-

Mastering the Art of Attracting New Clients in Mutual Fund Distribution

Posted On Monday, Apr 08, 2024

mastering the art of attracting new clients in mutual Fund distribution

-

World Health Day: Build a Healthier Portfolio with Quantum ESG Best-in Class Strategy Fund

Posted On Friday, Apr 05, 2024

As we celebrate World Health Day on April 7th, it's a timely reminder of the importance of wellness in all spheres of our lives.

-

ISEC Merger with ICICI Bank, Why Quantum voted against the Resolution

Posted On Friday, Mar 22, 2024

Since its Inception in March 2006, Quantum Long Term Equity Value Fund has been focused on generating sensible

-

The Last Mile

Posted On Wednesday, Mar 20, 2024

With some initial success in bringing down inflation, several central banks have now shifted their focus to the ‘last mile’ of inflation.

-

Mutual Fund Industry Assets Inch Near Rs.55 Trillion Landmark: A Gallop into Financial Prosperity

Posted On Wednesday, Mar 13, 2024

The mutual fund industry has witnessed a remarkable milestone as its assets soared past the Rs 50 trillion mark as on Dec 2023

-

Did Your New Car Come Without a Steering Wheel?

Posted On Monday, Mar 11, 2024

Everything that is produced, as you know, follows a particular process and has certain capacity constraints.

-

Small Cap, Big Difference: Staying Ahead with Liquidity & other Risk Controls

Posted On Friday, Mar 01, 2024

Amid a build-up of “froth” in the small cap and midcap space in terms of valuation

-

Discovering Certainty in an Uncertain World

Posted On Tuesday, Feb 27, 2024

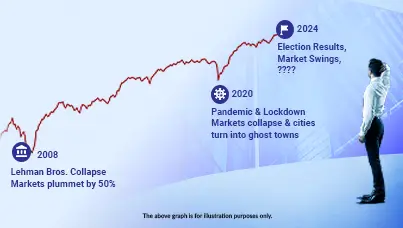

Where Were You When The Lights Went Out?

-

Time To Bond

Posted On Monday, Feb 19, 2024

Bonds have had a good start in 2024 so far. Market sentiment is upbeat on the back of falling inflation and the expectation of rate cuts by the RBI.

Go to page

Get In Touch

Take small steps in your financial planning to achieve big dreams! Start your investment journey today!