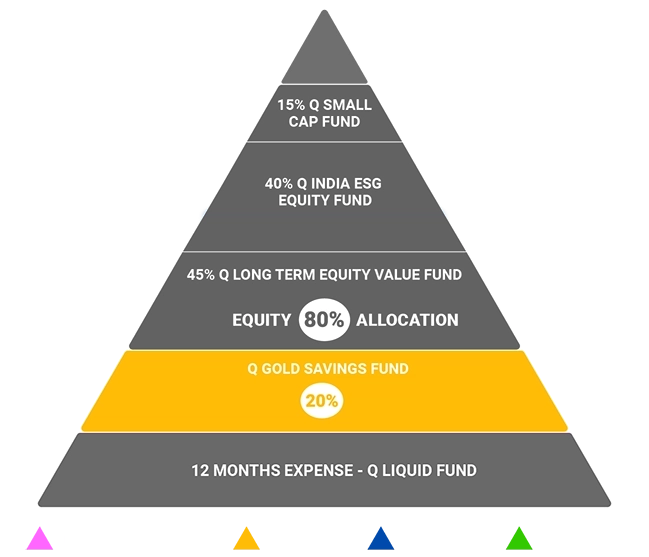

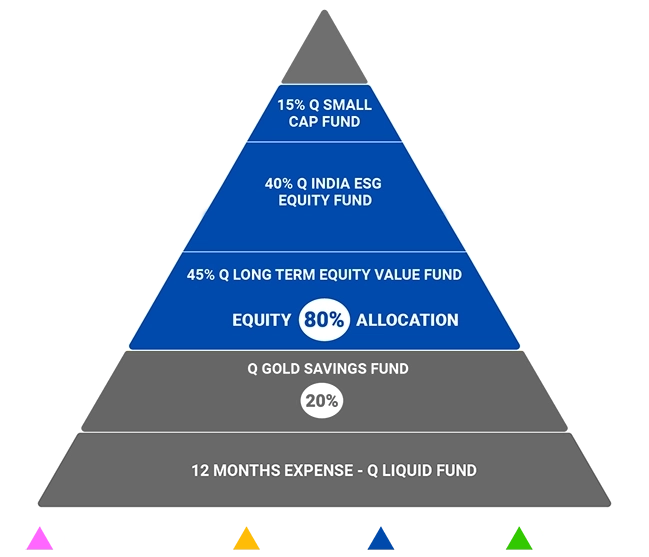

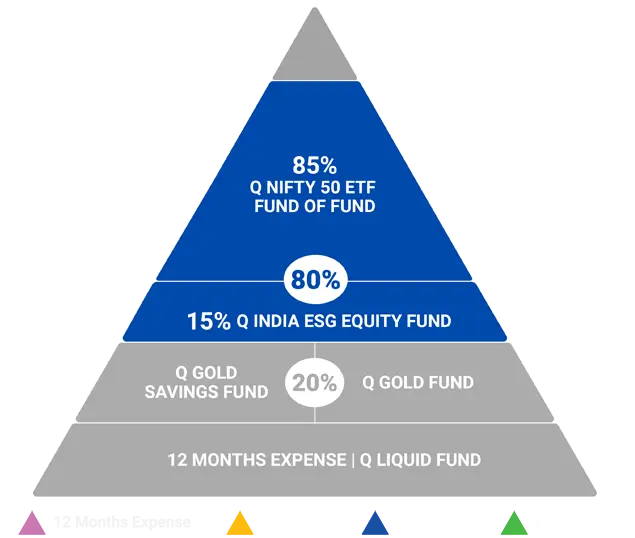

With 12|20:80# Barah-Bees-Assi Asset Allocation

In the interest of doing what’s best for you, Quantum has been meticulously adding funds over the years across the asset classes of Equity, Debt and Gold to create a one stop shop for all your needs. Each fund that Quantum has launched forms a building block in our well thought-out and time-tested 12|20-80 Asset Allocation strategy. There are three crucial building blocks within this strategy with underlying assets in Equity, Debt and Gold which helps you achieve your long-term goals and ride the market swings with peace of mind.

Safety Block

Set aside 12 months of your expenses in liquid fund to take care of emergencies.

Diversifying Block

Invest 20% of your investable surplus into gold, that generally has an inverse correlation with equity.

Growth Block

Allocate the balance 80% of your investable surplus in a diversified equity portfolio.

The Three Building Blocks for a Secure Tomorrow

Read More on Asset Allocation and its Importance

-

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More -

Gold Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After experiencing a surge of approximately 9% in 2025 through the end of February, gold prices further increased by an additional 9% in March, bringing year-to-date returns to around 19%.

Read More -

Debt Monthly View for March 2025

Posted On Monday, Apr 07, 2025

In March 2025, both U.S. Treasury and Indian Government Bond yields cooled off

Read More

Frequently Asked Questions

Asset allocation is the application of an investment approach to maintain the risk-reward ratio by diversifying investments in different asset classes at a certain proportion. The percentage of investment in each asset class is determined by factors like the ability to tolerate risks, the nature of the goal, and the time to achieve that goal.

Asset allocation not only helps to create wealth but to diversify one’s portfolio. It is a tactical allocation investment that helps mitigate risk when the market falls. With the right mix of asset allocation, all kinds of financial goals can be achieved. Key to wealth creation over the long term is optimally diversifying money across asset classes.

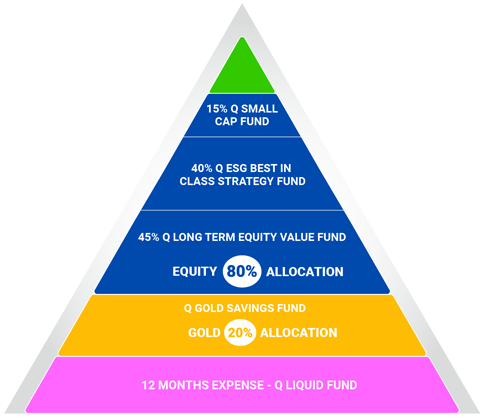

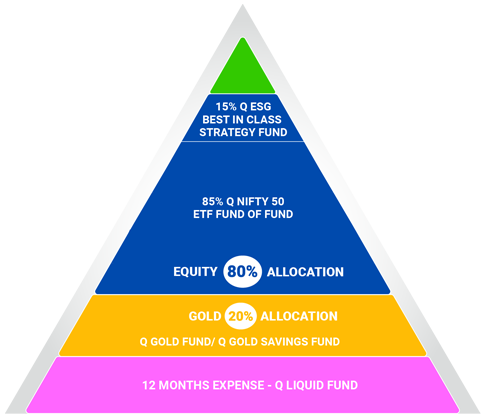

Adopt an effective asset allocation plan. The first step of asset allocation is to build a corpus for an emergency fund. Set aside at least 12 – 24 months’ worth of expenses & park it in a liquid fund that prioritizes safety and liquidity over returns. Only once you take care of your emergency corpus, you move on to the next step, which would be to invest for long-term financial goals. Choose a basket of diversified equity funds. An equity fund of fund could be a prudent solution to invest as much as 55% of your equity allocation. It not only makes it easy to manage your money but also ensures that a professional fund manager is curating some of the best equity funds for you. The rest of your equity allocation could be divided equally in value, ESG & small cap equity funds. These categories of equity funds have the objective of limiting the downside during uncertainties and focusing on sustainable returns. To give your investment portfolio enough diversification across asset classes, we suggest allocating ~20% of your portfolio to Gold. Rising uncertainties in economies around the world and geopolitical tensions warrant allocation to this yellow metal.

Factors that influence asset allocation are the investor’s age, risk profile or risk-bearing capacity, financial goals or investment objective, and time horizon of investing.

The objective of asset allocation is not just to provide optimum diversification but also to simplify investing. A 12 – 20 – 80 asset allocation strategy could provide a strong, resilient investment portfolio that has the potential to grow wealth in the long run. With this strategy investors need to allocate at least 12 months worth of their monthly expenses in a liquid fund which can thus be easily liquidated in times of emergencies, allocate 20% of the overall portfolio to Gold to provide downside protection during uncertain times, and dedicate 80% of the total investable corpus to diversified equity funds. This will help create wealth in long term and achieve all kinds of financial goals.

Investors can use Quantum’s DIY Asset Allocation calculator to get started. It not only helps you diversify, but it also helps you choose funds for all your financial goals. A few steps process, use this calculator to build an all-weather portfolio.

The three main elements of asset allocation are essentially equity, fixed income, and gold. Diversifying money across these three asset classes balances the risk-reward ratio of the investment portfolio. It is generally seen that these asset classes do not move in tandem with each other across different market cycles. Prudently allocating money by following the 12 – 20 -80 asset allocation strategy investors at any point in time can ensure that their portfolio is able to mitigate risk.