Do You Need to Update Your KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st, 2024

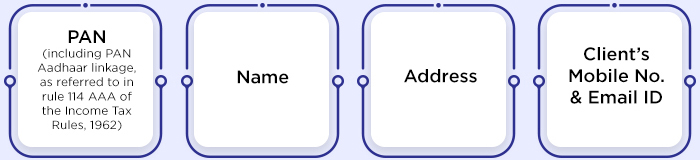

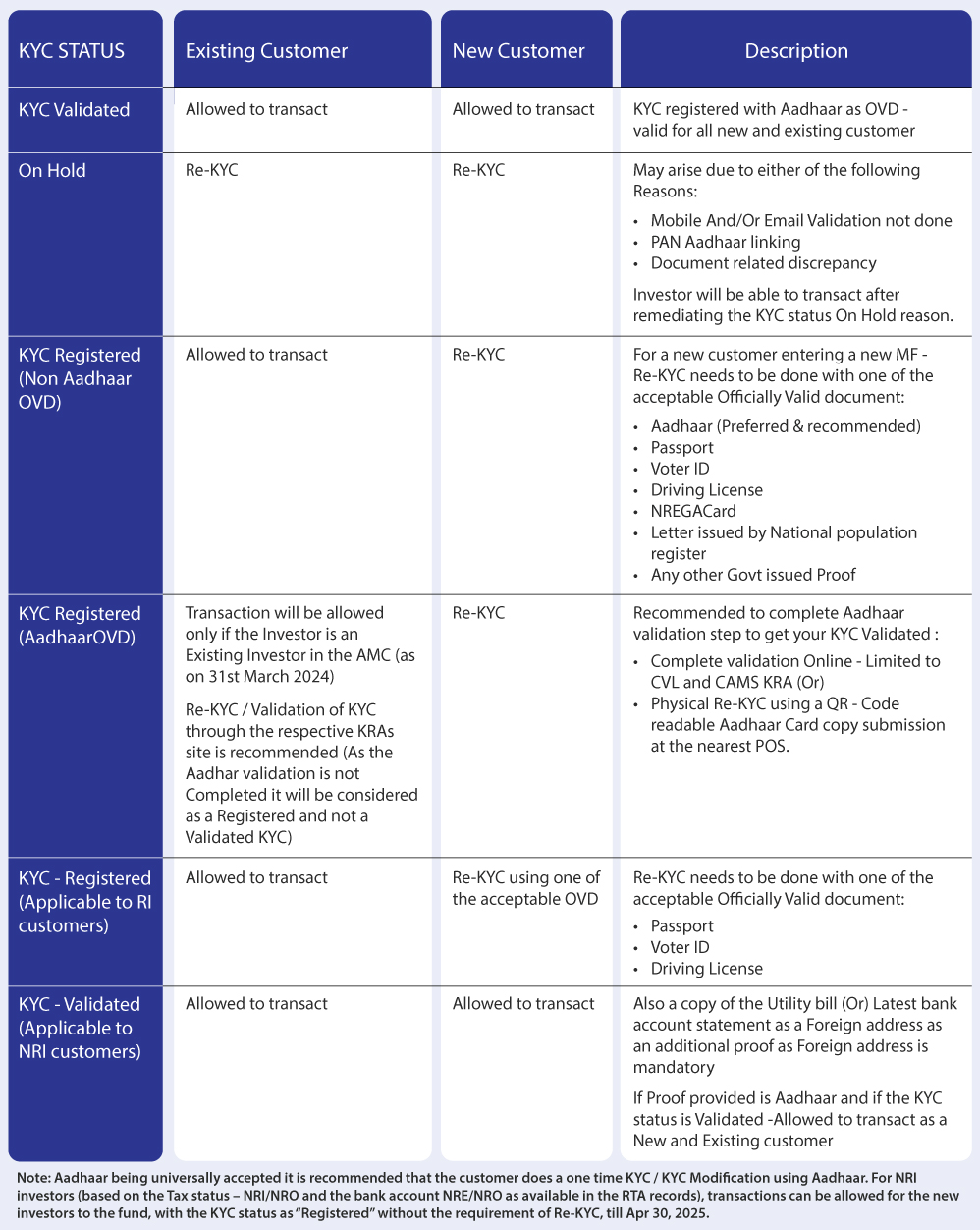

With the implementation of new KYC regulations, your KYC Status may no longer be valid for making investments. KYC Registration Agencies (KRAs) shall verify the following attributes of KYC:

The records of those clients in respect of which all the above attributes are verified by KRAs with official database (such as Income Tax database on PAN, Aadhaar XML/DigiLocker/M-Aadhaar) shall be considered as valid records.

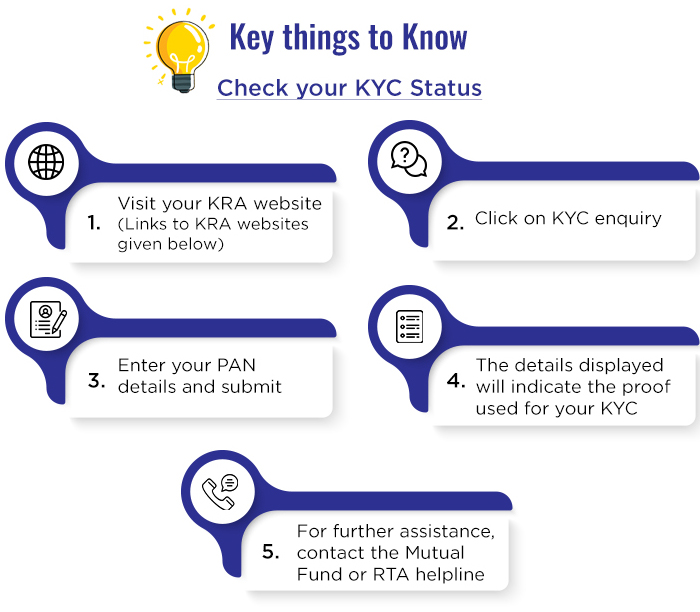

To avoid any delays or interruptions while doing a transaction, it is worthwhile to check your KYC Status and update if required with Valid Documents.

- Visit our website https://www.QuantumAMC.com/ekyc/ekycnew and follow the step by step process

- You can update your new or modify the existing eKYC

- You need to complete offline Aadhaar XML verification or e-Aadhaar via OTP or through Digilocker

- You need to verify the Contract details, complete the E-Sign process and Submit the Application

- Once Aadhaar is verified with UIDAI, your KYC will be validated across all fund houses

- Contact us on 1800-22-3863 or 1800-209-3863 (Toll Free) from Monday to Saturday anytime between 9.30 A.M. to 6.30 P.M. OR

- Write to us on [email protected] OR

- Contact your dedicated Relationship Manager

Aadhaar

Aadhaar Driving license

Driving license Passport

Passport Voter card

Voter card Job card by NREGA

Job card by NREGA

National population registry

National population registry Other documents notified by central government

Other documents notified by central government Utility bills and bank statements can't be used

Utility bills and bank statements can't be used

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Do You Need to Update Your KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More

Get In Touch

Take small steps in your financial planning to achieve big dreams! Start your investment journey today!