Small Cap stocks have the potential to create wealth and generate alpha as these are under-researched, generally often mis-priced, innovative, or niche businesses with a long growth runway and scope to increase market share. From the many Small Cap funds available today - the right Fund is one which prioritizes liquidity and does not stray from its mandate.

Quantum recognizes that Small Cap Funds with large AUM can become over-diversified, may face issues of illiquidity that can have a negative impact on performance. The Quantum Small Cap Fund is a high-conviction, adequately diversified portfolio of quality small cap companies, with a commitment that every investor of the Fund will get exposure to a portfolio that adheres to fund mandate. It is time to choose a Small Cap with a Big Difference.

1. True to Label Fund- Disciplined about fund capacity to prevent large size becoming a hindrance to performance.

2. Prioritizes Liquidity - Minimum Rs. 2CR Average Value per day in all stocks

3. High-Conviction Portfolio - Of 25 to 60 Stocks for optimal diversification to avoid becoming a “Closet” Small Cap Index.

4. Agile Portfolio Construction - Track Record since 2006 of judiciously building portfolios.

5. Ensures Limited Ownership - General limit of 5% of market capitalisation holding in all stocks.

Bottom-up Stock Selection Process - Investors get best of bottom-up ideas with a risk control measurement for each sector.

~945 stocks

ADDRESSABLE UNIVERSE

~450 stocks

PARAMETERS BASED SCREENING

~250 stocks

GARP BASED SCREENING

25 to 60 stocks

PORTFOLIO

The Investment Objective of the Scheme to generate capital appreciation by investing predominantly in Small Cap Stocks. There is no assurance that the investment objective of the scheme will be achieved.

S&P BSE 250 Small Cap TRI

An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks

Direct Plan and Regular Plan with Growth option

Lumpsum - 500 SIP - 100 (Daily) & 500 (Weekly, Fortnightly, Monthly & Quarterly)

| Name of the Scheme | This product is suitable for Investors who are seeking* | Risk-o-meter of Scheme# | Risk-o-meter of Tier I Benchmark |

|---|---|---|---|

| Quantum Small Cap Fund (An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks) Tier I Benchmark: S&P BSE 250 Small Cap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk. |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

#The product labeling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com

Small-Cap Funds are equity-oriented mutual funds that invest minimum 65% of its asset in Equity and Equity-related instruments of Small-Cap companies.

Small caps are companies ranking 251st onwards in terms of full market capitalisation.

Small Cap Stocks have the potential to create wealth and generate alpha over the long term as these are under-researched, generally often mis-priced, innovative, or niche businesses with a long growth runway and scope to increase market share. These stocks can offer investors exposure to emerging themes and sectors which may not be covered under large and mid-cap Companies.

There is a wide universe of 1000+ Small Cap Stocks and 24 Small Cap Funds -. Let’s understand the challenges the industry faces:

Overdiversification: Many large Small Cap Funds in the industry have to increase the number of stocks in the portfolio to accommodate new inflows to avoid holding a large part of a stock’s market capitalization. This dilutes the portfolio’s return potential. There are 24 Small Cap Funds in existence currently with an average AUM of ~1.85 crores as per data from AMFI as of Aug 31, 2023. Average number of stocks in their portfolio is 80 which translates to an average portfolio weight of 1.25% for each stock. Some of these funds become over diversified and, in some cases, ‘closet’ indexes which beats the point of paying a fee for active management.

The Quantum Small Cap Fund holds a high-conviction, adequately diversified 25-60 stock portfolio with minimum weight of 2% at cost to each stock selected after a bottom-up approach with an average trading volume of Rs. 2cr per day and a market cap that ranges between Rs.400 to Rs. 21,791 crores.

Bottom-up Stock Selection Process - Investors get best of bottom-up ideas with a risk control measurement for each sector.

~945 stocks

ADDRESSABLE UNIVERSE

~450 stocks

PARAMETERS BASED SCREENING

~250 stocks

GARP BASED SCREENING

25 to 60 stocks

PORTFOLIO

Small Cap Funds with large AUMs are unable to invest the incremental flows into either new or existing small cap stocks due to lack of investable opportunities or a portfolio stock’s inability to absorb more capital without the fund landing upholding a large part of its market capitalization. The Fund Manager is forced to invest in Debt / Money Market Instruments or to invest new money into Mid or Large cap Companies. Investors should be aware that if this happens, past track record of the fund, which was generated by investing in small cap stocks, may or may not be achieved in future.

Since Small cap stocks have lower market capitalization, Small Cap Funds have a risk of liquidity which increases with the increase in AuMs of the Fund. Some illiquid portfolio stocks of existing Small Cap Funds can take anywhere between a few months to few years to exit. If a fund’s holding in a stock becomes a large part of its market capitalization, it may not be able to exit that stock in an optimal time and at an optimal price.

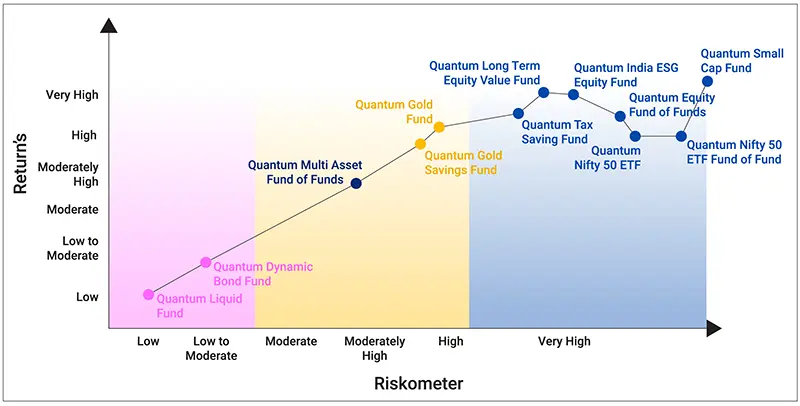

Small Cap Fund is suited for investors seeking exposure to emerging sectors and themes where Large & Mid Cap Companies are not present. Small Cap Fund is suited for investors with a long-term horizon, looking to earn risk adjusted returns, and do not mind taking very high risk. For this reason, the Small-Cap fund finds a place on the very higher end of the risk-return spectrum, just a notch above other actively managed equity funds from Quantum Mutual Fund (see graph below).

Quantum Small Cap Fund ranks higher in the risk-reward matrix signifying higher rewards for the very high-risk exposure.

The above chart is for illustration purpose only

Investors can consider allocating around 15-20% of their equity portfolio to a Small-cap Mutual Fund based on their goals and risk appetite. Adding a Small Cap Fund to one’s equity portfolio could potentially elevate the overall returns over the long term. As per the 12|20:80 Asset Allocation Strategy, Equity forms the largest building block of an investors portfolio occupying 80% of an investors portfolio while 20% should be allocated to the strategic diversifier - Gold. As an initial step, before one chooses to invest in a mutual fund, he/she should set aside 12 months of safe money in liquid fund as an emergency fund.

As any other equity mutual fund scheme, capital gains are taxed depending on the holding period. Short Term Capital Gain (STCG) refers to a holding period of less than 12 months and will be taxed at a flat rate of 15%. Long Term Capital gain exceeding Rs. 1 Lakh will be taxed at 10%.

The key advantages of Quantum small cap fund are:

1. True to Label Fund - Disciplined about fund capacity to prevent large size becoming a hindrance to performance.

2. Prioritizes Liquidity - Minimum Rs. 2CR Average Value per day in all stocks

3. High-Conviction Portfolio - Of 25 to 60 Stocks for optimal diversification to avoid becoming a “Closet” Small Cap Index.

4. Agile Portfolio Construction - Track Record since 2006 of judiciously building portfolios.

5. Ensuring Limited Ownership - General limit of 5% of market capitalisation holding in all stocks.

6. Sizeable Stock Exposure -Minimum weight of 2% at cost in each stock .

Small Cap Funds like any other equity mutual fund should be invested for long term period.

Ask these questions before you invest in a Small Cap Fund:

One way to assess this is to evaluate the portfolio weights of each of the Small Cap Stocks in the Fund. If the majority of the portfolio has weights less than 1% it means that such Small Cap Fund is overdiversified and any favourable upside in a stock may not necessarily correspond to a meaningful rise in returns of the Fund.

Small Cap Stocks have average smaller market capitalizations less than 21,791 Crores and may face the risk of illiquidity more than the Large / Mid Cap Companies. Low liquidity leads to risks of higher impact cost on exit and sub-optimal portfolio.

Smaller companies may have lower governance standards as these are likely to be companies with insufficient capital to attract best management talent. They may also face weaker oversight from external vendors. This is where Quantum Small Cap Fund can add value. Our integrity filter was introduced in 1991 at the Quantum group level. We would rather miss a short-term opportunity than risk your investment with a company of low integrity, irrespective of the weight of the stock in the benchmark index.

• Portfolio characteristics (the top-10 holdings, top-5 sector exposure, portfolio concentration or diversification, the market capitalisation bias, the style of investing followed, portfolio turnover, etc.)

• Whether there is a portfolio overlap of the Small-cap Fund with another scheme

• The quality of the fund management team, the experience of the fund manager, and the experience of the research team

The common risks associated with Small Cap Funds are:

• Liquidity - Small-cap l Fund may face liquidity risks. This means that the time taken for entering or exiting a position may be higher than anticipated.

• Governance - Small Cap Fund sometimes invest in emerging companies that may not have enough capital to attract and retain best management talent.

• Volatility - In the short term, Small Cap Funds could see sharp fluctuations. Investor should invest in Small Cap Fund for long term to avoid short term volatility.

• High Valuations - Some of the stocks may be overvalued and investing in them could cause higher downside risks.